the chief put beneath stress by the state of public funds | EUROtoday

Nicolas Sarkozy additionally made it a dogma. “I was not elected to increase taxes,” he stated, fifteen years in the past virtually to the day. Worried concerning the results of the monetary disaster on public accounts, its majority deliberate to assault the “tax shield”, the flagship measure of the Head of State, and even talked about distinctive taxation of excessive incomes… The president was pressured to withdraw earlier than the top of his five-year time period. And to desert this tax protect, image of triumphant Sarkozyism.

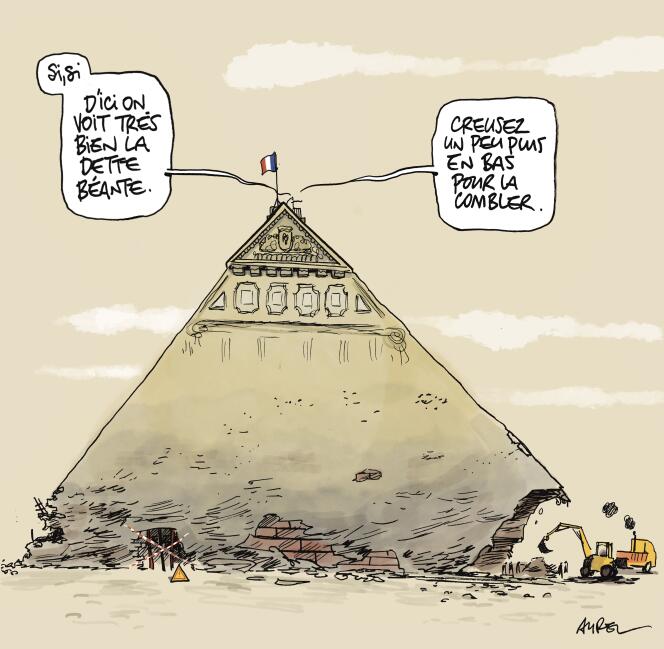

Emmanuel Macron has additionally made fiscal stability a totem, regardless of repeated stress inside his majority for seven years. And, as in 2009, the state of affairs of public funds, weighed down by two successive crises and greater than 100 billion euros in tax cuts, places this query on the coronary heart of the political debate.

“I’ve no dogma however I’ve two purple strains, which isn’t to extend taxes on the center lessons, echoed the Prime Minister, Gabriel Attal, on TF1, Wednesday night March 27. The second purple line: I cannot enhance taxes for what helps finance the work of the French (…). Who creates jobs? It’s nonetheless, above all, companies. »

Can the dogma maintain when the accounts are uncontrolled and the reforms permitting financial savings to be made are politically flammable? “We urgently want to extend taxes, known as this on March 7 within the columns of The Obs the essayist Alain Minc, nonetheless a fervent defender of supply-side coverage. If [Emmanuel Macron] don’t resign this dogma, I concern that we’ll be pressured to make a second layer of blind discount of credit, with critical penalties on development and deleterious socio-political results. » VAT, decrease than the European common, might be raised, and be coupled with a rise in revenue tax for the richest, with out affecting capital taxation, he explains.

The debate permeates the bulk

In latest days, the controversy has additionally permeated the bulk, and never simply the left wing. Figures just like the President (Renaissance) of the National Assembly, Yaël Braun-Pivet, or the chief of the Macronist deputies, Sylvain Maillard, explicitly ask the query. Both of them opened up about it through the dinner dedicated to the topic of public funds, Wednesday March 20 on the Elysée.

The first has since reiterated its message on taxes. “Let us not rule out this feature in precept, she repeated to Figaro March 22. We must query our revenues, together with the potential of taxing tremendous earnings in huge firms or share buybacks. » The CAC 40 teams made almost 155 billion euros in earnings in 2023, paying almost 68 billion euros in dividends and shopping for again 30 billion euros of shares, unequalled proportions.

You have 65.73% of this text left to learn. The relaxation is reserved for subscribers.

https://www.lemonde.fr/politique/article/2024/03/28/hausse-des-impots-l-executif-mis-sous-pression-par-l-etat-des-finances-publiques_6224585_823448.html