The Euribor rises once more in March and makes mortgages barely costlier | Financial markets | EUROtoday

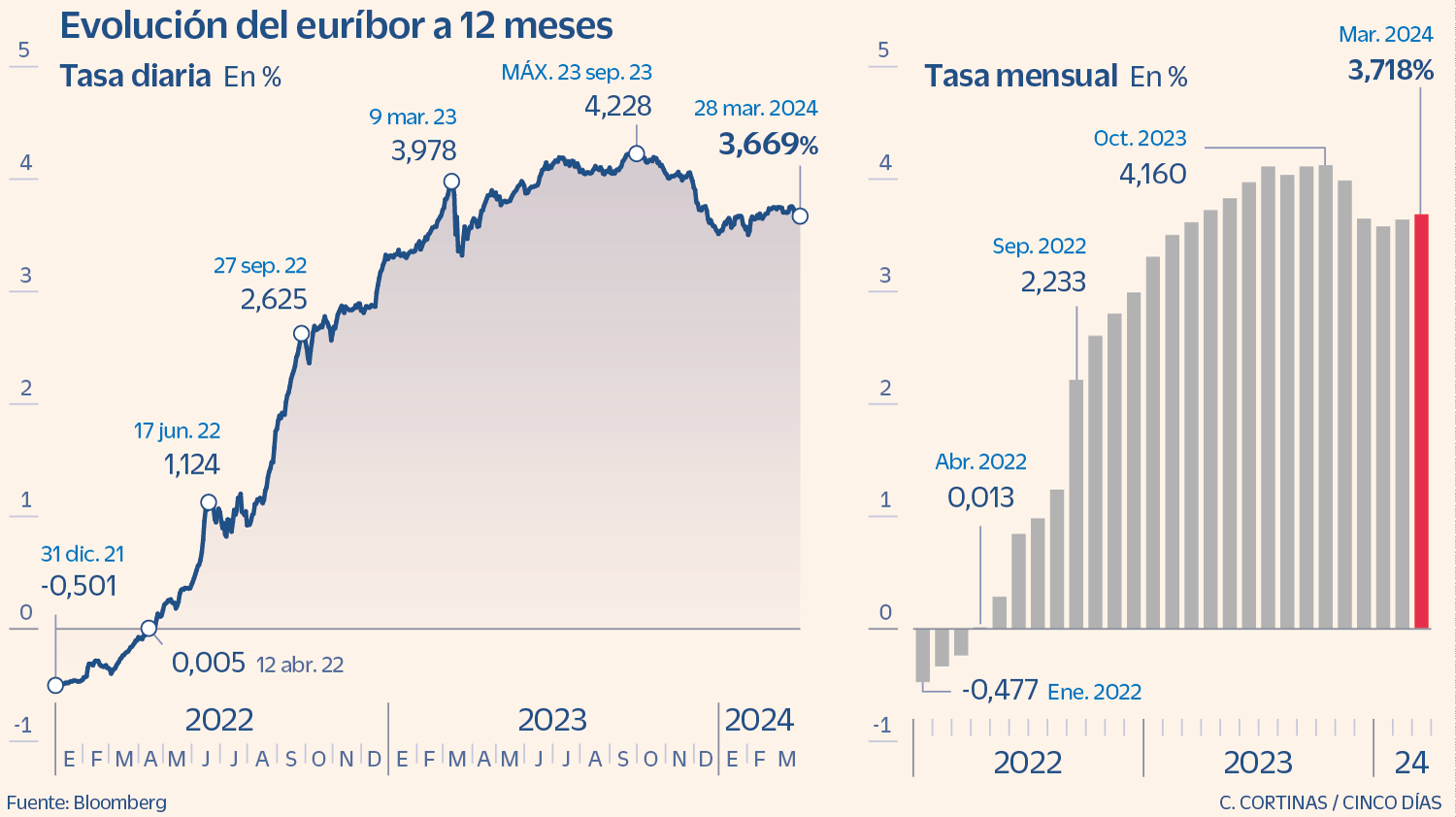

The path in the direction of decrease mortgage costs has proven in March that it’ll not be a easy downhill climb. The Euribor, used to calculate the installments of variable loans, closed the month with a mean of three.718%, in its second consecutive rise after February (3.671%), when a three-month streak of declines was ended. After that favorable remaining stretch of 2023, central banks have cooled expectations of a fast drop in rates of interest, which is slowing down the de-escalation of the indicator, which tens of millions of mortgage holders look to in the hunt for reduction from the excessive burden of curiosity they bear, after 16 months with the Euribor above 3%.

The change in March has been very slight. In reality, it’s about most average interannual advance for the reason that starting of its upward pattern in January 2022, within the annual comparability with which the vast majority of mortgages are calculated. For a mean mortgage of 150,000 euros with a time period of 25 years and a differential of 1% over the Euribor, the payments will improve by about six euros per thirty days or 72 euros per yr. For their half, mortgages reviewed semi-annually can pay considerably cheaper notes, particularly about 37 euros much less per thirty days or 444 euros per yr, since six months in the past the Euribor was nonetheless above 4%.

The Euribor started the month of March at 3.744%, and reached its highest degree on the nineteenth, when it touched 3.756%. Since then, it has been shedding some steam, which fuels hopes for April, on condition that if the pattern of the final days of March continues, the quotas will go down of their annual overview. Not solely as a result of this indicator is doing it, however as a result of in April 2023 it continued to rise.

If there may be not an surprising rise in inflation that modifies the central banks' roadmap, this pattern of reducing quotas can be repeated for the rest of the yr. The forecast panel of the Spanish economic system, a survey carried out by Funcas amongst 19 evaluation providers, estimates that the Euribor will shut 2024 at round 3.2%.

At its assembly on March 7, the European Central Bank saved rates of interest at 4.5%, unchanged regardless of having considerably lowered its inflation forecasts. “Until the ECB lowers rates, there will be no decisive movements in the Euribor, because the difference between both values is already very high,” says Simone Colombelli, director of Mortgages at iAhorro.

Inflation within the euro zone continued to gradual in February, reaching 2.6%, two tenths lower than in January, however the Frankfurt-based entity fears that robust wage progress will undermine the struggle for wage stability. costs, so he prefers to be extraordinarily cautious. Its president, Christine Lagarde, dropped within the final assembly that it doesn’t ponder a primary lower in April, sustaining that till June they won’t have all the required information to start to determine with better certainty. The US Federal Reserve has not made a transfer but, and among the many giant ones, solely the Swiss central financial institution has dared to take action, by lowering them final week by 0.25 factors to 1.50%, benefiting from the truth that inflation within the nation Switzerland is way more contained, and has been beneath 2% for a number of months.

Follow all the data Five days in Facebook, X y Linkedinor nuestra publication Five Day Agenda

https://cincodias.elpais.com/mercados-financieros/2024-03-28/el-euribor-vuelve-a-subir-en-marzo-y-encarece-ligeramente-las-hipotecas.html