More than 100 clients contact BBC about scams | EUROtoday

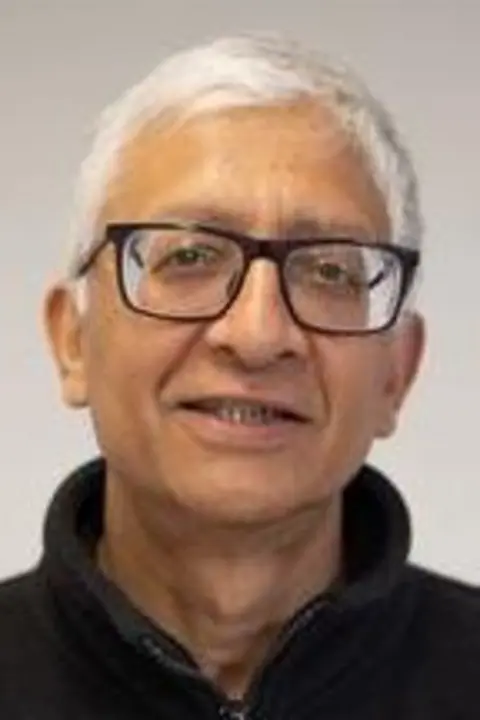

Reuters

Reuters“I never imagined I’d be a victim of a scam,” says Dr Ravi Kumar.

“But here I am, a 53-year-old NHS consultant in intensive care medicine and anaesthetics, deeply affected.”

He misplaced £39,000 in May when scammers tricked him into transferring cash into his Revolut account and giving them entry to it.

He’d been saving the cash for his youngsters.

“I was very depressed,” he provides. “My children are too young to share this grief with.”

Dr Kumar is considered one of greater than 100 individuals who have informed the BBC they really feel poorly handled by Revolut after being scammed, following a Panorama investigation into the e-money agency.

For him the deception began when he obtained a cellphone name from somebody claiming to be from American Express, his bank card firm. They informed him that fraudulent exercise had been detected on his account.

They mentioned they might report this to the trade regulator and that he ought to anticipate one other cellphone name from Barclays, his excessive road financial institution, as cash in that account may additionally be in danger.

A number of hours later he obtained a name from somebody who mentioned they have been from Barclays.

They informed him to switch his financial savings to his Revolut account for safekeeping whereas they carried out repairs.

He didn’t. At this level, Dr Kumar was changing into suspicious.

He wished the individual on the top of the road to show who they have been.

He was given a quantity to name – and when he did, he heard a well-known Barclays welcome message, which reassured him.

But it was nonetheless the scammer on the cellphone.

They informed him once more to switch his cash to Revolut as a safety measure – and this time, Dr Kumar agreed.

After the switch the scammer requested him to create two digital debit playing cards within the app for “testing” functions and informed him to delete the app for additional security.

Little did he know that this might permit them to spend 1000’s of kilos from his account – with out him getting any notifications.

The subsequent morning Dr Kumar reinstalled the Revolut app on his cellphone and located his account drained of £39,000.

The 25 transactions that had been made included purchases of luxurious vogue and know-how gadgets from corporations resembling Selfridges, Apple and Currys.

He contacted Revolut to complain however they informed him in a letter, seen by the BBC, that he wouldn’t be refunded as he had in the end authorised the scammers to make use of the digital debit playing cards.

Dr Kumar has employed legal professionals to submit his declare to the Financial Ombudsman Service (FOS), which settles complaints between customers and finance corporations.

“I don’t know how long I’ll be able to pay for the legal help,” he says. “We cancelled two holidays, I’ve been working almost every Saturday since.”

He provides: “What’s even more disheartening than the financial loss is the indifference and lack of accountability displayed by Revolut.”

‘Its enchantment may additionally be its weak spot’

The e-money agency, based in 2015 by two former bankershas 9 million clients within the UK and introduced document annual income final yr of £438m.

Revolut was additionally named in additional stories of fraud than every other main UK financial institution, in response to figures collected final yr by Action Fraud – the UK’s nationwide reporting centre for fraud and cyber-crime.

In Dr Kumar’s case, the Revolut characteristic which enabled the scammers to spend his cash was the creation of digital debit playing cards.

These work the identical manner as a bodily debit card besides they solely exist within the digital world.

They can provide clients extra safety as a result of you can also make on-line purchases with out offering the small print of your important card.

It’s amongst an inventory of options which a few of Revolut’s opponents don’t provide.

Others embody the choice to carry cash in numerous currencies, switch it overseas, purchase particular person shares, spend money on commodities and entry cryptocurrencies.

This vary of options offers Revolut a broad enchantment – it describes itself as an “all-in-one finance app for your money” – nevertheless it’s additionally what cyber safety specialists warn could possibly be a weak spot.

“It’s like putting all your eggs in one basket,” says Prof Mark Button, who researches cybercrime.

“If you have a product which can link to all the different aspects of your financial life, and you get compromised by a fraud or scam, then that is highly dangerous.”

While Revolut offers many features – one thing it doesn’t have is an emergency phone number you can call to freeze your account. You have to ask them using their app’s chat function.

A dedicated phone number might have helped Lynne Elms stop scammers taking £160,000 in seven minutes from her employer.

‘They controlled my computer’

She was working at her best friend’s cosmetics company in November 2022 when a scammer, who said they were from Revolut, told her the business’s account was under attack from fraudsters.

They said it was an emergency and she needed to move the money out of the account as soon as possible or risk losing it.

They convinced the 52-year-old to install a remote desktop application which they said would allow them to protect the account. It actually let them take control of her computer.

Over a period of seven minutes, the scammers pressured Lynne into authorising four transfers worth £160,000.

The accounts she was asked to transfer the money to had names including ‘refund’, ‘invoice’ and ‘cancel’.

It meant she saw these words in the notifications sent to her phone asking her to approve the transfers.

“Revolut were absolutely useless. It took me about three or four hours to get in touch with somebody,” says Lynne.

“Eventually Revolut froze the account. They told me there was nothing they could do. It felt like a one-liner to say sorry.”

Her employer has spent £70,000 on legal fees trying to get the money back.

An FOS investigator has recommended at least £115,000 should be refunded to them by Revolut, who are contesting the sum. A final decision by the Ombudsman is expected soon.

Revolut told us they were unable to comment on cases that were still ongoing with the FOS but said they were “sorry to hear about any instance where our customers are targeted by ruthless and highly sophisticated criminals”.

Addressing the fact that more than 100 people have contacted the BBC to complain about the firm, Revolut said such issues should be raised via their app.

They add that last year the number of fraudulent transactions using their service had been reduced by 20% and they had prevented £475m worth of potential fraud losses.

For victims who have lost money through scams on Revolut, the impact goes beyond financial stress.

“It felt like I was losing my business and my best friend,” says Lynne. “It was the worst time of my life. I never thought I’d get over it. I don’t think I have.”

https://www.bbc.com/news/articles/c9wkzv1zk91o