Mortgage charges rise regardless of rate of interest reduce | EUROtoday

Getty Images

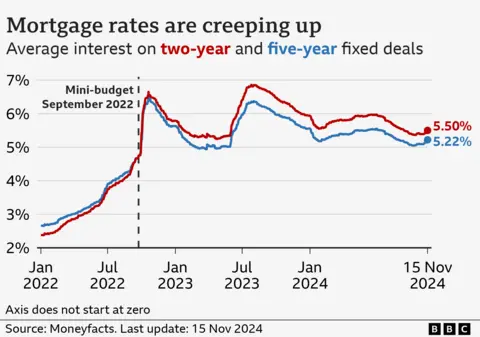

Getty ImagesMortgage prices are rising – with the common fee on a two-year mounted deal now at 5.5% – regardless of a current reduce in rates of interest.

A string of lenders, together with Barclays, HSBC, NatWest and Nationwide, have elevated the charges charged on new mounted offers in current days.

That has created a headache for debtors hoping prices had been on a constant downward development, particularly in mild of the Bank of England reducing the benchmark rate of interest earlier this month.

Recent occasions, such because the Budget, imply that borrowing prices on the whole have elevated, which can have a knock-on impact for these trying to find a house mortgage.

How mortgage charges have an effect on debtors

Some tracker and variable fee mortgages transfer pretty intently according to the Bank’s base fee. However, greater than eight in 10 mortgage clients have fixed-rate offers.

The rate of interest on this sort of mortgage doesn’t change till the deal expires, normally after two or 5 years, and a brand new one is chosen to interchange it.

About 800,000 fixed-rate mortgages, presently with an rate of interest of three% or beneath, are anticipated to run out yearly, on common, till the tip of 2027.

Hundreds of hundreds of potential first-time consumers additionally hope to get a spot of their very own with their first mortgage. All would welcome low mortgage charges.

There have been two important spikes within the final couple of years, with the common fee peaking at 6.85% in August 2023, in keeping with the monetary info service Moneyfacts.

Rates are decrease now, however the price of offers has been transferring up both aspect of the Budget.

The common fee on a two-year deal now stands at 5.5%, and the common on a five-year deal is 5.22%.

Nearly all the most cost-effective offers available on the market, usually for these capable of provide a big deposit, have risen again above a fee of 4%.

Why are rates of interest down however mortgage charges up?

On 7 November, the Bank of England reduce the bottom fee – which influences the broader value of borrowing for companies, people and the federal government – from 5% to 4.75%.

This had been extensively anticipated, so the markets had already factored the reduce into their calculations. In different phrases, it was so extensively anticipated that borrowing prices had already been adjusted accordingly.

However, the Bank of England additionally stated that future rate of interest cuts could not come as usually and as shortly as beforehand thought.

In the phrases of 1 mortgage dealer, that was as a result of the Budget delivered by Chancellor Rachel Reeves “threw a spanner in the works”. Spending pledges risked inflating some costs, one thing excessive rates of interest are designed to manage.

Bank governor Andrew Bailey stated charges had been prone to “continue to fall gradually from here”, but cautioned they could not be cut “too shortly or by an excessive amount of”.

Lenders value their mortgages not solely on the place rates of interest are at anybody time however the place they, and the monetary markets, count on them to be sooner or later.

Getty Images

Getty ImagesBrokers say the outlook had modified for lenders given the Bank’s newest view on rates of interest, prompting the latest mortgage fee strikes.

“The slew of fee modifications in current weeks has continued to push [mortgage] charges greater, reflecting the upper prices for lenders, because the market outlook for charges has edged towards a ‘higher for longer’ expectation,” said David Hollingworth, from mortgage broker L&C.

“Unwelcome as it’s for debtors, it’s necessary to notice that there’s no signal of charges skyrocketing as they’ve lately. The Bank of England base fee continues to be anticipated to fall over time, however markets are questioning if the tempo can be as fast.”

A Treasury spokesman said that the Budget was “placing the general public funds on a sustainable path” and that was “important to making sure regular mortgage charges for all householders”.

What goes up might come down

The general trend of interest rates is expected to be down, but timing can be tough for borrowers.

That is made harder because mortgage deals currently have a relatively short shelf-life, owing to the uncertainty.

“Any stand out best-buy offers usually are not lasting very lengthy,” said Aaron Strutt, from broker Trinity Financial.

“If your mortgage is due for renewal and you’re sticking together with your present lender, you must regulate the charges as a result of the lenders don’t have a tendency to inform debtors when they’re going up.”

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Read extra right here.

https://www.bbc.com/news/articles/cr7nje57jrlo