Four issues the newest figures inform us | EUROtoday

Getty Images

Getty ImagesYour cash is being stretched because the tempo of value rises has risen.

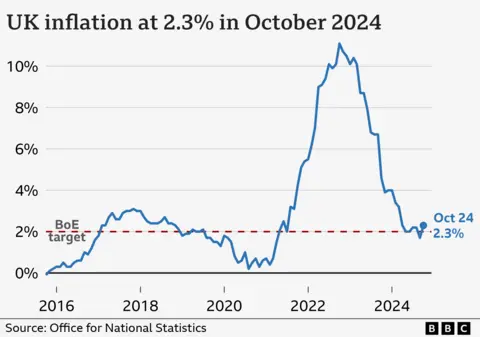

The inflation price, which charts the rising price of dwelling, elevated to 2.3% in October.

Prices aren’t hovering on the price seen over latest occasions. Inflation peaked at 11.1% two years in the past. But, there’s concern in regards to the influence the scenario is having, and can have, on individuals’s funds.

Here are 4 methods these figures have an effect on you.

The price of dwelling disaster is not over

Any journey to the grocery store reminds us that costs have risen sharply lately.

Compared with October 2020, costs of products and companies are 24% increased – pushed by will increase in meals and power costs.

That exhibits the continuing influence of value rises over the previous couple of years, irrespective of what is taking place now.

While excessive inflation is taken into account dangerous, a small quantity of inflation is taken into account essential to drive financial development.

The goal price for the Consumer Prices Index (CPI) measure of inflation, set by the federal government, is 2%.

At 2.3%, the speed is near that stage, however is at its highest stage for six months.

Wages are rising at a sooner price, offsetting a few of these costs will increase, however charities’ worries are rising about these on advantages.

Most working-age advantages, corresponding to Universal Credit, will go up by 1.7% in April – which analysts predict might be beneath the tempo at which costs are rising.

Lots of persons are nonetheless struggling to pay again money owed that constructed up over the previous couple of years. Some £3.7bn is collectively owed to power suppliers from individuals unable to pay their gasoline and electrical energy payments, for instance.

Inflation is risky

Analysts had anticipated a smaller rise in inflation than 2.3%.

But you should not put an excessive amount of retailer on a one-month determine.

As with any financial statistic, one month’s information can buck a common development and must be thought-about alongside different revealed information.

It is value noting too that a number of the components driving the newest rise in costs got here from outdoors of the UK.

Higher power prices are primarily the results of value of power on the worldwide markets, however which have an effect on households’ and companies’ payments.

Interest price cuts might be extra gradual

Interest charges have an effect on the price of borrowing and the returns accessible for savers.

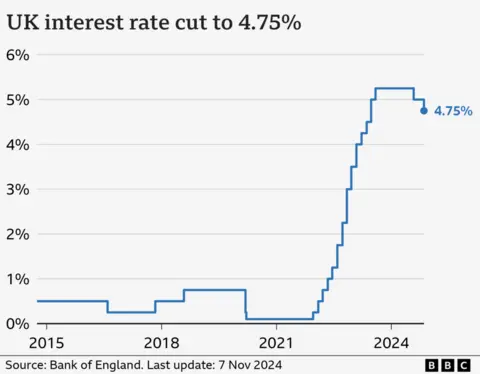

The benchmark – or base – price, set by the Bank of England at the moment stands at 4.75%. It was reduce from 5% earlier this month.

This is the chief software utilized by the Bank to attempt to hold inflation at its 2% goal. Raising charges cools borrowing and spending, thus limiting value rises, and vice versa.

With inflation a lot decrease than its peak, the Bank has – and nonetheless is – anticipated to cut back rates of interest.

But latest occasions, such because the Budget and now a higher-than-expected inflation price, imply the markets have revised their predictions for when and the way typically these cuts will come.

Even the Bank’s governor cautioned they might not be reduce “too quickly or by too much”, prompting forecasts that the base rate is unlikely to be reduced in December.

The impact for homeowners is that fixed mortgage rates have actually been creeping updespite the latest interest rate cut.

Official figures show the cost of renting a home has also risen. Average rent paid to private landlords was up 8.7% in year to October, the ONS says.

Savers, however, may see the interest paid on their savings hold up better than would otherwise be the case.

We don’t know what will happen next

Global and domestic factors will have a significant impact on how quickly prices rise, but how they will play out remains uncertain.

Donald Trump’s victory in the US presidential election was helped by his deciison to tap into voters’ concerns about the cost of living, analysts have suggested.

He has pledged a blanket 20% tariff on all imports into the US.

If he goes ahead and introduces tariffs – a tax imposed by one country on the goods and services imported from another – it could lead to a rise in prices, including in the UK, economists say.

Domestically, measures in the Budget, such as a rise in National Insurance paid by employers, has led to fears that the extra cost could be passed on in higher prices or fewer jobs.

However, other events could have a positive impact. A swift, relatively orderly, end to conflicts such as the war in Ukraine could settle the global economic outlook – albeit the impact of such geopolitical complexity is extremely difficult to call.

How can I save money on my food shop?

- Look at your cupboards so you know what you have already

- Head to the reduced section first to see if it has anything you need

- Buy things close to their best before date which will be cheaper and use your freezer

Read extra suggestions right here

https://www.bbc.com/news/articles/ce8yp69n6z3o