Higher vitality payments push price to 2.3% in October | EUROtoday

Getty Images

Getty ImagesAn increase in vitality costs pushed UK inflation to its highest price for six months, official figures present.

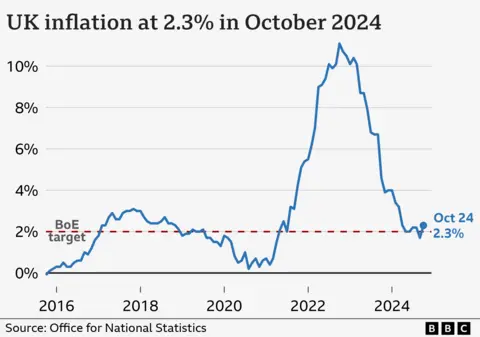

The inflation price, which measures worth modifications over time, hit 2.3% within the 12 months to October, a bigger-than-expected improve from 1.7% in September.

Annual gasoline and electrical energy payments for a typical family went up by about £149 final month, however costs are rising way more slowly than in recent times.

However, the speed, which is carefully monitored to find out rates of interest, is now again above the Bank of England’s 2% goal.

Interest charges had been reduce for the second time this 12 months to 4.75% two weeks in the past, however economists and analysts will not be anticipating additional cuts till 2025.

Higher inflation pushes up the price of dwelling for households, and might result in rates of interest remaining at the next degree, making the price of loans, bank cards and mortgages, dearer and impression folks’s spending energy.

Inflation has fallen from its peak in October 2022, however when the speed falls, it doesn’t imply that costs are coming down, however that they’re rising much less shortly.

Grant Fitzner, chief economist for the Office for National Statistics (ONS), mentioned whereas increased vitality prices had contributed, this improve was offset by falls in stay music and theatre ticket costs.

“The cost of raw materials for businesses continued to fall, once again driven by lower crude oil prices,” he added.

However, with temperatures dropping to freezing ranges and snow hitting elements of the UK this week, rising vitality payments will as soon as once more turn out to be the main focus of many households.

Although costs are nonetheless decrease than final winter, the leap in electrical energy and gasoline prices comes as help handed out in recent times for payments has been scaled again.

The authorities has additionally introduced that it’s going to begin means-testing winter gas funds, halting them for 10 million pensioners in England and Wales.

People utilizing an typical quantity of gasoline and electrical energy are at the moment paying £1,717 underneath the vitality worth cap, which is ready by the regulator Ofgem.

The cap determines the value paid for every unit of vitality utilized in 27 million properties throughout Britain. Different guidelines apply in Northern Ireland.

Darren Jones, chief secretary to the Treasury, mentioned the federal government knew “families across Britain are still struggling with the cost of living”.

“We know there is more to do,” he added.

‘Constant battle’

James Stott, basic supervisor of Garten Bar in Manchester’s Corn Exchange, mentioned inflation was “yet another challenge in an industry that seems to constantly battle challenges”.

“We will strive to not let that affect our guest prices, but eventually it will have to be passed on,” he mentioned.

He mentioned his enterprise needed to cope with rising wages, in addition to growing prices for items.

As properly as vitality prices growing final month, inflation within the companies sector, which measures worth rises for issues reminiscent of haircuts, airfares and lodges, ticked as much as 5%.

Food worth inflation remained unchanged from September, however alcohol and tobacco costs rose sharply.

Russ Mould, funding director at AJ Bell, mentioned policymakers might argue inflation at 2.3% continues to be “relatively low”, however he added house owners “will really feel the impact of the last few years’ cumulative price increases”.

He mentioned in comparison with October 2020, the products monitored to calculate the UK’s inflation price was up by 24%

“If policymakers and politicians want to know why consumer confidence remains depressed and voters remain fractious, there is your answer,” he added.

Fiona Cincotta, a monetary market analyst, instructed the BBC the “hotter” than anticipated inflation price comes because the Bank of England has “already warned that rates may be cut at a slower pace owing to the uncertain outlook for consumer prices after Labour’s Budget”.

Responding to the newest figures, shadow chancellor Mel Stride mentioned: “Having brought inflation back down to target, we know how important it is for all of us that the government does the same.”

He additionally questioned the impression of Chancellor Rachel Reeves’ first Budget on costs and the broader financial system.

An enormous increase to spending on public companies by the federal government is anticipated to lift inflation within the quick time period, which might forestall rates of interest falling extra shortly, whereas there are considerations tax rises for companies might hit financial development.

Andrew Bailey, the Bank’s governor, mentioned earlier this month that rates of interest had been more likely to “continue to fall gradually from here”, but cautioned they could not be cut “too shortly or by an excessive amount of”.

https://www.bbc.com/news/articles/c8rl4rgdj12o