The debt of growing nations reaches a brand new report with 8.8 trillion {dollars} | Economy | EUROtoday

The coronavirus pandemic is now behind us, however its results on the economies of growing nations are nonetheless current. During the disaster, these nations dramatically elevated their debt ranges to deal with the decline in financial exercise and authorities revenues, in addition to to strengthen their healthcare methods. This pattern has continued up to now and, by 2023, its complete debt has reached an all-time excessive of $8.8 trillion, in line with the worldwide debt report printed this Tuesday by the World Bank.

Short-term debt of growing nations elevated final yr for the third yr in a row. It elevated 5.5% to succeed in $1.1 trillion, underscoring its dependence on financing to reply to fast wants. Furthermore, excluding a slight decline of 0.3% in 2022, long-term debt has additionally been on an upward trajectory since 2006. And since this development occurred towards a backdrop of world rates of interest at two-decade highs, the prices debt service charges rose. Interest funds reached the very best stage in 20 years, which, in line with the World Bank, “reduced many countries’ budgets for critical areas such as health, education and the environment.”

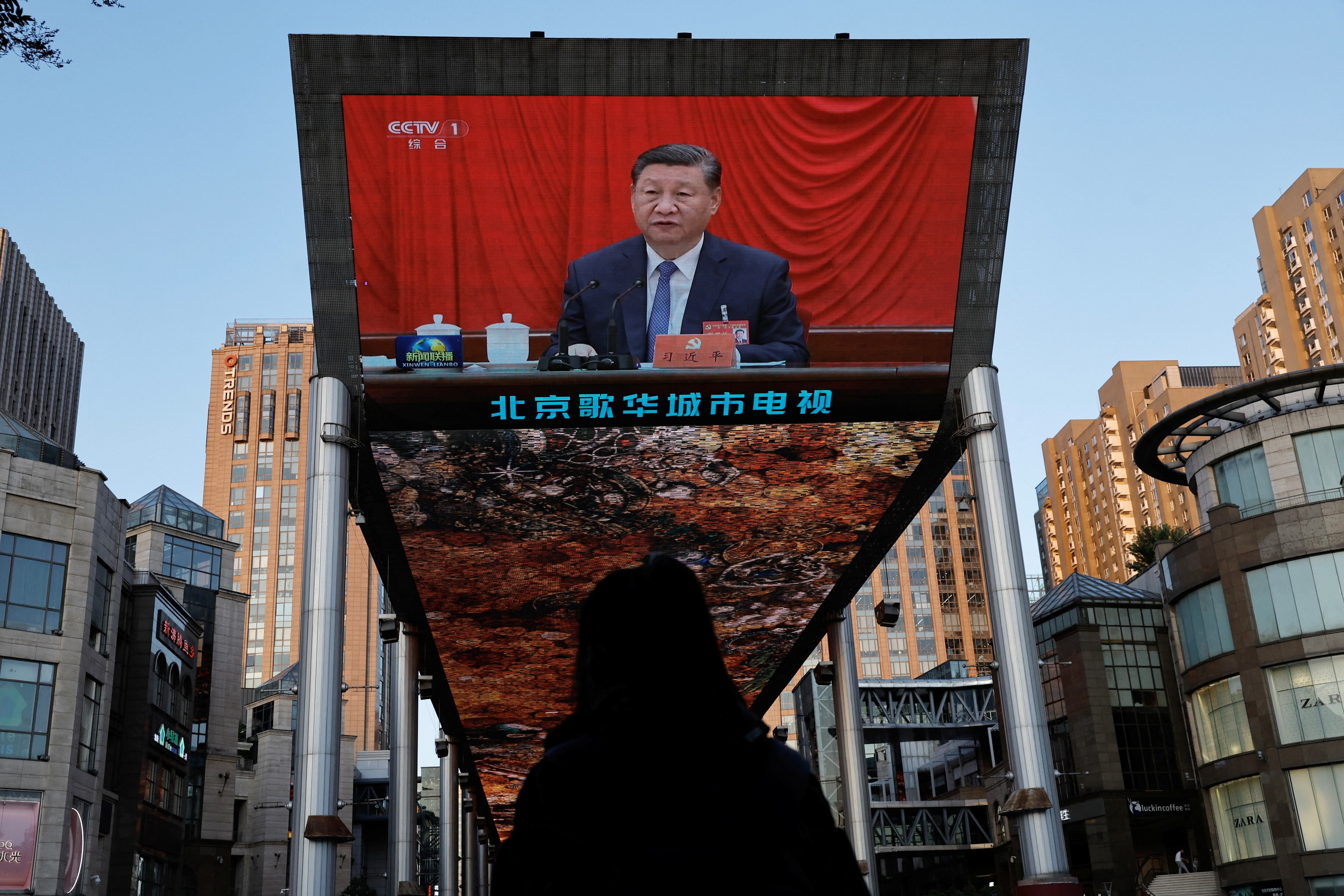

Despite inner challenges, China stays a key pillar within the context of world debt. Until final yr, it was the biggest borrower amongst rising nations, holding 27.4% of its complete debt. But on the similar time, Chinese debt has additionally tripled since 2010, reaching 2.4 trillion {dollars} in 2023. However, it’s the second consecutive yr by which the extent has decreased, after reaching its historic most in 2021 -2 .7 billion―. Specifically, it fell 1.1% in comparison with 2022, resulting from a contraction in unsecured personal sector loans, that are these loans granted with out the specific assist of the Government.

The outlook for Chinese debt displays that the nation is transferring at two speeds. On the one hand, it has greater than half of the whole short-term liabilities (those who have to be paid in lower than a yr) that growing nations accumulate, which, in line with the group, leaves it uncovered “almost equally to the “fluctuations” of worldwide markets each within the quick and long run. In the final yr, this merchandise rose virtually 2%, to 1.3 trillion {dollars}. Contrary to this pattern, long-term debt (whose phrases are normally 10 years) has fallen for the second consecutive yr, decreasing 4.2% to $1.1 trillion. This lower is essentially defined by the smaller quantity of loans taken by personal firms with out state backing, whose complete debt was lowered by greater than 8%. In specific, firms borrowed much less cash by bonds and financial institution loans, reflecting higher warning in personal sector borrowing.

The decline in China’s complete debt aligns with the slowdown in its financial development, pushed primarily by issues in the actual property sector. Between April and September, its Gross Domestic Product (GDP) elevated under the 5% goal that the Government had set for this yr, primarily because of the fall in funding in actual property improvement, which between January and September has decreased by 10% year-on-year. In a bid to revive the scenario, Beijing has launched a collection of stimulus measures, together with reducing curiosity and mortgage charges, elevating debt limits for native governments to spice up the actual property sector and rising financing for initiatives. of housing with the intention of supporting builders with works in progress.

https://elpais.com/economia/2024-12-03/la-deuda-de-los-paises-en-desarrollo-alcanza-un-nuevo-record-con-88-billones-de-dolares.html