UK inflation charge rises for second month in a row | EUROtoday

Getty Images

Getty ImagesThe UK inflation charge has gone up for the second month in a row, rising on the quickest charge since March.

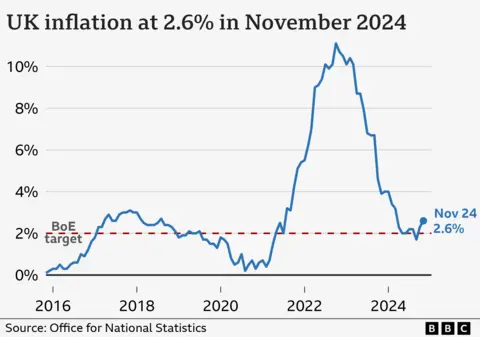

The UK inflation charge rose to 2.6% within the yr to November, based on official figures.

Fuel and clothes have been among the many primary drivers behind the rise. Increasing ticket costs for gigs and performs have been additionally an element.

The Bank of England raises rates of interest to attempt to maintain inflation at its goal of two%. Its subsequent charges resolution is on Thursday, however economists count on charges to be held at 4.75%.

“Inflation rose again this month as prices of motor fuel and clothing increased this year but fell a year ago,” mentioned Grant Fitzner, chief economist on the Office for National Statistics (ONS), which gathered the information.

“This was partially offset by air fares, which traditionally dip at this time of year, but saw their largest drop in November since records began at the start of the century.”

Chancellor Rachel Reeves mentioned she recognised that households have been nonetheless combating the price of residing.

“Today’s figures are a reminder that for too long the economy has not worked for working people.”

“I am fighting to put more money in the pockets of working people.”

Shadow chancellor Mel Stride mentioned: “The chancellor has made a series of irresponsible and inflationary decisions.”

“These figures mean higher costs in the shops, less money in working people’s pockets and risks keeping mortgage rates higher for longer.”

Paul Dales, chief UK economist on the assume tank, Capital Economics, mentioned the determine “could have been worse”.

When mixed with figures on Tuesday that confirmed sooner development in wageshe mentioned it made it unlikely rates of interest can be minimize on Thursday.

“There is almost no chance of the Bank of England delivering an early Christmas present with another interest rate cut tomorrow, ” he mentioned.

“That’s especially the case since domestic inflation pressures appear to be a touch stronger than the Bank expected.”

Capital Economics predicts inflation will dip in December after which rise once more in January, however by the top of subsequent yr would have fallen again to shut to the Bank of England’s 2% goal.

A wider measure of inflation confirmed housing and family companies prices, together with lease, rose by 3.5%.

https://www.bbc.com/news/articles/cvgmndllpz9o