UK inflation rise – what does it imply for me? | EUROtoday

Getty Images

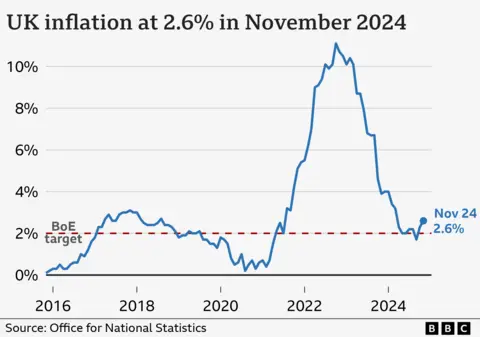

Getty ImagesThe UK inflation fee has gone up for the second month in a row, with costs rising at their quickest tempo since March. What does it imply for you?

What has occurred to inflation?

The major measure of inflation – taking a look at how a lot costs had risen over the earlier 12 months – went as much as 2.6%.

That is quite a bit decrease than its peak throughout the price of residing disaster. In 2022, inflation soared to 11.2% as a result of oil and fuel had been in better demand after the Covid pandemic, and power costs surged once more when Russia invaded Ukraine.

But inflation had fallen to 1.7% in September this yr – its lowest degree for over three years – however now it is rising once more.

What has gone up in worth?

The Office for National Statistics, which calculates the inflation fee, highlighted the rising price of petrol and diesel as one of many key causes behind the most recent inflation rise.

Tobacco merchandise went up after the chancellor raised taxes on them within the Budget. Clothing, footwear and digital video games additionally price extra.

But usually the worth of providers, reminiscent of theatre and live performance tickets, schooling and well being, rose sooner than items.

The price of housing, together with hire, which is calculated underneath a distinct headline determine, additionally rose sharply within the yr to November – up by 7.8%.

But air journey noticed its greatest November worth fall for the reason that begin of the century.

Will costs hold rising?

Prices are nearly all the time rising a bit; round 2% a yr is taken into account a wholesome fee of inflation.

Much decrease than that dangers folks delaying purchases as a result of they might get cheaper. Slightly inflation encourages you to purchase sooner – and that enhances financial progress.

But the Bank of England presently predicts that inflation will edge as much as 2.75% within the second half of subsequent yr earlier than falling once more.

The authorities’s official forecasting physique, the Office for Budget Responsibility, expects an analogous enhance. It has mentioned insurance policies introduced within the current Budget – together with corporations passing on larger prices from rises in employer nationwide insurance coverage and the minimal wage – would assist drive inflation larger.

Could there be one other price of residing disaster?

No-one is presently forecasting one other large burst of inflation, however predicting the longer term path of costs is troublesome, given all of the components that might affect them, from incoming US President Donald Trump’s insurance policies on commerce to the temper of buyers on the High Street.

On common wages are actually rising sooner than costs, which helps to alleviate the strain, however in fact costs for many issues stay considerably larger than they had been a couple of years in the past.

Housing prices, whether or not rents or mortgages, particularly are a serious supply of monetary strain for lots of people.

Even if the speed of inflation does come down subsequent yr, that doesn’t imply costs will fall. They will simply rise extra slowly, leaving most issues costlier than they had been earlier than.

What does it imply for rates of interest?

On Thursday the Bank of England’s curiosity rate-setting committee will meet to debate whether or not to chop charges.

They are usually not anticipated to deliver charges down from their present 4.75%.

That is as a result of larger rates of interest assist hold inflation in test by dampening down borrowing and spending. If borrowing will get cheaper, individuals are prone to have more cash to spend which may imply costs rise sooner.

So the upper inflation determine, added to the information earlier within the week that wages are rising sooner than earlier than, could have given them extra purpose to attend.

Investors are factoring in fee cuts for subsequent yr, however count on them to come back extra slowly than was forecast a couple of months in the past.

https://www.bbc.com/news/articles/c6230y85k06o