The Nasdaq collapses earlier than the financial fears within the US and drags the world baggage | Financial markets | EUROtoday

The concern of the deterioration of the US economic system is inflicting sturdy losses in world baggage. The newest figures, which replicate a brake on job creation and a deterioration of confidence in consumption, along with the influence of tariffs, are resulting in large gross sales of buyers in the beginning of the week. Donald Trump himself has fed fears this weekend by not ruling out a recession and admitting that the nation faces a “transition period” in its economic system. Under this situation, the opening of the inventory market session within the US holds sturdy losses, and significantly within the technological sector; The Nasdaq drops 4percenton the shut of European markets, with falls led by the magnificent seven: Tesla is left 8%, Apple 5%, Alphabet (Google) and NVIDIA 4%, Microsoft 3percentand Amazon 2%. The S&P 500, essentially the most consultant index, of the US inventory market, falls 3%.

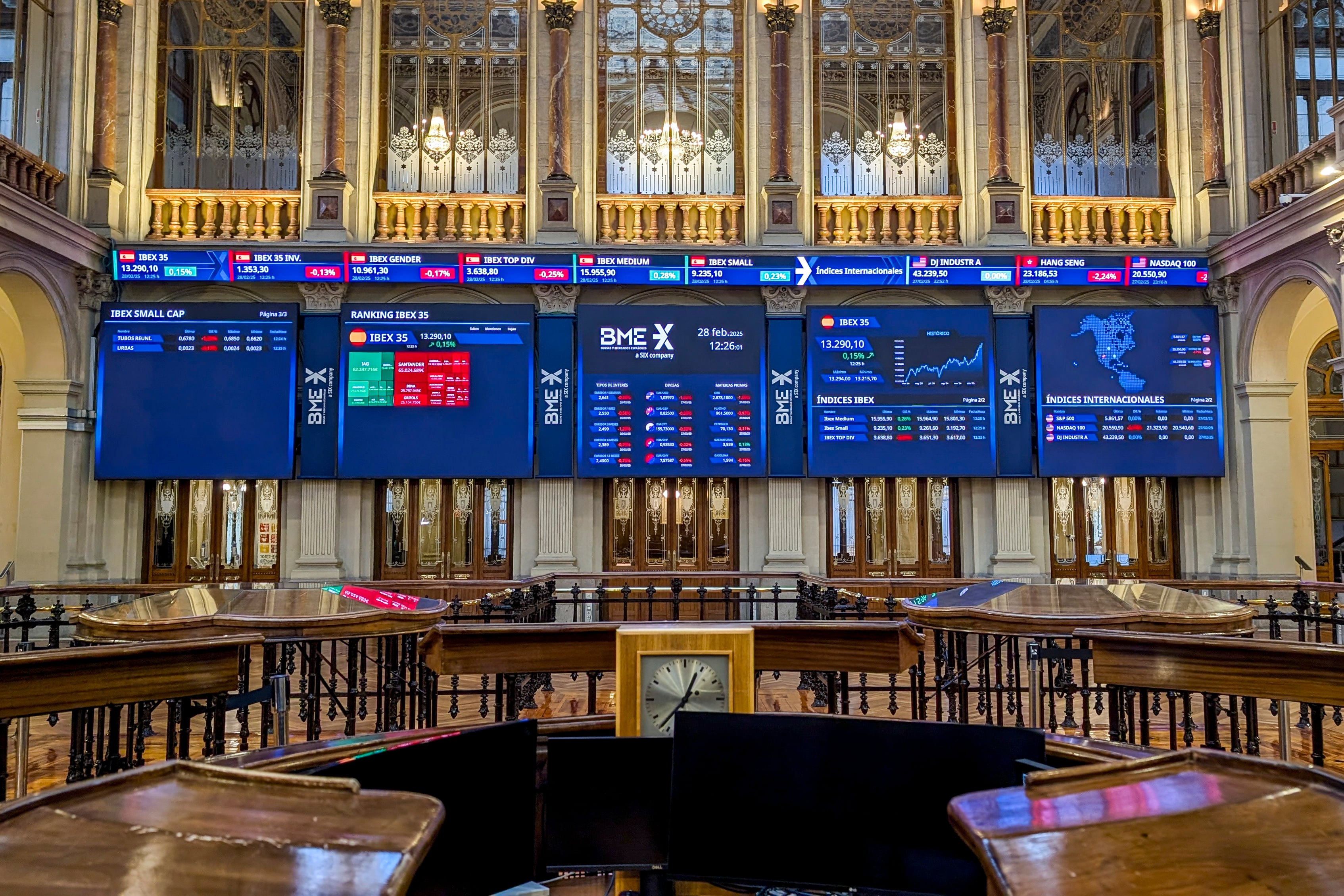

In Europe, the primary indices had began the day with losses which have been aggravated after the opening of the US. The IBEX has left 1.32% and is near dropping the 13,000 factors. It is subsequent to the German Dax (-1.69%) of the worst indices of the world, whereas the French CAC and the Italian MIB decreased 0.9%. The banking sector is positioned among the many most affected of the day, with Santander dropping 4.37% and BBVA, 3%. Broad drops are additionally marked by the metal Acerinox (-4.12%) and Arceormittal (-4.76%), weighed by the opportunity of decrease financial development. The first for the manufacturing uncovered to the United States and the second for tariffs. Only six values have been positively closing the session within the Spanish selective, because of the power sector (Enagás rises 3.78%, redefined 2.98percentand Iberdrola 1.18%).

On the one hand, the truth that Trump warns of difficult occasions for the economic system has put the markets on guard. JP Morgan economists have raised the danger of recession for this yr within the first economic system of the world to 40% from the earlier 30%. Goldman Sachs consultants have additionally raised their possibilities of financial recession from 15% to twenty%. And from Morgan Stanley they’ve decreased their financial development estimates and have raised inflation expectations. A combo that normally frightens cash.

And past a doable slowdown on the planet’s first economic system, buyers are additionally frightened as a result of Trump’s statements recommend that the president is not going to modify his tariff method, not even earlier than a situation of a doable recession. Until now, the concept that the White House would attempt to keep away from breaking the Wall Street streak among the many consultants. Analysts thought-about that tariffs have been extra a political instrument to attain concessions in different areas than a measure to be fulfilled. There are those that recommended that Trump used the S&P 500 as a validation thermometer of their insurance policies. But as soon as the specter of tariffs have come true, famend consultants are notifying the danger for the economic system, anticipating extra volatility.

“The American exceptionality that has shone for two years, and that the consensus had imagined that it would be maintained, wobble. The growth of the United States should slow down, at least in the first quarter, weighed by the sinking of the trade balance, caused in turn by the accused increase in imports in anticipation of the increase in tariffs. Political uncertainty is sinking the confidence of companies and households, and the labor market weakens again, ”explains Enguerrand Artaz, strategist of the financing of l’Enciquier.

It is a deep change within the funding feeling. The markets entered 2025 with the conviction that an American economic system beneath Donald Trump’s insurance policies would convey volatility, however would additionally enhance the euphoria that the luggage had dominated within the final two years. Just two months after assuming workplace, these hopes have been diluted. And on this new order, technological values, auged over the past two years by the euphoria that synthetic intelligence had unleashed, are the primary harmed.

“The deceleration of the US economy, the budding tariffs and regulatory uncertainty are promoting investors to diversify beyond the US coast, in search of not only of growth, but also of valuation opportunities in undervalued markets. While Wall Street reassess their prospects, international markets arouse a renewed interest. European and Chinese technological values, eclipsed for a long time by the frenzy of AI in the United States, are now outlined as attractive alternatives, ”they level out from Mirabaud.

Mike Wilson, by Morgan Stanley, hopes that the S&P 500 drops 5% to five,500 factors towards tariffs and the contraction of public spending. The index touched its historic maximums on February 19. Since then it loses 8%. In the case of Nasdaq the losses are extra pronoun. It reached its maximums within the late 2024 and since that stage it has yielded 13%.

For giving an extra concept, the Vix, often called the meter of the concern of buyers, and that has been stuffed with ups and downs since Trump gained within the elections final November, rises 15% to the closing of European markets. It is an index that measures the anticipated volatility of the market within the subsequent 30 days. It is used as a danger indicator. When lots goes up, buyers count on numerous uncertainty and falls within the baggage, as is going on this Monday.

Precisely, the drop within the baggage is taking the cash to the same old shelters, and the yields of the general public debt fall to seven factors within the case of the US debt to 10 years, as much as 4,233%. In Europe the descents are across the two primary factors. It barely has an influence, quite the opposite, on the worth of the euro, which stays at $ 1,083.

Bags – Currency – Debt – Interest charges – Raw supplies

https://cincodias.elpais.com/mercados-financieros/2025-03-10/la-bolsa-y-el-ibex-35.html