Bank of England anticipated to carry rates of interest at 4.5% | EUROtoday

Getty Images

Getty ImagesThe Bank of England is predicted to maintain rates of interest on maintain when policymakers announce their newest resolution on Thursday.

The Bank price closely influences the price of borrowing for households, companies and the federal government, in addition to returns for savers.

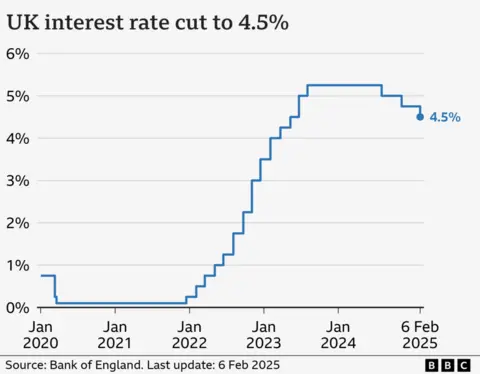

It was reduce from 4.75% to 4.5% following the final assembly of the Bank’s Monetary Policy Committee (MPC) in February.

While no change is predicted when the announcement comes at 12:00GMT, many analysts are forecasting two additional cuts by the tip of the yr.

Widespread affect

The MPC has a membership of 5 girls and 4 males, together with economists and main figures on the Bank of England. It is chaired by the Bank’s governor, Andrew Bailey. How these members vote can be intently watched by the markets.

The committee meets eight occasions a yr, and its selections have a widespread affect on every little thing from the price of mortgages to companies’ capacity to take a position.

Its main goal is to make use of rates of interest to make sure inflation – the annual price of rising costs – hits the federal government’s goal of two%.

The newest calculations confirmed the inflation price rose to three% in Januaryone purpose why commentators anticipate rates of interest to stay on maintain this time round.

Lowering charges might stimulate extra spending by shoppers and push inflation larger.

That may very well be a blow to some owners who want to see rates of interest and, in flip, mortgage charges proceed to fall.

“Bank of England policymakers have been warning on inflation and lingering uncertainty, so further rate cutting relief for homeowners looks to be an unlikely outcome from this month’s meeting,” stated Paul Heywood, chief knowledge and analytics officer at credit score company Equifax UK.

Mortgage rates of interest have been slowly edging down, primarily as a result of the markets and mortgage suppliers anticipate additional falls within the Bank price because the yr goes on.

The MPC has made three rate of interest cuts since August 2024, bringing it right down to its lowest degree for 18 months. However, the Bank has additionally stated it’ll take a “gradual and careful” method to additional reductions.

Lower charges might additionally imply decrease borrowing prices for loans and bank cards, but additionally decrease returns on financial savings.

Wider financial image

Those selections can be pushed by the outlook for the UK financial system.

Following the MPC assembly in February, the Bank halved its financial progress forecast for this yr, though it upgraded its forecasts for 2026 and 2027.

It stated the UK financial system was now anticipated to develop by 0.75% in 2025, down from its earlier estimate of 1.5%.

Meanwhile, it stated it anticipated the speed of inflation to rise to three.7% and take till the tip of 2027 to fall again to its 2% goal.

On high of those predictions come uncertainty over home and world financial coverage.

Next week will see Chancellor Rachel Reeves ship her Spring Statementwhich is unlikely to incorporate main coverage bulletins however will embrace the view of the official forecaster – the Office for Budget Responsibility – on the path of the UK financial system. It may also embrace some particulars of spending allowances for presidency departments.

The UK financial system is extensively seen to be underperforming and world elements, equivalent to US commerce tariffs, are having an oblique affect on the UK.

https://www.bbc.com/news/articles/ckgz82838l8o