‘I’ll make £12.24 an hour in my new job | EUROtoday

BBC Business reporter

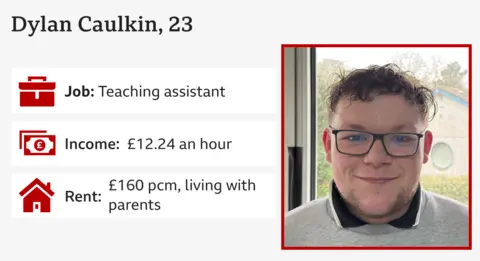

Dylan Caulkin

Dylan CaulkinOn Wednesday the chancellor will give an replace on her plans for the economic system.

The authorities has promised to spice up progress, which ought to imply greater pay, extra jobs, and extra spending on providers such because the NHS, schooling and transport.

Rachel Reeves will share the most recent official outlook, which is predicted to say the UK economic system will develop 1% this yr, moderately than the beforehand forecast 2%.

And she should clarify how she intends to sort out the massive challenges dealing with her when she delivers her Spring Statement.

Those challenges are additionally being felt on the bottom, in individuals’s on a regular basis lives.

People have contacted the BBC by our Your Voice, Your BBC News to inform us how they’re feeling in regards to the months forward and what plans they need to sort out the hurdles they face.

‘I’m altering jobs to maintain afloat’

“I’m working paycheque to paycheque,” says Dylan Caulkin. “If I have a tyre that pops, I rely on credit.”

The instructing assistant, who lives along with his dad and mom close to Truro, Cornwall, is about to begin a brand new job as a help employee for individuals with studying difficulties.

At £12.24 an hour, his pay can be solely simply above the extent the minimal wage is rising to in April. But it’s greater than he’s getting in his present function.

“I’m very excited,” he says. The alternative for doing additional time, too, means the change could have a “massive impact” on his funds.

He pays his dad and mom £160 a month lease and contributes to meals prices, that are greater for him as he’s on a gluten-free food regimen. His automobile – a necessity, he says – prices about £500 a month to run. And he has a small quantity of bank card debt he’s at present making an attempt to clear.

He generally has £100 left over on the finish of the month for spending on himself.

“I’m very lucky to have family around me,” he says. “I wouldn’t be able to survive without them.”

He wish to see the federal government present extra assist for younger individuals like him.

“In the near-future I’m looking to move in with my partner but it is just so expensive.”

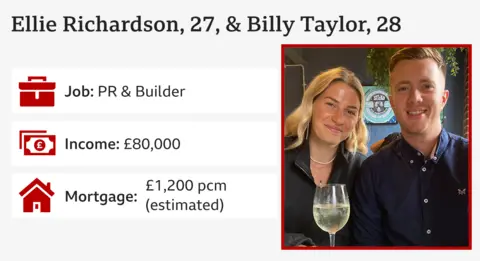

‘We earn £80,000 and are shopping for our dream dwelling’

What occurs subsequent with rates of interest is what issues most to Ellie Richardson and Billy Taylor.

They discovered their dream dwelling for £350,000 final yr, however the sale has been delayed and now will not be accomplished earlier than stamp obligation rises on the finish of this monthcosting them an additional £2,500.

“You have to roll with the punches,” says Ellie, who works in sports activities PR. But they hope mortgage charges aren’t additionally about to go up.

She and Billy, a builder, have been shuttling between his dad and mom’ and her dad and mom’ homes in Essex for the previous three years.

“We’ve worked really hard to save as much as we can for this house,” she says. “We’re pretty set on it.”

They have a joint earnings of round £80,000 and so they have a mortgage provide that may see them pay round £1,200 a month.

But if the home buy is delayed too lengthy, they might find yourself having to use for a brand new mortgage.

“The silver lining is, if we do complete later in the year, then hopefully mortgage rates could be lower,” she says.

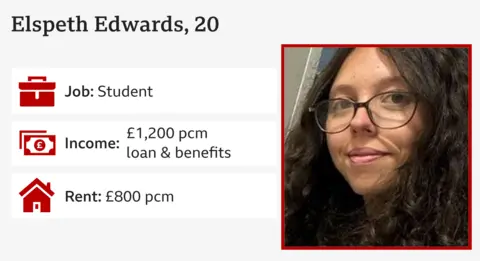

‘I’m learning however am too unwell for a part-time job’

The scholar from Worcester has a mixture of well being situations together with PoTS, which causes her coronary heart price to extend in a short time when she stands up and might result in lack of stability and consciousness.

“I faint multiple times a day, I’m in immense pain constantly. I dislocate my fingers, elbows, shoulders and knees a lot.

“Most college students work part-time,” she says. “I’ve been deemed unfit to work.”

Elspeth receives a total of about £1,200 a month through a student maintenance loan and incapacity and disability benefits.

She is dropping out of her current course – nursing – because she can’t manage the hospital shifts. She wants to start a new course, in astrophysics, in the autumn.

But she says her parents can’t support her financially, so if her benefits are cut, she will have to abandon that ambition.

“I’ve acquired extra outgoings than the common scholar,” she says.

Currently, she has nothing left at the end of the month, after spending around £800 on rent and another good chunk on her cardiac support dog, Podge.

His food costs £90 a month, there are vet’s bills, and recently he needed a new harness that helps him to communicate to her, including when she is about to faint. It cost £1,200.

“Currently all my cash goes on him,” she says.

‘I’m giving myself a 20% pay cut’

Businessman Lincoln Smith reckons consumer confidence is the lowest it has been for 15 years.

He owns and runs Custom Heat, a plumbing firm based in Rugby. The rising cost of living has meant his customers have cut back on annual boiler services and other things. On top of that, taxes for businesses go up in April.

“That makes you shrink your ambitions, makes you suppose, ‘Let’s not substitute people who find themselves leaving.'”

The company is not taking on apprentices this year, and has even got rid of the office cleaner.

Lincoln himself is taking a 20% pay cut to help balance the books for the forthcoming financial year.

He’ll be earning £125,000, while his wife, who also works for the business, earns £45,000.

“It feels like rather a lot,” he admits, but the cut will still mean lifestyle changes. “When you’re incomes any wage, you set your outgoings based mostly on it.”

With a mortgage of £3,000 a month they are already at “breakeven level”, he says.

“We have not booked a vacation this yr. We are undoubtedly not going away,” he says.

But if that is not enough he will look at moving house to reduce the mortgage.

It’s a bit upsetting, he says, because it’s the only house his sons, aged seven and four, have known.

“I do know it is ‘first world issues’,” he says. “You’ve simply acquired to do what you have to do.”

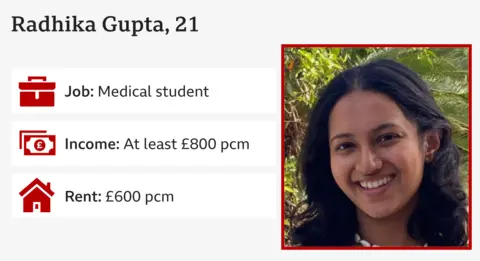

‘I get £800 a month as a student – it’s tight’

Radhika Gupta thinks whatever Rachel Reeves does on Wednesday she shouldn’t cut spending on health or education.

The student from Derry in Northern Ireland is in the third year of a five-year medical degree at Queen’s University in Belfast.

“One factor that worries me is what number of docs need to go away,” she says.

“The consensus is it’s not price practising medication within the UK due to how little you’re paid. And you’re left with lots of scholar debt.

“I don’t think the government really understands the challenges.”

Despite what she sees as underfunded providers and workers burnout she needs to work in England after she graduates.

But extra must be completed to fund and enhance medical coaching, she says.

The different factor she wish to see extra money spent on is transport, which is certainly one of her greatest bills at round £75 a month, partly as a result of unreliable public transport generally means she takes a cab to the hospital.

Her dad and mom and upkeep mortgage give her about £800 a month, which she dietary supplements with tutoring and informal work in hospitality. Her lease is £600. There are further prices like her scrubs – she wants a number of units – at £35 a set.

“Things are fairly tight,” she says.

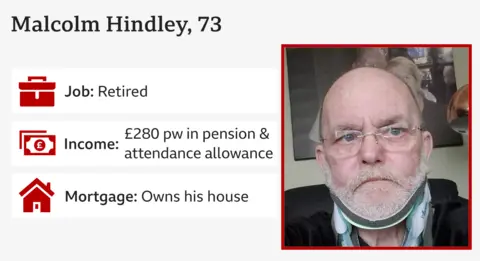

‘I get £280 every week. I’m anxious about profit cuts for the long-term sick’

“There doesn’t seem to be anything good on the horizon,” says Malcolm Hindley, a retired window cleaner from Liverpool.

A widower, he lives along with his daughter, who “does everything round the house” and cares for him and her disabled daughter.

He owns his personal home, however finds it arduous to get by on his £200-a-week state pension, plus attendance allowance of round £80 every week.

He wants a automobile to get to the outlets and medical appointments, and has simply been in a automobile accident that has left him with a neck brace, on high of current mobility points.

He can be listening out on Wednesday for additional particulars round cuts to advantages for the long-term sick and disabled.

Losing the winter gasoline cost was arduous, he says, as a result of he feels the chilly extra as he will get older. Now he’s anxious what else may go.

“The way this government’s working, it just seems to be hitting the poorer more. What else are they going to take off us?”

He does not have a lot left on the finish of the month, however what he does have goes on ice lotions and sweets for the grandchildren.

“When you see their faces it’s brilliant,” he says.

https://www.bbc.com/news/articles/cq6ydljn6nno