The 5 steps that would result in will increase | EUROtoday

Business reporter, BBC News

Getty Images

Getty ImagesChancellor Rachel Reeves has set out her plans for the UK economic system in her Spring Statement and is on monitor to satisfy her self-imposed guidelines on the general public funds, which she has stated are “non-negotiable”.

On the face of it, that appears like an excellent factor. So why are individuals saying that she could battle to satisfy them and the one manner she could achieve this is by elevating taxes?

It’s a sophisticated image.

1. Not a lot spare cash

Ahead of the Spring Statement, the chancellor had been below stress, with hypothesis over how she would be capable to meet her self-imposed monetary guidelines, certainly one of which is to not borrow to fund day-to-day spending.

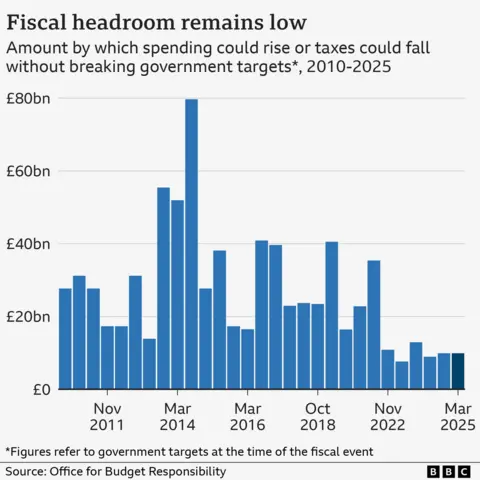

In October, the federal government’s official financial forecaster, the Office for Budget Responsibility (OBR), stated that Reeves would be capable to meet that rule with £9.9bn to spare.

An enhance in authorities borrowing prices since then meant that that room to spare had disappeared. Now massive welfare cuts and spending reductions within the Spring Statement have restored it.

Almost £10bn could sound like so much, but it surely’s a comparatively small quantity in an economic system that spends £1 trillion a 12 months, and raises across the similar in tax.

In truth it’s the third lowest margin a chancellor has left themselves since 2010. The common headroom over that point is thrice larger at £30bn.

“It is a tiny fraction of the risks to the outlook,” Richard Hughes from the OBR advised the BBC.

He stated there have been many elements that would “wipe out” the chancellor’s headroom, together with an escalating commerce battle, any small downgrade to progress forecasts or an increase in rates of interest.

2. Predicting the long run is tough

Which brings us on to the precarious nature of constructing financial forecasts.

“All forecasts turn out to be wrong. Weather forecasts also turn out to be wrong,” says Hughes.

Predicting what’s going to occur sooner or later, particularly in 5 years’ time is difficult, and is topic to revisions. You may very well be forgiven for not predicting a battle or a pandemic, for example.

The revered assume tank, the Institute for Fiscal Studies (IFS), has already stated there’s “a good chance that economic and fiscal forecasts will deteriorate significantly between now and an Autumn Budget”.

A living proof, solely hours after Reeves delivered her assertion in parliament, US President Donald Trump introduced new 25% tariffs on vehicles and automobile components coming into the US.

3. Car tariffs an indication worse may come

Reeves admitted the automobile tariffs can be “bad for the UK” however insisted the federal government was in “extensive” talks to keep away from them being imposed right here.

According to the OBR, these import taxes would have a direct impact on items totalling round 0.2% of GDP.

Before Trump’s announcement, the OBR had warned of the danger of an escalating commerce battle, and whereas the proposals don’t precisely match the watchdog’s worst-case state of affairs, which might see the UK retaliate, Hughes stated it had parts of it.

Although 0.2% is a tiny quantity, nonetheless it is going to have an effect on the economic system.

And within the OBR’s worst-case state of affairs, 1% can be knocked off ecomic progress.

4. Uncertainty means corporations and folks do not spend

Trump’s commerce insurance policies and the truth that no one appears to know whether or not he’ll comply with by together with his threats, U-turn on them, or how he’ll react to others is only one manner his presidency is making the world so unsure in the mean time.

The battle in Ukraine continues, regardless of Trump’s pledge to finish it.

The UK, together with Germany, has stated it is going to enhance defence spending. Trump has lengthy referred to as for European members of Nato to spend extra on defence, and there are additionally fears that if the US does make a cope with Russia to finish the battle, that would go away Europe susceptible.

Domestically, companies are additionally going through a worrying time as they brace for an increase in prices in April as employers’ National Insurance contributions, the National Living wage and enterprise charges are all set to go up.

Some corporations have stated they’ve delay funding selections in consequence, and lots of have warned of worth rises or job cuts. If these materialise, then that may knock progress.

5. Break the principles or increase taxes

Given the entire above, if the chancellor’s headroom had been to vanish, why would that matter?

Reeves has staked her status on assembly her fiscal guidelines, pledging to carry “iron discipline” and supply stability and reassurance to monetary markets, in distinction to former Prime Minister Liz Truss, whose unfunded tax cuts spooked the markets and raised rates of interest.

So if she continues to be to satisfy her guidelines and never borrow to fund day-to-day spending, that will imply both extra spending cuts or tax rises.

The authorities has already introduced massive cuts to the welfare invoice in addition to plans to chop the civil service and abolish a number of quangos together with NHS England.

But as Paul Dale, chief UK economist at Capital Economics, places it: “Non-defence spending can only be cut so far.”

By leaving herself so little wiggle room and with such a precarious financial outlook, “we can surely now expect six or seven months of speculation about what taxes might or might not be increased in the autumn,” says Paul Johnson from the IFS.

That hypothesis itself may cause financial hurt, he says.

Reeves has not dominated out tax rises however advised the BBC there have been “opportunities” in addition to “risks” for the UK economic system.

https://www.bbc.com/news/articles/cr52glegdnvo