Trump tariffs: Who shall be hardest hit by China-US commerce battle? | EUROtoday

China has retaliated with 34 per cent tariffs on imported US items, within the wake of President Donald Trump’s “Liberation Day” commerce battle.

On April 2, Mr Trump introduced an additional 34 per cent tariff on all Chinese items imported to the US, on prime of an present 20 per cent levy.

Now, China will impose 34 per cent reciprocal tariffs from April 10, with the China State Council Tariff Commission saying it was hitting again in opposition to “bullying”.

“This practice of the US is not in line with international trade rules, seriously undermines China’s legitimate rights and interests, and is a typical unilateral bullying practice,” the Commission wrote in an announcement.

Responding to China’s new levies, Mr Trump wrote on Truth Social: “China played it wrong, they panicked – the one thing they cannot afford to do!”

Here, we take a look at the areas that shall be impacted?

The US-China commerce relationship

Previously, retaliatory tariffs from China solely lined particular industries akin to gas and agricultural merchandise. Now, all US exports to China shall be hit.

The US imports way more from China than it exports. In 2024, items exported to China have been price $143.5bn, in line with the US Trade Representative workplace.

Meanwhile, the US purchased thrice as many items ($438.9bn) in the identical interval).

This makes the commerce deficit $295bn in 2024 – a 5.8 per cent enhance from the earlier 12 months; and a first-rate goal for President Trump.

This signifies that the US shall be much less affected by retaliatory tariffs, Dr Xin Sun, a senior lecturer in Chinese and East Asian enterprise at KCL, instructed The Independent.

“Given the imbalance in commerce between China and US, the harm brought on by China’s retaliation to US is because of be smaller than the affect of US tariff on China, which isn’t solely the best amongst all international locations but in addition impacts a wider vary of sectors.”

In addition, the financial ties between China and the US have already been shrinking, and the US-China commerce relationship accounts for lower than 5 per cent of worldwide items commerce.

“There’s been a big unwinding within the financial ties between these international locations because the center of a part of the final decade,” explains Simon Evenett, Professor of Geopolitics and Strategy on the International Institute for Management Development.

“The disengagement has been well underway. What we’re seeing now is the next chapter in the process of decoupling between these geopolitical rivals,” he said.

US exports to China

According to 2023 data from the Observatory of Economic Complexity (OEC), around half of all goods exported to China are concentrated within five key categories.

The top goods exports are fuel products, including crude and petroleum oil, propane, and liquefied natural gas, which were worth $23.6bn in 2023 (the latest available data).

While the US is a big buyer of machinery and electronics from China, it is also reliant on China buying its own technology.

China bought $17bn in machinery and parts from the US in 2023, and $12bn in electronics.

The top products most affected by reciprocal tariffs, are integrated circuits and gas turbines.

While Mr Trump was quick to slap tariffs on foreign-made cars and parts, the US also exports $7.5bn in cars to China, which will now be impacted by its reciprocal 34 per cent tariffs.

Other areas of the transport manufacturing sector, namely aviation, have billions of dollars in goods at risk.

Dr Mary Lovely, Senior Fellow at Peterson Institute for International Economics, said major American brands will suffer from the changes.

“We had settled into a new routine, and now that status quo was just completely upended by the tariffs from both sides,” she instructed The Independent.

“I think long term, this actually reduces the prospects for companies like Boeing. This is going to impact companies like Apple and Caterpillar exports – companies which also export to [China].”

The US pharmaceutical business can be a significant exporter to China, promoting over $7.5bn in vaccines and packaged drugs in 2023, alongside $3.3bn in medical devices.

US farmers set to undergo most

Most of all, Dr Lovely believes that the US agricultural sector shall be worst hit by China’s tariffs.

China is a prime purchaser of its vegetable merchandise ($20bn) — not least US soy ($15bn), shopping for over half of all US exports.

Billions in American meat and animal merchandise may also be affected, whereas Mr Trump makes an attempt to power the UK to purchase chlorinated hen in change for tax reduction.

These tariffs on farmers could have a significant impact on Trump’s core political base, Dr Sun warned, pointing out that agriculture is a key export from the US to China.

Dr Sun said: “Since agriculture constitutes a lion share of US export to China, China’s retaliation has an even bigger affect on a few of Trump’s core political base. By focusing on this inhabitants, China hopes to trigger political pains for Trump and power him to again down considerably.”

What about Chinese items?

Of all of the international locations hit with tariffs, Americans will probably really feel the affect of China’s most – and shortly.

The 54 per cent whole tariff on imported Chinese items is the best of any nation. And extra importantly, American customers are extremely reliant them, by many elements of the provision chain.

Unsurprisingly, electronics and equipment are the highest items imported to the US from China, at $208bn in 2023 alone.

These merchandise span all parts of Americans’ lives; from computer systems to home home equipment, and electrical batteries.

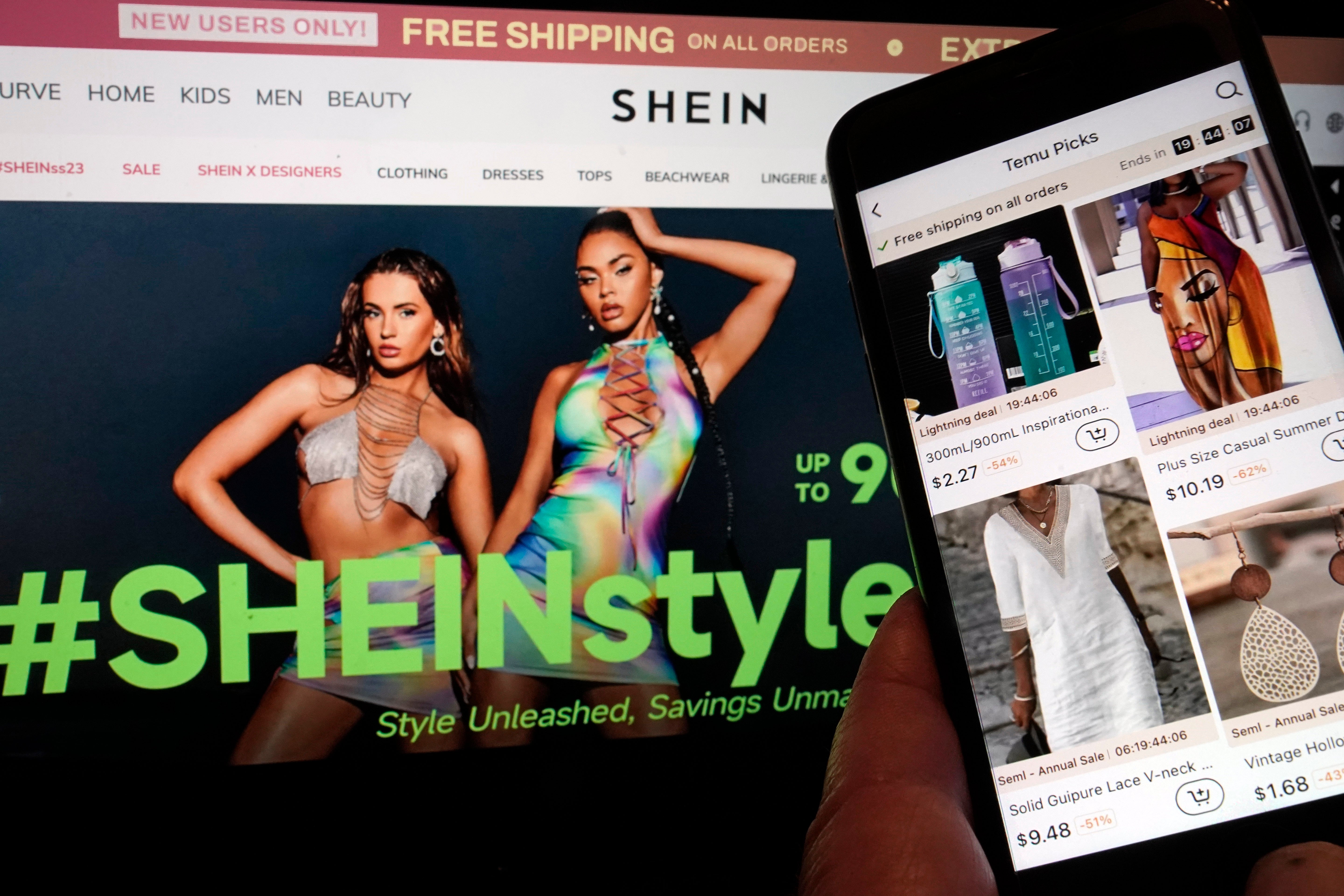

Textile imports price $36bn may additionally affect common customers; notably since increasingly clothes manufacturers import from China.

The US can be ending an exemption that allowed low-value merchandise to keep away from tariffs.

This signifies that low-cost, American-favourite manufacturers akin to Shein and Temu might face tariffs for the primary time – and be pressured to extend their costs.

https://www.independent.co.uk/news/business/china-retaliates-trump-tariffs-trade-war-b2727949.html