China isn’t backing down from Trump’s tariff conflict. What subsequent? | EUROtoday

Getty Images

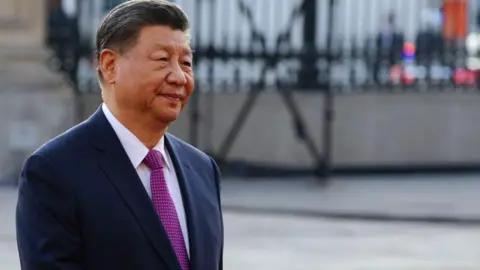

Getty ImagesThe commerce conflict between the world’s two greatest economies exhibits no indicators of slowing down – Beijing has vowed to “fight to the end” hours after US President Donald Trump threatened to almost double the tariffs on China.

That might depart most Chinese imports going through a staggering 104% tax – a pointy escalation between the 2 sides.

Smartphones, computer systems, lithium-ion batteries, toys and online game consoles make up the majority of Chinese exports to the US. But there are such a lot of different issues, from screws to boilers.

With a deadline looming in Washington as Trump threatens to introduce the extra tariffs from Wednesday, who will blink first?

“It would be a mistake to think that China will back off and remove tariffs unilaterally,” says Alfredo Montufar-Helu, a senior advisor to the China Center at The Conference Board assume tank.

“Not only would it make China look weak, but it would also give leverage to the US to ask for more. We’ve now reached an impasse that will likely lead to long-term economic pain.”

Global markets have slumped since final week when Trump’s tariffs, which goal virtually each nation, started coming into impact. Asian shares, which noticed their worst drop in a long time on Monday after the Trump administration did not waver, recovered barely on Tuesday.

Meanwhile, China has hit again with tit-for-tat levies – 34% – and Trump warned that he would retaliate with an extra 50% tariff if Beijing would not again down.

Uncertainty is excessive, with extra tariffs, ranging to greater than 40%, set to kick in on Wednesday. Many of those would hit Asian economies: tariffs on China would rise to 54%, and people on Vietnam and Cambodia, would soar to 46% and 49% respectively.

Experts are anxious in regards to the pace at which that is occurring, leaving governments, companies and traders little time to regulate or put together for a remarkably totally different world economic system.

How is China responding to the tariffs?

China had responded to the primary spherical of Trump tariffs with tit-for-tat levies on sure US imports, export controls on uncommon metals and an anti-monopoly investigation into US companies, together with Google.

This time too it has introduced retaliatory tariffs, but it surely additionally seems to be bracing for ache with stronger measures. It has allowed its forex, the yuan, to weaken, which makes Chinese exports extra engaging. And state-linked enterprises have been shopping for up shares in what seems to be a transfer to stabilise the market.

Getty Images

Getty ImagesThe prospect of negotiations between the US and Japan appeared to buoy traders who had been preventing to claw again a few of the losses of latest days.

But the face-off between China and the US – the world’s greatest exporter and its most vital market – stays a significant concern.

“What we are seeing is a game of who can bear more pain. We’ve stopped talking about any sense of gain,” Mary Lovely, a US-China commerce knowledgeable on the Peterson Institute in Washington DC, instructed the BBC’s Newshour programme.

Despite its slowing economic systemChina might “very well be willing to endure the pain to avoid capitulating to what they believe is US aggression”, she added.

Shaken by a chronic property market disaster and rising unemployment, Chinese persons are simply not spending sufficient. Indebted native governments have additionally been struggling to extend investments or develop the social security web.

“The tariffs exacerbate this problem,” mentioned Andrew Collier, Senior Fellow on the Mossavar-Rahmani Center for Business and Government at Harvard Kennedy School.

If China’s exports take a success, that hurts a vital income stream. Exports have lengthy been a key consider China’s explosive progress. And they continue to be a major driver, though the nation is attempting to diversify its economic system with high-end tech manufacturing and larger home consumption.

It’s laborious to say precisely when the tariffs “will bite but likely soon,” Mr Collier says, including that “[President Xi] faces an increasingly difficult choice due to a slowing economy and dwindling resources”.

It goes each methods

But it isn’t simply China that might be feeling the impression.

According to the US Trade Representative workplace, the US imported $438bn (£342bn) price of products from China in 2024, with US exports to China valued at $143bn, leaving a commerce deficit of $295bn.

Getty Images

Getty ImagesAnd it isn’t clear how the US goes to seek out different provide for Chinese items on such quick discover.

Taxes on bodily items apart, each international locations are “economically intertwined in a lot of ways – there’s a massive amount of investment both ways, a lot of digital trade and data flows”, says Deborah Elms, Head of Trade Policy on the Hinrich Foundation in Singapore.

“You can only tariff so much for so long. But there are other ways both countries can hit each other. So you might say it can’t possibly get worse, but there are many ways in which it can.”

The remainder of the world is watching too, to see the place Chinese exports shut out of the US market will go.

They will find yourself in different markets similar to these in South East Asia, Ms Elms provides, and “these places [are dealing] with their own tariffs and having to think about where else can we sell our products?”

“So we are in a very different universe, one that is really murky.”

How does this finish?

Unlike the commerce conflict with China throughout Trump’s first time period, which was about negotiating with Beijing, “it’s unclear what is motivating these tariffs and it’s very hard to predict where things might go from here,” says Roland Rajah, lead economist on the Lowy Institute.

China has a “wide toolkit” for retaliation, he provides, similar to depreciating their forex additional or clamping down on US companies.

“I think the question is how restrained will they be? There’s retaliation to save face and there’s pulling out the whole arsenal. It’s not clear if China wants to go down that path. It just might.”

Getty Images

Getty ImagesSome specialists consider the US and China might have interaction in non-public talks. Trump is but to talk to Xi since returning to the White House, though Beijing has repeatedly signalled its willingness to speak.

But others are much less hopeful.

“I think the US is overplaying its hand,” Ms Elms says. She is sceptical of Trump’s perception that the US market is so profitable that China, or any nation, will finally bend.

“How will this end? No-one knows,” she says. “I’m really concerned about the speed and escalation. The future is much more challenging and the risks are just so high.”

https://www.bbc.com/news/articles/ckg51yw700lo