Billionaire hedge fund chief warns US going through one thing ‘worse than a recession’ | EUROtoday

The U.S. is perilously near coming into a proper financial recession and will effectively be going through one thing a lot worse on the horizon, a billionaire investing knowledgeable warned Sunday.

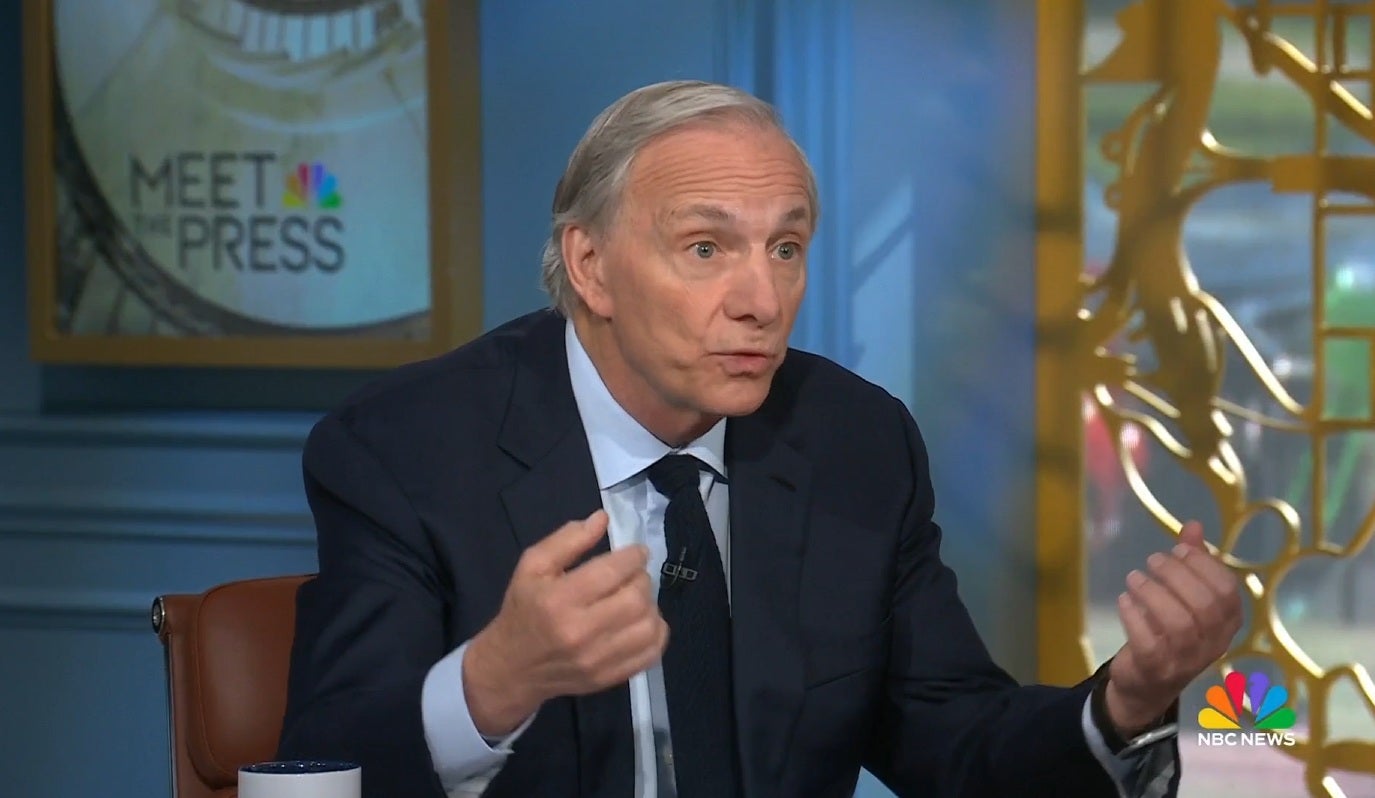

Ray Dalio, founding father of Bridgewater Associates, appeared on NBC’s Meet the Press, the place he warned that the “disruptive” nature of Donald Trump’s tariff bulletins have been inflicting market instability and was making it troublesome for each U.S. enterprise and international buying and selling companions to depend on the America.

A Wall Street veteran who predicted the collapse of the housing bubble in 2008 which triggered a monetary disaster that 12 months, Dalio instructed NBC’s Kristen Welker that the prospect of stopping “something that is much worse than a recession” got here all the way down to how strategically the White House dealt with what the president’s advisers have defined is his finish aim: a grand reorganization of the worldwide commerce construction.

“We are having profound changes in our domestic order […] and we’re having profound changes in the world order. Such times are very much like the 1930s,” stated Dalio.

“So if you take tariffs, if you take debt, if you take the rising power challenging existing power, if you take those factors and look at the factors – those changes in the orders, the systems, are very, very disruptive,” he continued. “How that’s handled could produce something that is much worse than a recession. Or it could be handled well.”

Dalio – who has a internet value of $14 billion – repeated what he has on a number of events warned: that he believes the rising US federal debt, now at greater than $36 trillion, is a ticking time bomb that can hinder the U.S.’s capability to spend and borrow sooner or later.

“We have a breaking down of the monetary order,” Dalio warned. “We are going to change the monetary order because we cannot spend the amounts of money [we want].”

He continued: “I believe that members of Congress should take the pledge, what I call the 3 percent pledge. That in one way or another, that they will get that budget deficit down to that number. If they don’t, we’re going to have a supply/demand problem for debt at the same time as we have these other problems. And the results of that will be worse than a normal recession.”

His warnings come after days of instability on the inventory market, pushed by plunging tech shares and different industries hit by the White House’s new tariffs and vexed by the constantly-changing nature of the insurance policies themselves.

Late Friday night, Trump’s Customs and Border Protection company issued a discover exempting smartphones, photo voltaic cells and different imports related to America’s tech sector from each sky-high “reciprocal” tariffs on China and his decrease baseline tariff fee of 10 % on all imported items. It was a win for corporations resembling Apple, however one which was deadened Sunday when Commerce Secretary Howard Lutnick warned that these tariffs could be reimposed inside one to 2 months.

It stays unclear whether or not the president will go away in place the rest of his much-maligned “reciprocal” tariff charges in opposition to dozens of U.S. buying and selling companions together with the E.U., Japan, Canada and Mexico, or whether or not Trump will likely be talked into backing down partially or complete as he has in repeated current situations. Trump Cabinet officers and White House advisers have been unable to provide a transparent reply as as to whether these tariffs or the president’s across-the-board 10 % tariff fee are easy negotiation techniques and could possibly be rolled again, or whether or not they are going to stay in place at some point of his time period.

Other trade leaders have acknowledged what White House officers repeatedly declare: that the tariffs are no less than semi-permanent because the president seeks to power U.S. corporations and overseas traders to onshore manufacturing and manufacturing within the U.S. to be able to sustainably entry American markets.

“What we’re seeing now is a structural shift, driven by policy, that’s likely to be long-lasting,” Felix Stellmaszek, international lead of automotive and mobility at Boston Consulting Group, instructed CNBC on Saturday.

“This may well be the most consequential year for the auto industry in history — not just because of immediate cost pressures, but because it’s forcing fundamental change in how and where the industry builds.”

https://www.independent.co.uk/news/world/americas/us-politics/ray-dalio-bridgewater-trump-tariffs-recession-b2732716.html