What made a billionaire wish to purchase this fading relic | EUROtoday

BBC

BBCFrom the top of April, the 500-year-old Royal Mail will probably be managed by a Czech billionaire who co-owns a soccer membership and is a serious investor in a British grocery store – so, why would he need this ailing establishment?

Listen to the audio model of this on BBC Sounds

“A pair of scissors, one empty teapot and some hot water, please.” The barely baffled employees at Claridge’s scrambled to adjust to Daniel Kretinsky’s breakfast order as he sanitised and moisturised his fingers.

The upscale lodge has been serving tea to the worldwide elite for many years however Mr Kretinsky introduced alongside his personal packet of Chinese inexperienced tea, which he snipped open (therefore the scissors) and poured into the empty pot.

He was tall, completely groomed, steely-eyed however unfaultingly well mannered and considerate. If you advised anybody within the eating room he was a billionaire, they’d haven’t any drawback believing it.

Known because the Czech Sphinx for his enigmatic type, Mr Kretinsky, who’s 49, is price £6bn in response to the Sunday Times Rich List. He lives in plush mansions in Paris and London, was initially a lawyer and made his fortune in European power markets.

Reuters

ReutersOur assembly was at Claridge’s in June 2024 – I used to be attempting to persuade him to present me an interview about his audacious try to purchase a British establishment that was as soon as seen as a nationwide treasure: Royal Mail.

His profile as a purchaser was one which that unions and ministers usually can be cautious of due to his historic connections with Russia – his corporations personal a fuel pipeline that has transported Russian fuel to Europe.

But six months on, his bid to purchase Royal Mail’s father or mother firm was cleared by the UK authorities after he agreed “legally binding” undertakings.

It was agreed that the federal government would retain a so-called “golden share”, requiring it to approve any main modifications to Royal Mail’s possession, headquarters location and tax residency. The deal was additionally blessed by unions.

Earlier this month, the proprietor of Royal Mail stated that the takeover might be accomplished by the top of April because the deal cleared the ultimate regulatory hurdles standing in the best way.

But step again and Royal Mail appears an odd goal for a globally cell oil and fuel billionaire investor to set his sights on. It begs the query why would anybody, not to mention a profitable worldwide entrepreneur, wish to purchase this light relic?

How Royal Mail’s crown slipped

Royal Mail was based by Henry VIII greater than 500 years in the past and nonetheless carries the royal cipher on its vans. It is a part of the material of British life and many individuals nonetheless have a fond relationship with their ‘postie’, who walks down their path bringing their letters and parcels to their door.

But lately Royal Mail’s crown has slipped. It is shedding cash and market share, has been fined for lacking supply targets and has made an enemy of its personal workforce by means of a sequence of bitter strikes.

Royal Mail’s letter enterprise is in steep decline too. It has gone from a peak of 20 billion letters despatched in 2004 to underneath seven billion despatched final 12 months.

In December 2024, it was fined £10.5m by the regulator Ofcom for failing to fulfill supply targets for first and second class mail.

While the increase in e-commerce has seen the amount of parcels rise, Royal Mail’s share of that extra worthwhile enterprise has been falling as new opponents like DPD, DHL, Amazon and Evri have eaten into its market share.

Royal Mail was break up off from the Post Office in 2012 and privatised in 2013 at a price of £3.3bn. Its shares instantly rocketed by 38% on the primary day of buying and selling, resulting in criticism – from the National Audit Office, amongst others – that it had been bought on a budget.

At its peak in Covid-era May 2021, the corporate was price greater than £6bn however had slumped to only over £2bn when Mr Kretinsky launched his takeover bid final April.

He sealed the deal at £3.6bn – 63% greater than earlier than he signalled his intent, however barely greater than it was price at privatisation over a decade in the past.

“Royal Mail is a business that has historically found it difficult to grow revenues by more than costs,” says Alex Paterson, an analyst at Peel Hunt stockbrokers. “It has seen its parcels market share eroded by more dynamic competition that has been able to invest more in technology, and it has struggled with industrial relations to keep staff working towards a common goal.

“This will not be a problem to underestimate nor one that may be overcome rapidly, however that requires appreciable long-term funding in infrastructure, know-how and employees.”

Part of the challenge, and one that puts Royal Mail at a disadvantage compared with its rivals, is that unlike them, Royal Mail has to meet a string of legal and regulatory obligations, says Hazel King, the editor of Parcel and Post Technology International.

Under what is called the universal service obligation (USO), Royal Mail is required by law to deliver letters six days a week and parcels five days a week to every address in the UK. So it cannot pick and choose which business it wants to do.

“Royal Mail should meet their common service obligation whereas attempting to compete with non-public companies who usually cherry-pick probably the most worthwhile enterprise,” says Ms King.

The ‘Czech Sphinx’s’ plan

Mr Kretinsky says he has a plan. His success in the energy sector allowed him to buy a 27.5% stake in Royal Mail’s parent company, International Distribution Services (IDS). And his company – EP Group – intends to build a pan-European conglomerate built on three pillars: energy, retail and logistics.

He sees IDS as the cornerstone of the logistics pillar, with a plan to go toe-to-toe with the likes of Deutsche Post DHL, DPD and Amazon.

The USO has been under review by Ofcom, with Royal Mail hoping that the regulator will reduce the requirement to deliver second-class letters from six days a week to every other weekday. That single move could save Royal Mail £300m a year – putting it back on a break-even footing.

PA Media

PA MediaMr Kretinsky told me during our interview that he would honour the USO “so long as I’m alive”, but he is unsurprisingly very much in favour of changing its terms. He said he hopes that “rational minds prevail” when reforming a service that is unsustainable in its current form.

So far, the noises from Ofcom seem to be supportive. The regulator’s chief executive Dame Melanie Dawes told the BBC there were “actual questions on what the service must be going into the longer term”.

Given letter numbers are falling, “we have now to consider what’s economical”, she said, adding Ofcom would be publishing plans for the regulation of Royal Mail “to ensure it’s sustainable”.

While Royal Mail generally welcomed the proposed changes to the Universal Service Obligation, Royal Mail pushed back against proposed new delivery time and business customer requirements.

Royal Mail said last week that the level at which Ofcom is proposing to set the new delivery targets – 99.5% of First Class letters delivered within three days, and the same percentage of Second Class letters within five – is “over specified and can add important price to the supply of the Universal Service”.

It also expressed concerns that proposals to add a new category of regulation to ensure timely delivery for business users like direct mail companies “goes towards the broader authorities drive to scale back pointless regulation”.

European parcel know-how

But there are other factors that may have driven the sale. Some analysts have speculated that there is another jewel in the crown of IDS – and that Mr Kretinsky may really be after a different part of the business.

Along with Royal Mail, IDS also owns a European parcels business called GLS which it acquired in 1999 – long before Royal Mail was split off from the Post Office and privatised.

Last year GLS made a profit of £320m, compared to Royal Mail, which lost £348m as letter volumes continued to plunge and new competitors ate into its market share of the more profitable parcels business.

“GLS has been a worthwhile progress enterprise, which has seen funding whereas Royal Mail has been a perpetual underperformer, because the board of father or mother firm IDS has invested the place it thinks it would see the very best returns,” says Mr Paterson.

Mr Kretinsky rejects suggestions from some quarters that he wants to break up the group and has committed to keeping it together for at least five years. Even beyond that, he says the plan is to grow the company rather than shrink it, so a disposal of GLS would be “nonsensical”.

In fact, Mr Kretinsky says he hopes to bring the European parcel know-how at GLS to bear on Royal Mail’s operations.

What the unions are hoping, and Kretinsky is promising, is that Royal Mail will see greater investment and over time begin to look a bit more like GLS and its European counterparts such as Deutche Post DHL.

Catching up with competitors

Given all the challenges Royal Mail faces, there’s an obvious question – why would a billionaire want to chance his arm on turning round something that others couldn’t, while up against powerful competitors?

Well, if you believe as Kretinsky does – and he is surely right – that getting parcels to people is a profitable and growing industry, then buying Royal Mail and GLS gives you a way to become a big European player in logistics quickly.

Add to that a powerful and historic brand, a database with every single UK address and a frontline workforce that most of its customers are fond of and pleased to see when they walk down the path – then, despite the challenges, it begins to make sense.

Reuters

ReutersMr Kretinsky is convinced future growth lies in out-of-home (OOH) delivery. The parcel lockers found in supermarket car parks and elsewhere, operated by the likes of Amazon, Evri and UPS, have grown quickly across Europe.

Earlier this month it was reported that Sainsbury’s would be the first supermarket to partner with Royal Mail and install parcel lockers at supermarkets. Some are already operating at several stores including ones in Clapham, Kidderminster and Chislehurst.

Royal Mail has also trialled a new postbox that can take small parcels. Customers procure a barcode from an app, then at the postbox they scan the barcode and drop the parcel into a drawer – this is all powered by solar panels on the box.

Emma Gilthorpe, Royal Mail chief executive, called it an “historic change” to give postboxes “a brand new lease of life”.

All of this boils down to the same thing: convenience. It means customers don’t have to wait at home for a delivery – the sender or parcel business emails or texts a code to unlock the locker. For the business it’s more efficient, allowing couriers to deliver lots of parcels to one place – meaning fewer miles on the road and less time.

Getty Images

Getty Images“If they will develop the parcels enterprise and claw again market share, there’s each probability that they will add new jobs that might offset the discount in jobs within the declining letters enterprise,” says Mr Paterson.

“There is a big long-term alternative to run Royal Mail extra efficiently with regulatory modifications to the USO and larger funding in know-how and out-of-home deliveries.”

But Royal Mail still has a lot of catching up to do with its competitors. It currently has 1,500 lockers in the UK and aims to grow this figure to at least 20,000 over time. By contrast, Amazon already has 5,000 lockers across the UK and InPost has 7,500 across the UK.

Winning over doubters

That Mr Kretinsky has pulled off the takeover is no easy feat. Royal Mail is, after all, considered vital national infrastructure and as such the deal required review under national security laws.

Then there is the fact that his companies own a gas pipeline that has transported Russian gas to Europe – paid for and approved by EU member states. The small amount that was transported was reduced to zero at the end of 2024 when Ukraine refused to renew permission for any gas to flow across its borders.

Speaking in front of MPs in November, UK Business Secretary Jonathan Reynolds referred to Mr Kretinsky as a “official enterprise determine” whose alleged links to Russia had already been reviewed and dismissed when he became the biggest shareholder in the company two years ago.

Getting the unions on board seemed even more of a challenge and the Communication Workers Union was wary of Mr Kretinsky. “The CWU believes Royal Mail must be in public fingers,” Dave Ward, the CWU’s general secretary, told the BBC in June. “We know there are official considerations about Royal Mail Group being owned by a overseas non-public fairness investor.”

But during negotiations, union representatives secured a series of time-limited commitments from him, including guarantees that he will protect Royal Mail’s pension surplus, that there will be no compulsory redundancies for two years, no sell-off or break-up of any operational part of the existing company and no outsourcing of grades represented by the CWU.

Getty Images

Getty ImagesMr Kretinsky also agreed to restrictions on moving dividends out of Royal Mail Group and to respect agreements with and recognition of the CWU. He said he would keep the brand name and Royal Mail’s headquarters and tax residency in the UK for the next five years.

Union bosses told me that a life under Mr Kretinsky “could not be any worse than what we have now had for the final 10 years”.

So, as Mr Kretinsky looks certain to pull off the sale, what will customers notice?

The frequency of second-class deliveries may be reduced after the Ofcom review. We will see new Royal Mail lockers appearing in our neighbourhoods. And the price of first-class mail may go up: second-class stamps are regulated by Ofcom, while first-class ones are not.

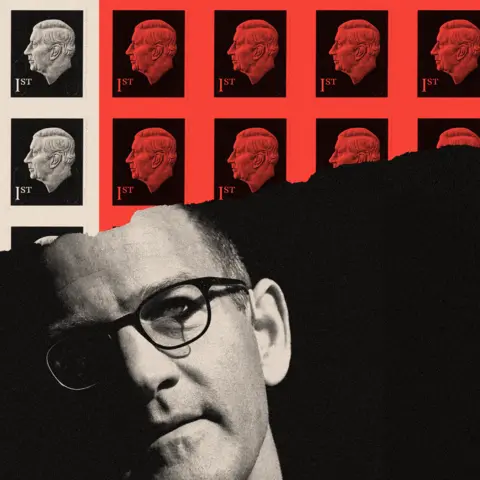

The monarch’s head will still be on those stamps, but there is a new king of our mail system. And his name is Daniel Kretinsky.

Top image credit: Getty

BBC InDepth is the house on the web site and app for the very best evaluation, with recent views that problem assumptions and deep reporting on the most important problems with the day. And we showcase thought-provoking content material from throughout BBC Sounds and iPlayer too. You can ship us your suggestions on the InDepth part by clicking on the button under.

https://www.bbc.com/news/articles/cn4mm3kx0v2o