‘Fake financial institution app allowed scammers to shake my hand and steal from me’ | EUROtoday

BBC West Investigations

BBC

BBCA person who misplaced £1,000 value of instruments after being scammed by a pretend banking app has stated it makes you “lose faith in humanity”.

The apps mimic respectable cellular banking platforms and permit fraudsters to pretend financial institution transfers in individual, present the vendor a “successful payment” message after which stroll away, leaving sellers hundreds of kilos out of pocket.

Dr Tim Day, lead in doorstep crime and scams for the Chartered Trading Standards Institute (CTSI), described the apps as an “emerging threat.” He added: “The in-person nature of this scam is unusual.”

Victim Anthony Rudd stated: “I found it absolutely sickening that you could look someone in the eye, shake their hand, and then rob them.”

About 500 studies of crimes involving pretend banking apps have been made to Action Fraud previously three years.

Some of those apps had been obtainable on the Google Play retailer previously however had been eliminated. Google stated the “safety and security of users is our top priority”.

Now, BBC West Investigations have discovered variations of the apps obtainable elsewhere on-line which will be downloaded on to Android telephones with out the usage of an official app retailer.

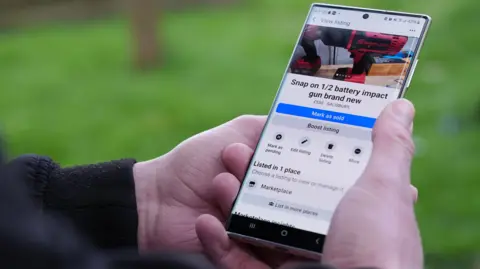

Mechanic Mr Rudd was promoting greater than £1,000 value of energy instruments on a social media platform when he obtained a message from a profile named Liam Wright.

When “Mr Wright” stated he was excited about viewing them, Mr Rudd invited him to come back to his workshop in Salisbury, Wiltshire.

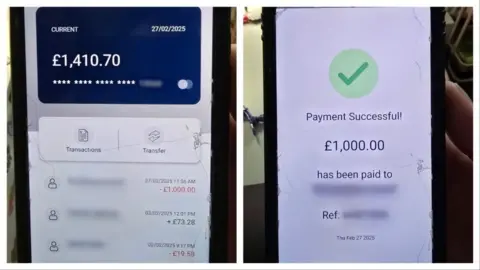

After the person arrived, he checked over the instruments, provided a financial institution switch and opened what seemed to be a banking app.

“He handed his phone over to me and I typed in my account details, clicked send, and it came up with a successful payment notification,” Mr Rudd stated.

“It looked absolutely genuine.”

While Mr Rudd was ready for the cash to seem in his checking account, he turned his again to choose up equipment handy over as a part of the sale.

The scammer used this chance to depart with all of the instruments, however the cash by no means arrived in Mr Rudd’s checking account.

John Reddock

John Reddock“He came into my workplace and took my tools,” Mr Rudd stated.

“It angered me so much that someone could be so brazen, but it’s also embarrassing that I allowed this to happen.”

Mr Rudd resigned from his job as a result of he stated the rip-off had “a huge impact” on his psychological well being.

“You lose faith in humanity, that someone could be that low,” he stated.

Wiltshire Police informed Mr Rudd it is not going to be taking any additional motion because it has been unable to determine the suspect for the reason that incident on 11 February.

John Reddock

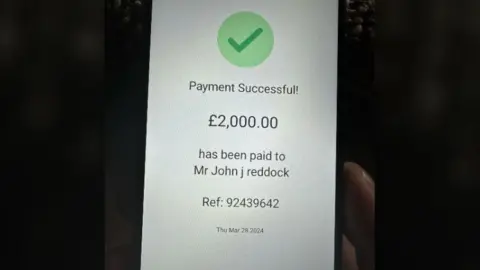

John ReddockIt was an analogous story for John Reddock, from Liverpool.

He was promoting a gold bracelet within the hope he may use the cash to take his two youngsters on vacation to Spain.

He additionally used a social media platform to promote the merchandise, which he listed for £2,000.

“I was trying to do something nice for my kids and it backfired on me,” stated Mr Reddock.

Two males arrived at his home to view the bracelet and determined they had been comfortable to go forward with the acquisition, providing a financial institution switch.

Mr Reddock informed them his checking account particulars and one in every of them typed it into what seemed to be a banking app on their telephone.

It then confirmed a fee profitable notification.

John Reddock

John ReddockThey left with the bracelet however Mr Reddock by no means obtained the cash.

“It’s given me nightmares and sleepless nights. I’m disgusted about what they’ve done to me,” he stated.

“It’s made me really angry because I was trying to do something good for my kids, and they came to my property to steal from me.”

Mr Reddock reported the incident to the police however no additional motion was taken.

John Reddock

John ReddockBBC West Investigations discovered the pretend banking apps – which we’re not naming in order to not promote them – can be found to obtain onto an Android telephone immediately from the web.

Dr Day stated: “So much of fraud is now happening online that it’s easy to drop our guards when dealing with people in person.

“It offers us a false sense of safety however fraud and scams are simply as prone to occur on this house.”

Dr Day said it also shows how scams are becoming “extra advanced and complicated”.

“The amount of cash which is accessible because of fraud is so large and the relative ranges of enforcement attainable means it is a crime sort which is attracting increasingly skilled criminals,” he added.

He said that tech companies need to be “extra engaged” in driving out fraud on online platforms.

How to keep away from the rip-off

UK Finance represents more than 300 firms in the UK’s banking and financial industry. A spokesperson said the fake banking app scam is “a priority” and they gave the following safety advice:

- Do not be pressured into accepting payment by bank transfer

- Never hand over goods unless you are sure you have received the money and check your own bank account to see if the payment has arrived

- Check if the buyer has a newly registered profile before you meet them as this may mean they are not who they say they are

More information about staying safe from scams will be discovered right here.

But this is of little comfort to Sebastian Liberek, who runs his business Seb’s Repairs in Gloucester.

He sells and repairs phones, tablets and computers and has been targeted by fraudsters – who walked directly into his shop – using fake banking apps on three occasions in recent months.

He said he has lost hundreds of pounds to a bank transfer faked by a customer.

“It makes you’re feeling offended and susceptible,” Mr Liberek said.

“When you have spent 15 years constructing a enterprise and somebody can chip at it and take items away with out penalties.”

Mr Liberek has now installed extra security measures such as CCTV to protect his business from future attempts.

“The reality it is occurred 3 times, it can in all probability occur a fourth time,” he stated.

“There’s nowhere to go, you can not discover them, you’ll be able to report them to police, however possibilities of something being accomplished about it are pretty slim.

“It’s a situation without answer, or ending.”

A authorities spokesperson stated they had been taking “ambitious steps to tackle the evolving threat of fraud”.

“In the coming months, we will set out further details including plans to strengthen international cooperation, introduce better protections against AI-enabled fraud, and increase collaboration between government and the private sector,” they added.

Get our flagship e-newsletter with all of the headlines it is advisable begin the day. Sign up right here.

https://www.bbc.com/news/articles/cn05d58jwvdo