Why ought to I care if the dollar falls? | EUROtoday

Getty Images

Getty ImagesThe US greenback has seen large declines in latest months.

Currencies rise and fall on a regular basis however the latest drop within the greenback has been significantly dramatic.

So why has the greenback been falling and why does it matter?

What has occurred to the greenback since Trump was elected?

The greenback was rising within the autumn within the run-up to the 2024 presidential election off the again of comparatively robust US financial development, and continued to strengthen after Trump’s victory in November on hopes he would possibly prolong that pattern.

Talk of his commerce coverage additionally had an impact, as many buyers thought the tariffs that he promised to herald would push up inflation, forcing the US central financial institution, the Federal Reserve to lift rates of interest, or no less than not reduce them as quick as anticipated.

The prospect of upper charges within the US makes the greenback extra enticing because it means buyers will earn more money on their money in {dollars} in comparison with different currencies.

But the calculus has shifted in latest months as the small print of his tariffs have emerged – typically adopted by pauses or, within the case of China, extensions – leaving a lot uncertainty surrounding the impression they’ll have.

US development is now broadly anticipated to weaken.

That has had a knock-on impression on the greenback, which has seen steep falls. Trump’s assaults on Fed chief Jerome Powell for not chopping rates of interest additionally seem to have added stress to the dollar.

The worth of all currencies goes up and down influenced by many elements comparable to inflation expectations and central financial institution insurance policies.

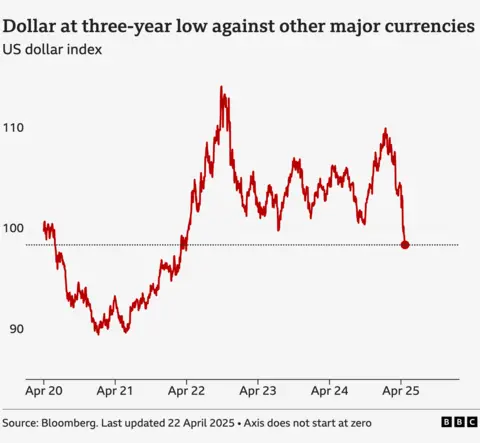

But the greenback index, which measures its energy in opposition to a set of currencies, has fallen to its lowest degree for 3 years.

Is this uncommon?

The greenback is often seen as a secure funding in troubled instances.

So the sharp drops within the foreign money – in addition to the latest sell-off in US authorities bonds, additionally typically thought of a secure US asset – are uncommon.

The fall within the greenback after Trump’s “Liberation Day” tariffs announcement was “quite shocking”, says Jane Foley, head of overseas alternate (FX) technique at Rabobank.

“For several years, the market’s been buying this US growth story, the US stock market’s been outperforming other stock markets, and suddenly you had economists thinking tariffs would push the US into recession,” she says, pointing to the large sell-off of US shares, US bonds and the greenback.

That has raised hypothesis about whether or not the drop would possibly sign a extra far-reaching flip away from the US, in addition to away from the greenback.

What does a weaker greenback imply?

The first time bizarre Americans would possibly discover a weaker greenback is once they go overseas, as their cash won’t go as far. While overseas vacationers within the US will discover their foreign money will purchase them extra.

But actions within the greenback even have an enormous impression internationally, extra so than swings in different currencies do.

That’s as a result of it’s the world’s main reserve foreign money, that means it’s held by central banks around the globe in massive portions as a part of their overseas alternate reserves. Central banks use US {dollars} in worldwide transactions, to pay for worldwide debt, or to assist home alternate charges.

The greenback can also be the primary foreign money utilized in worldwide commerce, with round half of world commerce invoices finished in US {dollars}, says Jane Foley.

A fall within the greenback means US items exports turn out to be cheaper. But imported items could turn out to be dearer because of the weaker foreign money, in addition to any direct impression from tariffs.

Many commodities that commerce internationally, comparable to oil and fuel, are additionally priced in {dollars}. A weaker greenback makes crude oil cheaper for international locations that maintain different currencies.

What occurs if the greenback retains falling?

In the US a robust greenback has been seen as an emblem of American political would possibly.

The very concept that it would lose its standing because the world’s reserve foreign money has been unthinkable.

Ms Foley says that whereas different currencies could turn out to be extra necessary, the greenback will not lose its primary standing any time quickly, though one Federal Reserve official steered final yr that the US can not take this with no consideration.

Ms Foley thinks the greenback will win again some floor over the subsequent few weeks however won’t get again to the place it was.

That’s as a result of with very important market strikes, there’s at all times the opportunity of revenue taking. For occasion, if buyers determine to promote euros whereas they’re buying and selling strongly, that might result in the euro falling and the greenback rising.

The markets can be watching this week to see if Trump continues his assault on the pinnacle of the Federal Reserve. He has known as Mr Powell “a major loser” and has publicly known as for his “termination”.

If there may be stress on Powell to go away workplace, the markets will begin to marvel concerning the Fed’s credibility, one thing which is seen as essential.

“The independence of central banks is seen as critical to ensure long-term price stability, ringfencing policymakers from short-term political pressures,” says Susannah Streeter, head of cash and markets at Hargreaves Lansdown.

https://www.bbc.com/news/articles/cwyn1egyn4xo