When will rates of interest go down once more and the way do they have an effect on mortgages? | EUROtoday

Cost of residing correspondent

BBC

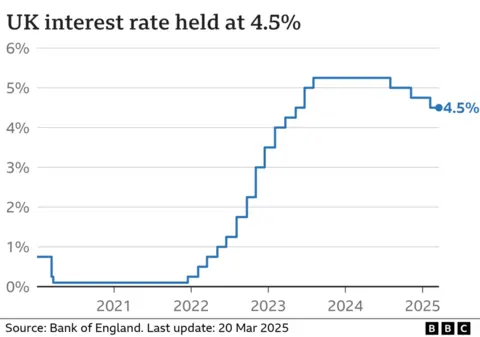

BBCThe Bank of England is extensively anticipated to chop rates of interest on Thursday, with additional falls anticipated throughout the remainder of the yr.

The Bank’s Monetary Policy Committee lower charges to the present degree of 4.5% in February.

Interest charges have an effect on mortgage, bank card and financial savings charges for hundreds of thousands of individuals.

What are rates of interest and why do they alter?

An rate of interest tells you ways a lot it prices to borrow cash, or the reward for saving it.

The Bank of England’s base charge is what it fees different banks and constructing societies to borrow cash.

That influences what they cost their very own prospects for loans reminiscent of mortgages in addition to the rate of interest they pay on financial savings.

The Bank strikes charges up and down with the intention to hold UK inflation – which is the rise within the worth of one thing over time – at 2%.

When inflation is above that concentrate on, the Bank can determine to place charges up. This encourages individuals to spend much less, lowering demand for items and providers and limiting worth rises.

Once inflation is at or close to the goal, the Bank might maintain charges, or lower them to stimulate spending and financial development.

Will charges fall additional?

It is troublesome to foretell precisely what’s going to occur to rates of interest.

The predominant inflation measure, CPI, was 2.6% within the 12 months to March 2025, down barely from the earlier month.

Although that’s far beneath the height of 11.1% reached in October 2022, inflation stays above the two% goal.

As effectively as inflation, the Bank has to think about how the UK economic system is doing extra typically.

It additionally pays shut consideration to the efficiency of the worldwide economic system, which has been thrown into chaos by the widespread tariffs launched by US President Donald Trump.

Bank of England governor Andrew Bailey beforehand mentioned he would take a gradual and cautious method to reducing charges.

But the uncertainty brought on by US tariffs might imply UK rates of interest fall additional than predicted because the Bank seeks to assist increase the economic system. Some analysts consider charges may fall to three.5%.

How do rates of interest have an effect on mortgages, loans and financial savings charges?

Mortgages

Just below a 3rd of households have a mortgage, in line with the federal government’s English Housing Survey.

About 600,000 householders have a mortgage that “tracks” the Bank of England’s charge, so a base charge change has a right away affect on their month-to-month repayments.

But the overwhelming majority of mortgage prospects have fixed-rate offers. While their month-to-month funds aren’t instantly affected by a charge change, future offers are.

Mortgage charges are nonetheless a lot greater than they’ve been for a lot of the previous decade.

As of 6 May, the typical two-year mounted mortgage charge was 5.16%, in line with monetary data firm Moneyfacts, and a five-year deal was 5.09%. The common two-year tracker was 5.16%.

This means many homebuyers and people remortgaging are having to pay much more than if they’d borrowed the identical quantity a couple of years in the past.

About 800,000 fixed-rate mortgages with an rate of interest of three% or beneath are anticipated to run out yearly, on common, till the tip of 2027. Their borrowing prices are anticipated to rise sharply.

Lenders have been lowering charges on new mounted offers in expectation that UK rates of interest will fall additional.

You can see how your mortgage could also be affected by future rate of interest adjustments by utilizing our calculator:

Credit playing cards and loans

Bank of England rates of interest additionally affect the quantity charged on bank cards, financial institution loans and automotive loans.

Lenders can determine to scale back their very own rates of interest if Bank cuts make borrowing prices cheaper.

However, this tends to occur very slowly.

Getty Images

Getty ImagesSavings

The Bank base charge additionally impacts how a lot savers earn on their cash.

A falling base charge is prone to imply a discount within the returns supplied to savers by banks and constructing societies.

The present common charge for an easy accessibility account is 3% a yr.

Any lower may significantly have an effect on those that depend on the curiosity from their financial savings to high up their revenue.

What is going on to rates of interest in different nations?

In latest years, the UK has had one of many highest rates of interest within the G7 – the group representing the world’s seven largest so-called “advanced” economies.

In June 2024, the European Central Bank (ECB) began to chop its predominant rate of interest for the eurozone from an all-time excessive of 4%. After a sequence of cuts, this now stands at 2.25%.

In the US, the central financial institution – the Federal Reserve – lower charges 3 times within the latter a part of 2024, however held rates of interest in March, that means its key lending charge has a goal vary of 4.25% to 4.5%.

The Fed’s selections have come below assault from President Trump, who desires to see additional cuts.

https://www.bbc.com/news/articles/c3dky111m40o