This shock resilience might not be momentary | EUROtoday

Pa Media

Pa MediaIt’s not a growth, however it’s one thing to be roundly welcomed.

Today’s financial figures could replicate erratic commerce struggle components, and bounceback from stagnation on the finish of final yr.

The progress could show quick lived if the gravitational pull of US tariffs and tax rises do hit arduous.

The legitimate caveats, mustn’t, nevertheless, get in the best way of the primary story right here.

The UK financial system did much better than doom-laden predictions for the primary three months of this yr.

It was nowhere close to a recession.

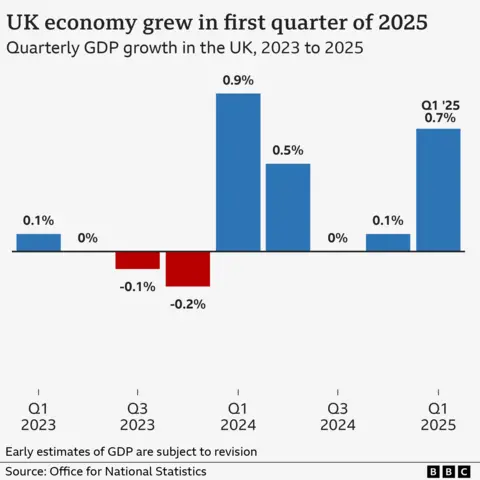

A progress price of 0.7% beat expectations.

It is a return to regular, wholesome ranges of progress, no less than in that quarter.

On successive governments’ favorite metric – the expansion of the remainder of the G7 superior economies – the UK will now be the quickest rising. This is topic to affirmation of Japan and Canada’s numbers within the coming days, however they are going to be decrease.

While virtually everyone expects progress to gradual within the present quarter, after months of tariff uncertainty and April’s tax rises, this determine ought to alter the body of desirous about the British financial system.

Are tens of millions of households nonetheless affected by the price of dwelling squeeze? Yes.

Are small companies particularly in retail and hospitality below suffocating strain from rises in employer National Insurance and the National Living Wage? Also sure.

But away from these necessary sectors, there’s undoubtedly resilience, and it appears much more than that.

The affect of rate of interest cuts, and relative political and financial stability, could have been extra far more necessary.

Real incomes are up, and for a lot of companies outdoors retail and hospitality, the rise in National Insurance contributions has been accommodated by a squeeze to revenue margins and wage rises.

The flipside of the National Living Wage rise, is, in fact, a extra sturdy shopper amid a demographic that does spend within the outlets.

The UK is a world away from the predictions of early January when widespread doom-mongering equated an increase in authorities borrowing charges – primarily pushed by world components – with the danger of a UK-specific mini Budget fashion disaster.

There are apparent challenges.

The shadow chancellor is true to say there ought to no champagne corks, however no bubbles have been in proof when Rachel Reeves spoke on the Rolls-Royce manufacturing facility after the numbers have been printed.

But this quantity offers a chance for the chancellor after a progress stutter, partly self-inflicted, below this authorities.

A robustly rising financial system, steady financial coverage, falling rates of interest, and a graspable positioning within the present world commerce tumult as an oasis of tariff stability, are first rate promoting factors in an unsure world.

It is why Reeves resisted my suggestion that her welfare cuts is likely to be negotiable after an obvious backbench revolt: “We will take forward those reforms,” she stated.

The chancellor could have extra work, nevertheless, in convincing companies that progress is that this authorities’s primary precedence, given the prime minister’s deal with an immigration crackdown.

Some attention-grabbing conversations will quickly happen with companies, for instance the development firms meant to ship 1.5m houses, and the brand new infrastructure which has been deliberate, or merely even to employees care houses.

For now it’s a reduction that the British financial system seems resilient and sturdy.

It could also be momentary, however we must always not assume that. These figures present an opportune second for some optimism and a tough promote of the UK to the remainder of the world.

https://www.bbc.com/news/articles/cjwq4vy4e11o