What subsequent for gasoline and electrical energy payments and might I repair? | EUROtoday

BBC

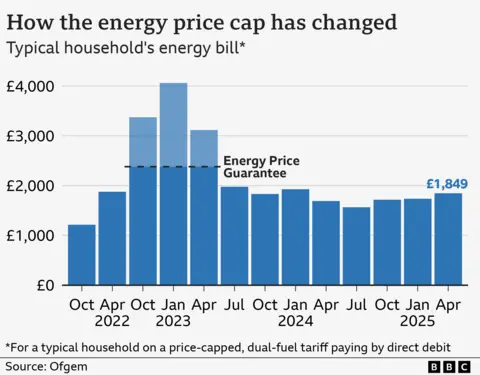

BBCGas and electrical energy payments are anticipated to fall in July, when a brand new worth cap takes impact.

It is more likely to reverse the rise for hundreds of thousands of households on 1 April, underneath the present cap.

The annual invoice for a family utilizing a typical quantity of gasoline and electrical energy rose to £1,849 per 12 months, a rise of £111, in April.

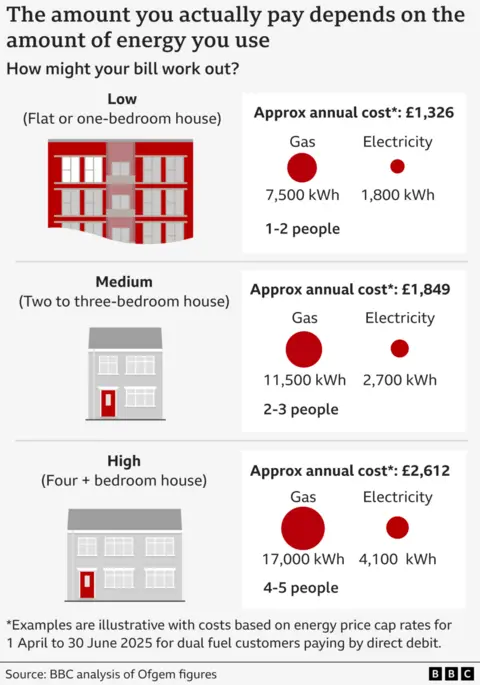

The power worth cap units the utmost quantity prospects may be charged for every unit of power, however precise payments rely on how a lot gasoline and electrical energy you utilize.

What is the power worth cap and the way is it altering?

Those who pay their payments each three months by money or cheque pay £1,969.

The cap doesn’t apply in Northern Ireland, which has its personal power market.

What is a typical family?

Your power invoice will depend on the general quantity of gasoline and electrical energy you utilize, and the way you pay for it.

The kind of property you reside in, how power environment friendly it’s, how many individuals reside there and the climate all make a distinction.

The Ofgem cap is predicated on a “typical household” utilizing 11,500 kWh of gasoline and a couple of,700 kWh of electrical energy a 12 months with a single invoice for gasoline and electrical energy, settled by direct debit.

The overwhelming majority of individuals pay their invoice this fashion to assist unfold funds throughout the 12 months. Those who pay each three months by money or cheque are charged extra.

Should I take a meter studying when the power cap adjustments?

Submitting a meter studying when the cap adjustments means you’ll not be charged for estimated utilization on the incorrect charge.

This is very vital when costs go up.

Customers with working sensible meters don’t must submit a studying as their invoice is calculated robotically.

What is occurring to prepayment prospects?

Between April and June, households on prepayment meters are paying barely lower than these on direct debit, with a typical invoice of £1,803, an increase of £113 from the earlier quarter.

About 4 million households had prepayment meters in January 2025, in keeping with Ofgem.

Getty Images

Getty ImagesMany have been in place for years, however some have been put in extra lately after prospects struggled to pay greater payments.

Rules launched in November 2023 imply suppliers should give prospects extra alternative to clear their money owed earlier than switching them to a meter. They can’t be put in in any respect in sure households.

Can I repair my power costs?

Fixed-price offers are usually not affected by the power worth cap, which adjustments each three months and might go up or down.

They supply certainty for a set interval – usually a 12 months, or longer – but when power costs drop when you’re on the deal, you possibly can be caught at the next worth. You may additionally need to pay a penalty to go away a hard and fast deal early.

Ofgem, the power regulator, says prospects who need the safety of understanding what their invoice will likely be ought to take into account shifting to a hard and fast deal. However, it says they need to ensure that they perceive all the prices.

Martin Lewis, founding father of Money Saving Expert, recommends checking whole-of-market power worth comparability websites to assist discover one of the best deal.

What are standing fees and the way are they altering?

Standing fees are a hard and fast day by day payment to cowl the prices of connecting to gasoline and electrical energy provides. They differ barely by area.

On 1 April, the common electrical energy standing cost fell from 60.97p to 53.8p however the common gasoline standing cost elevated from 31.65p to 32.67p

Some prospects in London and the North Wales and Mersey area noticed bigger will increase.

Campaigners argue standing fees are unfair as a result of they make up a much bigger proportion of the invoice of low power customers.

In response, Ofgem has stated that power companies should present a selection of price-capped tariffs from winter 2025.

One would have a standing cost and unit charge – as is the case now – and one other no standing cost however the next unit charge. However, the proposals have been criticised as being too sophisticated.

What assist can I get with power payments?

The Household Support Fund, which was launched in September 2021 to assist weak prospects, has been prolonged till March 2026.

The Warm Home Discount scheme continues to supply a reduction to eligible pensioners and low revenue households.

The authorities’s Fuel Direct Scheme will help individuals to repay an power debt instantly from their profit funds.

In addition, suppliers should supply prospects reasonably priced cost plans or compensation holidays if they’re combating payments.

Most suppliers additionally supply hardship grants.

Changes to the winter gasoline cost imply greater than 10 million pensioners haven’t acquired the cash this winter.

https://www.bbc.com/news/articles/cdd29v8mp9jo