Good for mortgages, dangerous for meals costs | EUROtoday

Kevin PeacheyCost of residing correspondent

Getty Images

Getty ImagesWalking round your native grocery store and you will wrestle to seek out a lot that is wholesome on your funds on the cabinets – meals value rises are accelerating.

The price of the weekly store is, and can proceed to be, a fear for hundreds of thousands of individuals.

Beyond simply meals, costs of products and companies normally are going up, however the charge of these value rises have slowed.

And that’s more likely to carry higher information for the price of borrowing, specifically mortgage charges for householders and first-time patrons.

Are costs going up or down?

Prices just about all the time rise. Official statistics chart the motion in the price of lots of of products and companies within the UK.

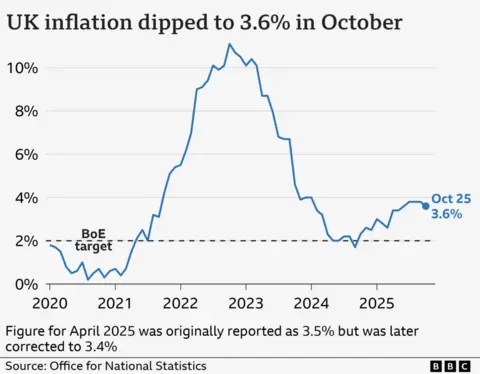

It is the speed of improve that’s essential, and that inflation charge is revealed each month by the Office for National Statistics (ONS).

On Wednesday, the ONS stated the speed of inflation had fallen to three.6%, which implies costs are rising extra slowly than they have been and can foster hope that inflation has peaked.

Delve a bit of additional into the info, and there are extra particulars about what’s behind the newest traits.

For instance, fish, greens, chocolate and confectionary have been among the many merchandise that rose in value, though fruit costs fell barely.

Recent analysis by the Bank of England discovered that individuals on common are nonetheless shopping for the identical quantity of meals, however paying extra for it. That stated, they’re altering the best way they store.

“Concerns about rising food costs and utility bills still dominate conversations,” it stated.

“Households continue to change their shopping habits to reduce spending, such as buying more vegetables and reducing meat consumption.”

Getty Images

Getty Images“Staples like bread, meat and potatoes all cost more than they did even a month ago,” says Danni Hewson, head of economic evaluation at funding platform AJ Bell.

But she does level to a silver lining – the dip within the inflation charge means the Bank of England is now extra more likely to lower rates of interest in December.

The Bank makes use of its benchmark rate of interest – which closely influences the price of borrowing for households and companies – to attempt to carry inflation to its goal charge of two%.

“Inflation remains well above the Band of England’s happy place of 2%,” says Alice Haine, private finance analyst at Bestinvest.

But, she says, the newest figures may pave the best way for a sixth rate of interest lower since August final 12 months.

The prospect of an rate of interest lower has seen lenders make modifications already. In latest weeks, many main lenders have lowered their charges for individuals getting a brand new fixed-rate mortgage or renewing their present one.

“There has been particular emphasis placed on rates for home movers with some of the best rates available for purchases,” says David Hollingworth, of mortgage brokers L&C.

Data from the monetary data service Moneyfacts reveals that the common charge on a brand new two-year mounted deal has fallen to 4.88%, and is right down to 4.93% for the common five-year mounted deal.

Average charges for these solely in a position to put down a deposit of 5% or 10% – typically first-time patrons – are actually wanting decrease than they’ve been at any time within the final two or three years.

Why are lenders slicing charges now?

Inflation is just one consider lenders’ choices to chop mortgage charges now.

Generally, Christmas is a quiet time for the housing market as potential patrons and sellers think about turkey and trimmings as an alternative.

So, they could be decreasing charges in a bid to stimulate customized.

The similar can’t be stated for financial savings charges. “Competition has been scarce,” says Caitlyn Eastell, from Moneyfacts.

That is compounded by the truth that a lot of these patrons, sellers and savers have put plans on maintain till they discover out what occurs within the Budget delivered by Chancellor Rachel Reeves on 26 November.

The Budget looms giant over the housing market, with discuss of taxation on excessive worth properties, in addition to over financial exercise normally.

Reeves needs to introduce measures to decrease the speed of inflation, and assist individuals with the price of residing. However, she additionally wants to herald more cash or lower authorities spending to fulfill her personal fiscal guidelines.

It is a fragile balancing act that can have an effect on particular person and household funds, affecting the cash individuals must spend within the grocery store and the urge for food they’ve to avoid wasting, in addition to purchase or promote a house.

https://www.bbc.com/news/articles/c1wlrw8ygvxo?at_medium=RSS&at_campaign=rss