Sold 30 objects on Vinted? Don’t panic for those who get a message about tax | EUROtoday

Jennifer MeierhansBusiness reporter

Getty Images

Getty ImagesJazz singer Billie van der Westhuizen began utilizing Vinted about six months in the past to promote garments and sneakers she hadn’t worn for ages.

“I got really into it and was selling loads of stuff,” she says. “Then I got a message saying I needed to enter my National Insurance number. It wasn’t clear at all why it was asking.”

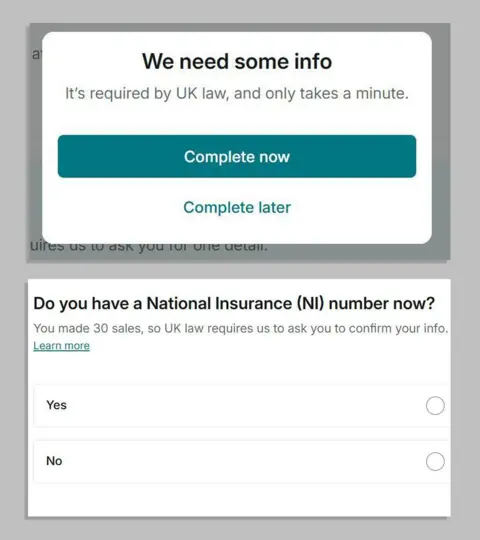

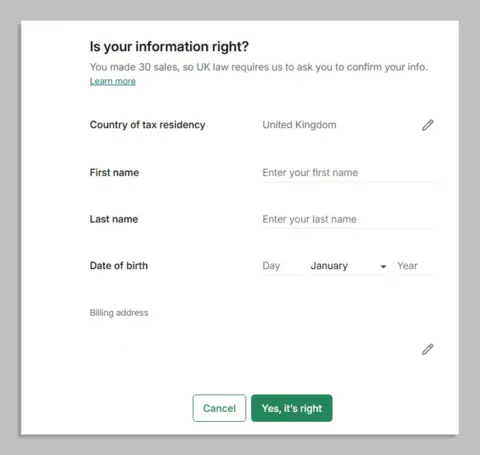

Vinted customers who’ve bought 30 objects or made £1,700 in a yr are being requested for his or her NI quantity, leaving many like Billie confused and a few panicking that they must pay tax.

But this isn’t about any tax adjustments – it is as a consequence of reporting guidelines for web sites and apps that enable customers to promote items or companies, together with eBay, Etsy, Depop and AirBnb.

Billie, 30, from London, says she entered her NI quantity as prompted however in hindsight was undecided what it was about.

Billie van der Westhuizen

Billie van der Westhuizen“I just sent it but I thought there’s no way they could tax the amount of money I’ve made off this,” she says.

“If I was making thousands maybe, but I reckon I’ve made maybe £500 and I’m selling things for less than I paid for them.”

The pop-up alert Billie acquired sends Vinted customers to a type asking for his or her title, tackle and NI quantity “as required by UK law”.

Some Vinted sellers have posted screenshots of the messages on TikTok and Instagram asking if they’ve to present their particulars, and in the event that they do, will they be taxed.

Vinted

VintedOne consumer posted on Reddit: “Vinted is asking for my National Insurance number, does this mean I have to pay taxes? I barely make money on Vinted – what happens if I ignore this?”

Chartered accountant Abigail Foster says whereas lots of people could panic when requested for tax data by Vinted, for many customers that is nothing to fret about.

“If you’re simply selling your own second-hand clothes or household items, you won’t owe any tax, even when Vinted shares that data with HMRC,” she says.

“This rule is aimed at people who are effectively running a resale business, not those decluttering their wardrobes.”

It could be very simple for HMRC to inform if somebody was buying and selling by checking for a number of listings of the identical product or objects purchased and shortly resold for increased costs, she provides.

New reporting necessities for digital platforms got here into impact on 1 January 2024 with the federal government saying they’d assist it “bear down on tax evasion”.

Vinted sellers reported receiving in-app messages asking for his or her NI quantity round this time final yr.

Information should be shared with HMRC by the tip of the calendar yr that sellers hit the 30 merchandise or £1,700 threshold, in keeping with Vinted.

Vinted

VintedAn HMRC spokesperson stated: “People remain responsible for their own tax affairs, and for assessing whether they need to complete a tax return to report trading income.

“As your facet hustle grows, any unpaid tax may come underneath the highlight.

“This could lead to an unexpected and possibly very large tax bill if you haven’t told us about the extra money you’ve been earning. That’s why it’s really important to stay on top of your tax affairs.”

Research commissioned by HMRC in 2022 instructed round one in 10 UK adults participated in what it known as the “hidden economy” – earnings which can be totally or partially hid from the tax authority to keep away from paying taxes.

What are the tax guidelines for on-line promoting?

- Platforms should inform HMRC about anybody who sells greater than 30 objects or whose complete gross sales hit £1,700 in a yr

- This doesn’t mechanically imply these folks need to pay tax

- Selling your individual garments or different objects shouldn’t be taxable for those who’re promoting them for lower than you initially paid as you aren’t making a revenue

- Tax solely applies if you’re shopping for inventory to resell, or making greater than £1,000 in revenue per yr

- If you promote an merchandise for greater than £6,000, it’s possible you’ll must pay Capital Gains Tax.

- You can use HMRC’s on-line instrument to verify if it’s worthwhile to inform the authority about your earnings

https://www.bbc.com/news/articles/c0mxe7l7wp1o?at_medium=RSS&at_campaign=rss