Why this month’s inflation determine could also be excellent news for you | EUROtoday

Kevin PeacheyCost of dwelling correspondent

Getty Images

Getty ImagesOn the face of it, there may be comparatively little festive cheer in your funds within the newest inflation figures.

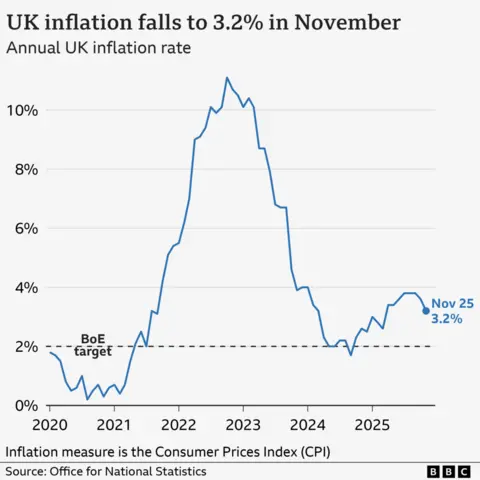

Prices have risen by 3.2% in contrast with a yr in the past. If you stuffed your digital buying bag with items and providers at a value of £100 a yr in the past, the identical choice will now value £103.20.

The price of rising costs is effectively above the Bank of England’s goal of two%, and a few objects are nonetheless rocketing up in worth. Chocolate, arguably central to the household weight-reduction plan at Christmas, is 17% dearer than a yr in the past.

But, crucially, there are actually clear indicators that costs are going up at a slower price. That bodes effectively for subsequent yr, and extra instantly for the price of borrowing.

And, with necessities driving the slowdown, the newest information shall be welcomed by those that really feel significantly stretched by the price of dwelling.

Pasta, sugar and flour costs fall

The price of inflation, which charts the rising value of dwelling, has overcome its latest mini-peak, in accordance with analysts.

The mountainous peak of inflation was in October 2022 when the speed hit 11.1%. The price then fell, however there was an uptick within the late summer season of 2025, reaching 3.8%.

And it was the value of meals – a vital for customers – driving November’s drop in inflation.

Food and non-alcoholic drinks rose by 4.2% within the yr to November, in comparison with 4.9% in October. Alcohol and tobacco had been up 4% in comparison with 5.9% in October.

Moving in the other way to chocolate, and beef and veal (which rose by almost 28% in a yr), had been olive oil (down 16%) in addition to drops in worth for flours, pasta and sugar.

Importantly, meals is crucial spending. When the value rises sluggish, that is significantly better information for these on decrease incomes who see an even bigger proportion of their revenue spent on issues that it’s inconceivable to do with out.

Sarah Coles, head of non-public finance at funding agency Hargreaves Lansdown, stated this was additionally helpign the general inflation price drop sooner than anticipated: “It has been following the path the Bank of England had forecast – peaking in September and gradually moving south.”

Will the excellent news final?

The causes for slowing worth riese are sometimes particular to particular person objects.

For instance, the drop within the worth of olive oil is primarily the results of a restoration in harvests after some significantly dangerous years of heatwaves and drought in Greece and Turkey.

Clothing and footwear costs fell by 0.6% within the yr to November in comparison with an increase of 0.3% in October.

This has been linked to retailers bringing ahead Black Friday reductions because of weak gross sales as buyers battle with the price of dwelling pressures.

Consumers, too, have modified their habits owing to the monetary local weather of latest years.

Lucy Fairs, who helps run a cake-sharing social membership, referred to as Band of Bakers in Camberwell, London, stated that, during the last 5 years, they’d began utilizing what they already had of their cabinets, moderately than shopping for further particular components.

“When I chose a recipe for today, I thought of the theme – but, more so, I thought of what I already had in my pantry,” stated membership member Costa Christou.

Impact on borrowing and saving

The rising value of products and providers has an influence on the cash you save or earn. Inflation erodes the spending energy of cash you’ve got acquired saved and – until you get a pay rise – of your wage.

Analysts say the newest inflation information strengthens the chance of a reduce in rates of interest by the Bank of England’s Monetary Policy Committee on Thursday.

That ought to make it cheaper for customers to borrow cash, however carry decrease returns for savers.

“Lower inflation is good news for household budgets, but it is a different story for savers,” stated Sally Conway, financial savings commentator at Shawbrook Bank.

“Some savings will inevitably take a hit over Christmas. The key is what happens next. Once the dust settles, it’s worth checking whether remaining cash is working hard enough.”

Policymakers try to encourage extra folks to speculate their cash in shares and shares – which they are saying is more likely to carry increased returns over time than money financial savings.

It is why the Financial Conduct Authority has given the go-ahead for focused assist – a scheme that, for the primary time, permits banks and monetary companies to present solutions about the place to speculate your cash.

Additional reporting by Josh McMinn

https://www.bbc.com/news/articles/c0r9x1xx0x7o?at_medium=RSS&at_campaign=rss