European personal fairness falls 40% on the inventory market from its highs whereas the sector in Spain units information | Financial Markets | EUROtoday

Private markets are a magnet for traders seeking to diversify past the inventory market. The rise of personal fairness —personal fairness in English—is a novelty on the planet of funding, with automobiles that use traders’ cash to purchase firms (listed or not on the inventory market) with the assistance of excessive doses of debt, search for methods to extend their valuation and promote them inside a sure interval (5 or seven years) with juicy capital features, from which they deduct the debt funds and, after all, their very own emoluments.

The entry of Apollo into Atlético de Madrid in an operation that values the membership at 2,500 million euros, or the acquisition of the Alfonso Large firms are under no circumstances the one goal of the personal fairness, which additionally focuses on small and medium-sized firms, equivalent to the phone producer Fermax or the Fuentes logistics group. This funding format, a combined bag as a result of range of the property it acquires, yields enviable returns, above 11% on common, in keeping with a examine printed yesterday by EY Parthenon and SpainCap, an affiliation of funding entities. personal fairness and its traders.

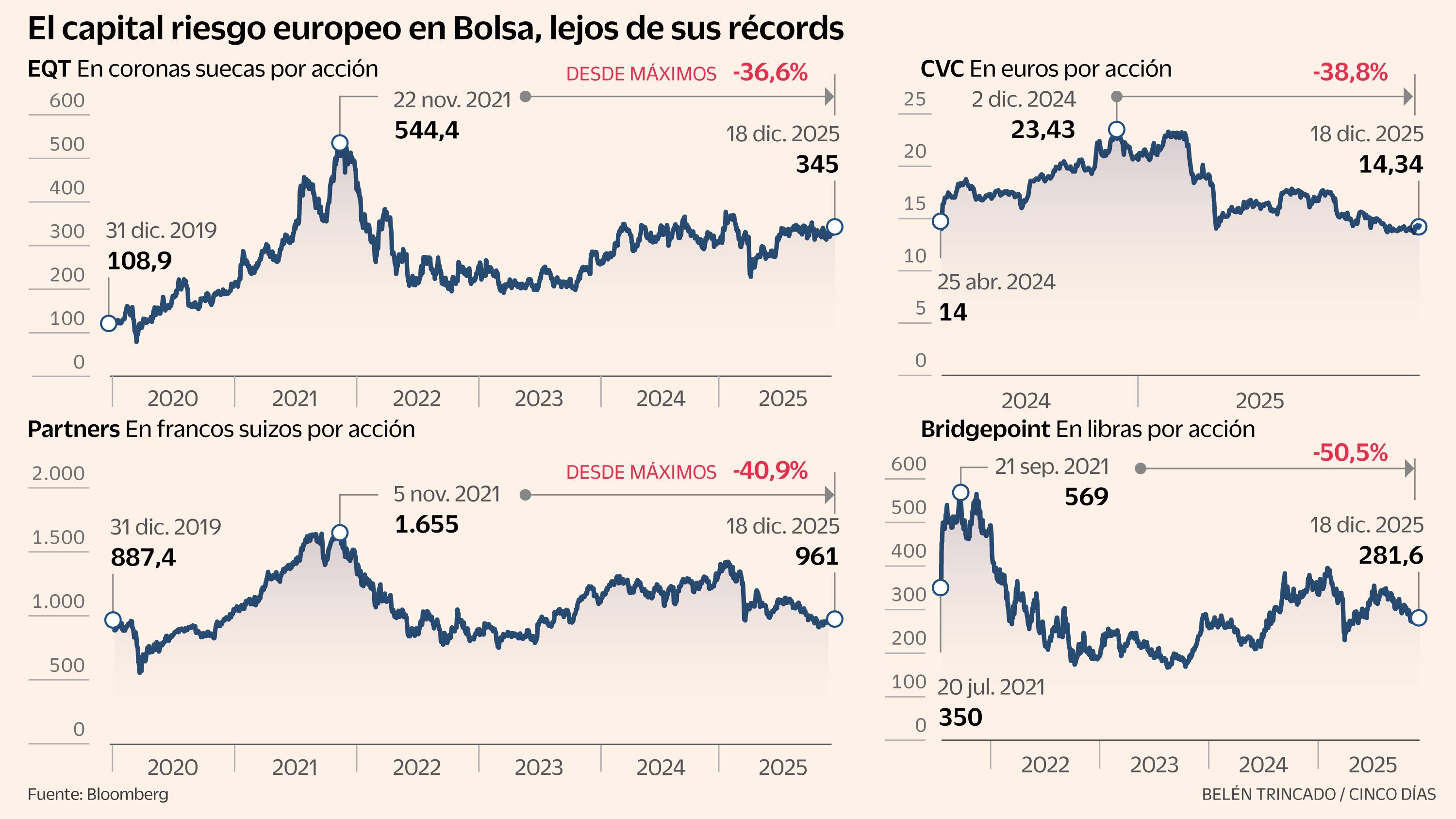

Thus, the sector in Spain is at historic ranges, with some 1,300 personal fairness companies, which suggests multiplying the quantity in 2013 by 5, and accumulates property underneath administration that exceeds 50,000 million euros, in keeping with the newest information from the CNMV. However, the massive managers of the Old Continent which are traded on the inventory market are buying and selling removed from their historic highs. A paradoxical scenario when the key world indices present information.

The French CVC, which debuted on Euronext in April of final yr, is in a low surroundings, after dropping 39% from its report. With property of round 200 billion euros, its Spanish investments embrace Deoleo, Naturgy and Exolum (the previous CLH). The Swedish EQT, which manages greater than 240,000 million and is thought in Spain for being the proprietor of Parques Reunidos, the European University or Zelestra (former Solarpack), is buying and selling 37% under its most.

Several components clarify the inventory market conduct of European asset managers. personal fairness, that haven’t recovered from the falls they suffered on the finish of 2021, when charge will increase started to appear to cease rising inflation after overcoming the toughest a part of the pandemic. “The difficulties now come from the drought of disinvestments: sales at attractive prices are being complicated in this context. Interest rates, in addition, have remained paralyzed at 2% in the euro zone and there are indications that the next movements may be upwards,” explains a sector govt.

The inventory market conduct of the 2 aforementioned managers is just like that of Partners and Bridgepoint. The first, primarily based in Switzerland and which controls property valued at 150,000 million euros, is the proprietor in Spain of the Bluesea lodge chain and the Nuva Living actual property platform. It falls 41% from its highs on the inventory market. The British Bridgepoint, for its half, has greater than 70 billion euros in property, and is the proprietor—exactly along with Partners—of the chief in sustainable agriculture Rovensa. It corrects 51% from the degrees it reached on the finish of 2021.

Experts additionally warn {that a} vicious circle happens when divestments should not carried out in keeping with the deliberate schedule. “If there are no returns for investors, they lack cash and it costs more to raise money for new funds,” provides one other sector govt. And, given the slowdown in disinvestments, the typical size of time the funds are held will increase. Specifically, as much as 5.6 years final yr, the second highest determine within the historic collection with an rising pattern since 2019, in keeping with the EY and SpainCap report. To compensate for this, different formulation to acquire liquidity have gained weight, equivalent to dividend recap (cost of dividends by rising the debt of the investee firm), which can have secondary results. “One of the main criticisms of dividend recapitalizations is that the extra leverage introduces additional risks,” explains Cyril Demaria-Bengochéa, director of Private Markets Strategy at Julius Baer, in a observe final September.

Another in style resolution to acquire money They are continuation funds, created by the identical supervisor to purchase one or a number of property from different automobiles of the agency. Schroders reveals in a report that this liquidity software reached a report of greater than 70 billion {dollars} (about 60 billion euros) worldwide final yr and anticipates that it’ll proceed to rise within the coming years. “These vehicles only make sense for particularly attractive assets.” [trophy asset o activos trofeo, como se conoce en la jerga, aquellos de los que la entidad no se quiere desprender] “that have entered another phase of growth,” explains a supervisor of a boutique Spanish funding banking.

The advertising universe is expanded

Institutionals are the large traders in enterprise capital. That is, banks, insurance coverage firms, pension and sovereign funds, and a few public organizations, such because the Official Credit Institute (ICO) in Spain. The novelty is that in latest instances its target market has expanded, in order that it now reaches personal banking shoppers in abundance. These, in keeping with UBS in a latest report on listed European enterprise capital managers, have been essential in elevating cash this yr, with the evergreen (personal capital funds which are at all times open and that permit us to acquire liquidity every now and then) as nice allies.

In Spain, from 2022 the Government permits people to speculate from 10,000 euros in personal capital, so long as this quantity represents lower than 10% of the monetary property and correct recommendation is offered. The CNMV has already issued a warning to sailors, fearing that it will likely be distributed to people who find themselves not conscious of the dangers related to this kind of product. “Private equity funds can never be a product for the general public, since their investments are illiquid by definition,” admits an govt within the sector.

In this situation of higher entry and extra supervision, personal capital faces the problem of constant to lift contemporary cash to take care of its profitability. Although the movement continues to reach, it does so with rising warning that forces traders to be particularly selective. As the sector factors out, the market has entered a section of discrimination: solely essentially the most skillful managers with a confirmed monitor report of capital features are managing to draw the mandatory liquidity in a well timed method.

https://cincodias.elpais.com/mercados-financieros/2025-12-19/el-private-equity-europeo-cae-un-40-en-bolsa-desde-maximos-mientras-el-sector-en-espana-marca-records.html