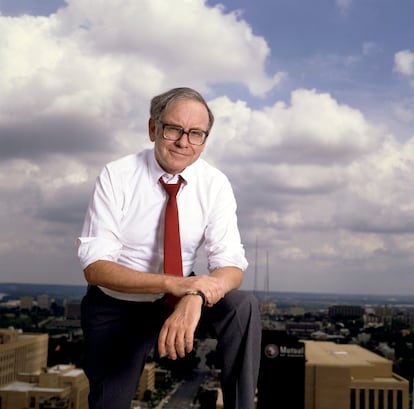

The inventory market oracle says goodbye: why Warren Buffett is taken into account one of the best investor in historical past | Business | EUROtoday

Warren Buffett, the best investor of all time, is retiring on the age of 95, after having devoted the final 90 years to the enterprise world. When he was six, on a household trip to Iowa, he purchased a pack of six Coca-Colas for 25 cents, he went to promote them to vacationers for 5 every and obtained 30. Before, at 5, he offered gum from door to door that he checked in his grandfather’s retailer, however he found that tender drinks could be extra worthwhile. Raised throughout the Great Depression, he devoured inventory info like comics and at 11 he purchased his first inventory. Today he amasses a fortune of 150 billion {dollars} and Berkshire Hathaway, his conglomerate, is price greater than a billion. Among these belongings is, in fact, a very good chunk of Coca-Cola shares.

The funding empire of Warren Edward Buffett (Omaha, Nebraska, 1930) has grown and coexisted below governments of every type and intervals, from Eisenhower to Trump, from Kennedy to Obama. During booms and downturns. Obsessive about evaluation, philanthropist, charismatic and sarcastic, with an innate capability for dissemination, Buffett has entered the pantheon of the good leaders of the American economic system. The annual shareholder conferences in his native Omaha, the corporate’s headquarters, are one thing just like a Woodstock of capitalism, held the primary weekend in May and often attended by celebrities akin to Bill Gates, Bill Murray, Arnold Schwarzenegger or Hillary Clinton, who additionally dropped by there this final yr. Until 2023, Buffett appeared alongside his right-hand man, Charlie Munger, who died that November, aged 99. In these marathon periods the 2 previous inventory market rockers philosophized in regards to the economic system and likewise about life.

When on the final assembly, final May, he introduced his retirement at hand over the baton to Vice President Greg Abel later this yr, Buffett obtained a standing ovation. For six many years, he had earned their belief, created a titan, given them recommendation and instructed the boatman’s truths. But, above all, it had made them some huge cash. To offer you an thought, somebody who put $100 in Berkshire in 1965 has nearly three million {dollars}.

Originally, Berkshire Hathaway was a textile firm that entered right into a severe disaster because of globalization. Buffett purchased it in ’62 and based a hyperdiversified conglomerate, with tentacles within the railroad sector (Burlington Northern), non-public aviation, actual property companies, vitality, footwear, clothes, toys and sweet. Among its best-known manufacturers are Duracell, Fruit of the Loom or the insurance coverage firm Geico, amongst others. And to this we should add investments in teams akin to Coca Cola, Apple, American Express, Meta or Chevron.

Contradictions

From Buffett you should buy every kind of merchandise merchandising. His annual letters to traders are a reference and he’s cited endlessly in universities and books.

How does a man who has not invented Fordism, the electrical automotive or a big digital retailer like Amazon, however has principally devoted himself to getting cash out of cash, change into a fable? The dimension of his determine, the impression on well-liked tradition and the best way of seeing the enterprise world is known from that public sphere and his disciplined method of transferring out there.

Three contradictions encompass the Buffett phenomenon: he’s thought of an excellent image of American financial energy, however he has been a free verse inside it; He is a fierce critic of the defects of capitalism, however he has punished it like nobody else; His nice nickname is the Oracle of Omaha, however he denies the prophets.

Let’s go together with the primary one. Buffett is a kind of few super-rich Americans who has referred to as for fairer and better taxation for his form and tried to mobilize others together with the Gates. During Barack Obama’s administration, he proposed what could be formally recognized within the White House because the “Buffett rule”: that no family that earned greater than one million {dollars} ought to pay a decrease proportion in taxes than center class households often pay. He maintains a comparatively frugal life-style in his hometown: he nonetheless lives in the identical home he purchased within the Nineteen Fifties and, till lately, reportedly drove his personal Cadillac to work or to choose up an order at McDonald’s. The nice luxurious of the standard millionaire that he’s recognized for is a non-public aircraft that he baptized as “The Indefendible”, though he later renamed it “The Indispensable”. In 2006 he determined to progressively donate the majority of his fortune to his foundations and has at all times been crucial of the excesses of Wall Street, which he has come to explain as a “casino”, warning in opposition to hedge funds or funding bankers. “It’s like when a barber tells you you need a haircut. They don’t make money unless people do things and they take a cut. However, “they make much more cash when folks guess than when folks make investments.”

But none of this conscious capitalism that is often attributed to him seems at odds with the passion for money that has motivated Buffett since his childhood, as reflected in that sale of soft drinks with added value. The episode is reported in Buffett. The making of an American capitalist (1995). Son of a stockbroker and Republican congressman, his first years of life took place in the midst of the Great Depression. In 1931, the bank where his father worked, Union Street Bank, closed and he was left with no savings and no job, but he rebuilt himself by opening his own brokerage with a partner. At Columbia University he had as a professor the legendary Benjamin Graham, the most influential investor of his time, considered the father of value investing (value investing), for which he later worked.

Value investing is a long-term investment strategy that seeks solid businesses that are undervalued by the market and that have a differential advantage over their rivals. If you were once tempted to go after mediocre companies at knockdown prices, Munger convinced you that you should go after good companies at reasonable prices and make them grow. “The key to investment is not to evaluate how much an industry is going to affect society, or how much it is going to grow, but rather to determine the competitive advantage of any company and, above all, the duration of that advantage,” he once said. This advantage can be a very strong brand (such as Apple or Coca-Cola). Reinvesting profits is one of the keys to its success, with money traveling from one asset to another growing profits.

Due to his exceptional record of service and personal charisma, stories about Buffett in the United States exude an inevitable aroma of hagiography. The Oracle of Omaha, however, is not without blemish. During the Great Recession, which he came to refer to as “an economic Pearl Harbor,” he invested in Goldman Sachs, which embodied many of the flaws he criticized, although it did help save the system (with profits). And while he has been an enthusiast for fair taxation, his conglomerate is designed to pay as little tax as possible. He has also paid fines to the stock market supervisor (SEC) and has made mistakes, from the purchase of the Berkshire textile company at too high a price, the Salomon Brothers blunder or a very timid approach to technology.

Quality seal

A long-term investor, he bought Coca Cola securities in 1988 and remains in the capital. He joined American Express in 1991 and remains. The well-known rigor of Buffett’s requirements for investing turned the presence of Berkshire as a shareholder in a firm into a seal of quality. However, it has underperformed the S&P of late. That strategy of not putting money into anything he didn’t understand well led him to not soon invest in giants like Amazon or Microsoft. The first foray into technology was Apple, of which today Berkshire is the main shareholder, but it did not enter until 2016, with the products already consolidated in the market. The progression in value has been extraordinary. He bought the shares at $100 and now they are around 273, but taking into account the split from 4 shares to one that he made in 2020, the revaluation is much greater. “I’m a little embarrassed to admit it, but Tim Cook has made Berkshire a lot more money than I’ve made him,” he said at the last meeting.

In the latest results presented under Buffett’s command, relating to the third quarter of 2025, the conglomerate’s operating profits reached $13.5 billion, up 34%, and broke another liquidity record, with $381.7 billion. This figure, in reality, has little good news, since it reflects the few investment opportunities that Berkshire, under its criteria, is finding. In his letter this year, he seemed to justify himself: “Berkshire will never prefer ownership of cash equivalent assets to ownership of good businesses, whether controlled or solely owned,” he said.

Buffett, a Democrat, supported Hillary Clinton in the 2016 elections against Donald Trump, but has advised presidents of governments of both political stripes. In recent years, in contrast to other business figures such as President Trump himself or Elon Musk, his way of being and doing has shone with its own light. He has not held his tongue and has openly criticized, for example, Trump’s trade policy. “In the United States, we should always search to commerce with the remainder of the world. We ought to do what we do greatest and so they do what they do greatest,” he said at the last meeting. “Trade should not be a weapon,” he insisted. However, Berkshire’s 2024 annual report follows in the footsteps of many other companies and, in the midst of a hurricane about trump against everything he calls wokeomits references to promoting diversity and inclusion in employee onboarding.

He married his deceased first wife, Susie, in 1952, with whom he had three children. Quite a character, his authorized biography (Snowball. Warren Buffett and the business of life), tells how when his daughter Susie asked him to borrow money to renovate the kitchen in the 80s and her father told her to go ask the bank for it, like everyone else. Warren Buffet’s annual speeches, interviews and letters have generated an enormous number of sentences for history. Perhaps one of those that best serves to describe his particular way of being on that Olympus of billionaires—the consciousness for which he is so appreciated—is this reflection that he wrote in 2010 in a magazine:

“My fortune comes from a mix of residing in America, some fortunate genes, and compound curiosity. Both my youngsters and I gained what I name the ‘ovarian lottery.’ on the battlefield with a medal, and that rewards an excellent trainer with notes of gratitude from dad and mom, however rewards those that know the best way to detect the mistaken value in market values with quantities that attain billions. In quick, future in the case of distributing luck is wildly capricious.

Buffett plans to attend the shareholder assembly subsequent May, in 2026, however will now not converse. The foundations are run by his youngsters and Greg Abel faces the problem of taking the place of the previous clever man from Omaha in Berkshire and discovering good firms through which to take a position, sustaining a revenue price on the top of historical past and weathering the speculative operations of the indices. Abel had been answerable for the day-to-day enterprise for years, however the query is whether or not he’ll keep in Berkshire that nearly magic that’s attributed to the oracle. The technique was not new, and Buffett has defined it many occasions, however nonetheless nobody has managed to duplicate its success.

https://elpais.com/economia/negocios/2025-12-27/el-oraculo-de-la-bolsa-dice-adios-por-que-warren-buffett-es-considerado-el-mejor-inversor-de-la-historia.html