The tentacles within the Ibex 35 of the achiever Jeffrey Epstein | Economy | EUROtoday

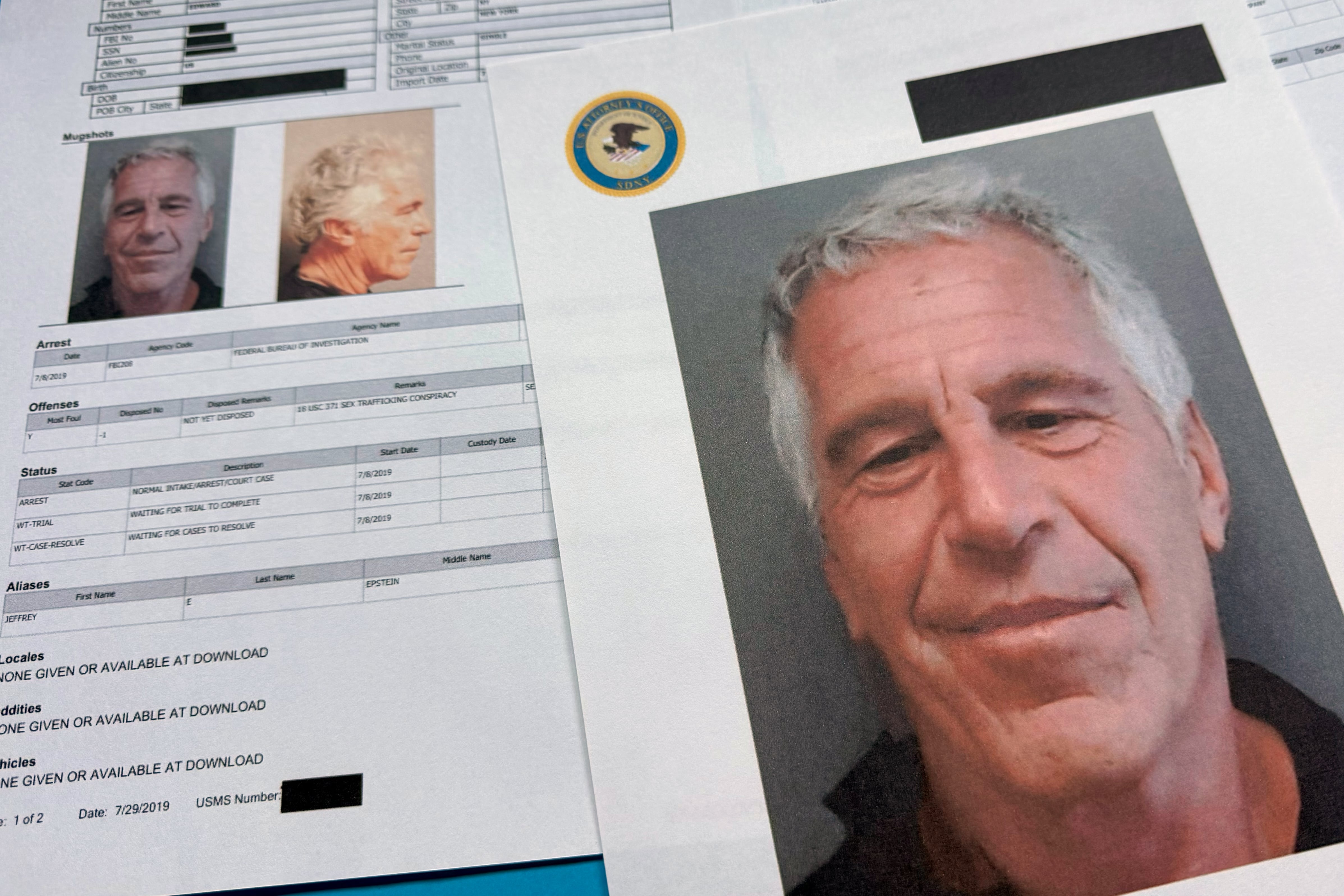

The declassification of hundreds of thousands of paperwork from the Epstein case has revealed the connection of the American magnate and his entourage with businessmen and personalities from all over the world and the entry they needed to company operations in progress or below examine. Among the greater than three million just lately revealed pages seem varied Spanish businessmen with whom the pedophile Jeffrey Epstein and his collaborators had contact, comparable to Alberto Cortina, his first spouse Alicia Koplowitz and his son Pelayo Cortina. In the correspondence of the financier accused of sexual exploitation, who died in jail in August 2019 whereas awaiting trial, there may be additionally proof of enterprise operations, such because the tried entry of the Russian oil firm Lukoil into Repsol or the sale of Stansted airport by Ferrovial, paperwork that illustrate the privileged entry to data and the wonderful community of contacts of this dealer and fee agent.

Alberto Cortina was in Epstein’s very extensive circle of pals. The businessman, who nonetheless controls 4.993% of ACS collectively together with his cousin Alberto Alcocer – recognized within the monetary world of the 80s and 90s as Los Albertos – by way of Corporación Financiera Alcor, has additionally been government president of Banco Zaragozano, director of Telefónica, AC Hoteles and Portland Valderribas. Cortina and his spouse, Elena Cué, attended two dinners by which Epstein participated in February and August 2010, in line with data made public.

Three years later, Cortina’s identify reappears within the Epstein universe. Investor Todd Meister informed the businessman in an electronic mail that Alberto Cortina and his brother can be in Caracas in February of that yr: “I will keep you informed about the oil situation in Venezuela when it is convenient for you. Alberto Cortina and his brother [Alfonso Cortina, quien fue presidente de Repsol entre 1996 y 2004] They are going to travel to Caracas, so I wanted to be there.” Days later, Epstein responds asking for details of the trip.

That same year, 2013, Alfonso Cortina established the now defunct company Inversiones Petroleras Iberoamericanas as president. Company that obtained oil contracts from the government of Hugo Chávez. His nephew Pelayo Cortina, Alberto’s son, served as CEO. In fact, in May of that same year, Todd Meister and Epstein talked about arranging a meeting with Pelayo Cortina:

-Are you around here? There’s an amazing guy I want you to meet, Meister writes.

-Not until the 22nd. Who is it? Better girls, much better plan, responds Epstein.

-Koplowitz and his son Palayo [por Pelayo] Cortina.

-How do you know them?

-He is 30 years old and very intelligent. I have built a close relationship with him and go hunting with him every year. He is a close friend. Omega will direct [el family office familiar] and all family entities.

In response to questions from this newspaper, Alicia Koplowitz and Pelayo Cortina have assured that they neither met Epstein nor had a relationship with him.

Ferrovial and the sale of Standsted

The dealership is another of the Spanish companies that appear cited in Epstein’s papers. On July 19, 2011, British competition authorities confirmed that BAA, a British airport then controlled by the Spanish group, had to sell two of its six airports in the country. The decision was expected in the market and did not come as a surprise to Ferrovial or Epstein’s circle, who were already studying the sale of Standsted airport. Six days before the decision of the British organization, the American businessman received an email from an unknown source (the investigation has crossed out names and contact information of many of the people who appear in his correspondence) with information about the sale of the British airport by Ferrovial.

“I’m serving to a Chinese airport group with curiosity in Stansted airport, however I’m fairly certain they will not purchase it. One billion. The proprietor — Ferrovial, from Spain. Is it fascinating to us?” the source asks Epstein. The email also states that Ferrovial was willing to hold confidential and exclusive conversations with Hainan. [operador chino de aeropuertos HNA]. Information to which Epstein responds by asking for more information and for which he received a dossier on the sale of Stansted dated April of that year carried out by an investment firm. The airport ended up being sold by BAA in 2013 to Manchester Airport Group for 1,785 million euros.

Corinna Larsen and Lukoil

The papers also contain evidence of the role played by Corinna Larsen, ex-lover of Juan Carlos I, in the attempt by the Russian oil company Lukoil to enter the capital of Repsol in 2008. In one of the published emails, Olivier Colom, who was Nicolas Sarkozy’s diplomatic advisor in the Elysée between 2007 and 2013, writes to Epstein: “The Spanish judges are investigating what Corinna ZSW did. [Zu Sayn-Wittgenstein, apellidos de su segundo esposo] in Spain: first for help to the King’s son-in-law, who faces justice, and second to take Spanish companies to the Middle East and Russia; and, by the way, he also tried to convince the Spanish to accept Lukoil in the capital of Repsol.”

Criteria, the funding arm of La Caixa, and Sacyr, then Sacyr Vallehermoso, acknowledged casual conversations with Lukoil in November 2008. The Russian firm’s goal was to succeed in nearly 30% of Repsol’s capital – thus avoiding launching a takeover bid – by buying the 20% held by Sacyr and the remaining within the fingers of Criteria. Lukoil even placed on the desk a proposal of greater than 27 euros per share, effectively above the 15 euros at which the oil firm was buying and selling on the time. An operation that didn’t come to fruition because of the difficulties in closing the mandatory financing.

Alejandro Agag and Enrique Bañuelos

To the already recognized names of the previous President of the Government José María Aznar and his spouse, Ana Botella, is added that of his son-in-law, Alejandro Agag. He launched Formula E Holdings in 2012 together with variety of businessmen, amongst whom was Enrique Bañuelos, founding father of the Astroc actual property firm. The undertaking, bought as a 100% electrical single-seater championship and which in the present day is 65% managed by Liberty Global, was in search of buyers and sponsors in 2013.

In December of that yr, Epstein obtained an electronic mail by which they assured him that the undertaking would substitute Formula 1 in ten years and that they have been in search of “technology companies that want worldwide advertising. They are paying 10% for this.”

BBVA and Sabadell

Public documentation information the big variety of funds and transfers that Epstein made by way of a lot of banks. Among them there may be proof of operations with two Spanish entities: BBVA and Sabadell. Different financial institution statements despatched by JP Morgan to the businessman present transfers to a BBVA account in Puerto Rico between 2010 and 2011 for a mixed quantity that quantities to $40,725. The Spanish financial institution bought its Puerto Rico subsidiary in 2012 to the native group Oriental Financial.

There can also be proof of transfers to a different Sabadell account. The relationship with the Vallesano financial institution has its origins in its American subsidiary, Sabadell United Bank, from which it was separated in 2017. According to the documentation revealed by the American administration, the Sabadell subsidiary granted a private mortgage to Epstein in 2010 and a yr later signed a line of credit score assured by JP Morgan to MC2, a modeling company owned by the American businessman.

Santander has additionally been concerned within the Epstein case. In November, the resignation of Larry Summer from its worldwide advisory board was introduced. The former US Treasury Secretary was on the head of the financial institution’s advisory physique chaired by Ana Botín since 2016, a place he left after emails he exchanged with the pedophile turned public.

https://elpais.com/economia/2026-02-07/los-tentaculos-en-el-ibex-35-del-conseguidor-jeffrey-epstein.html