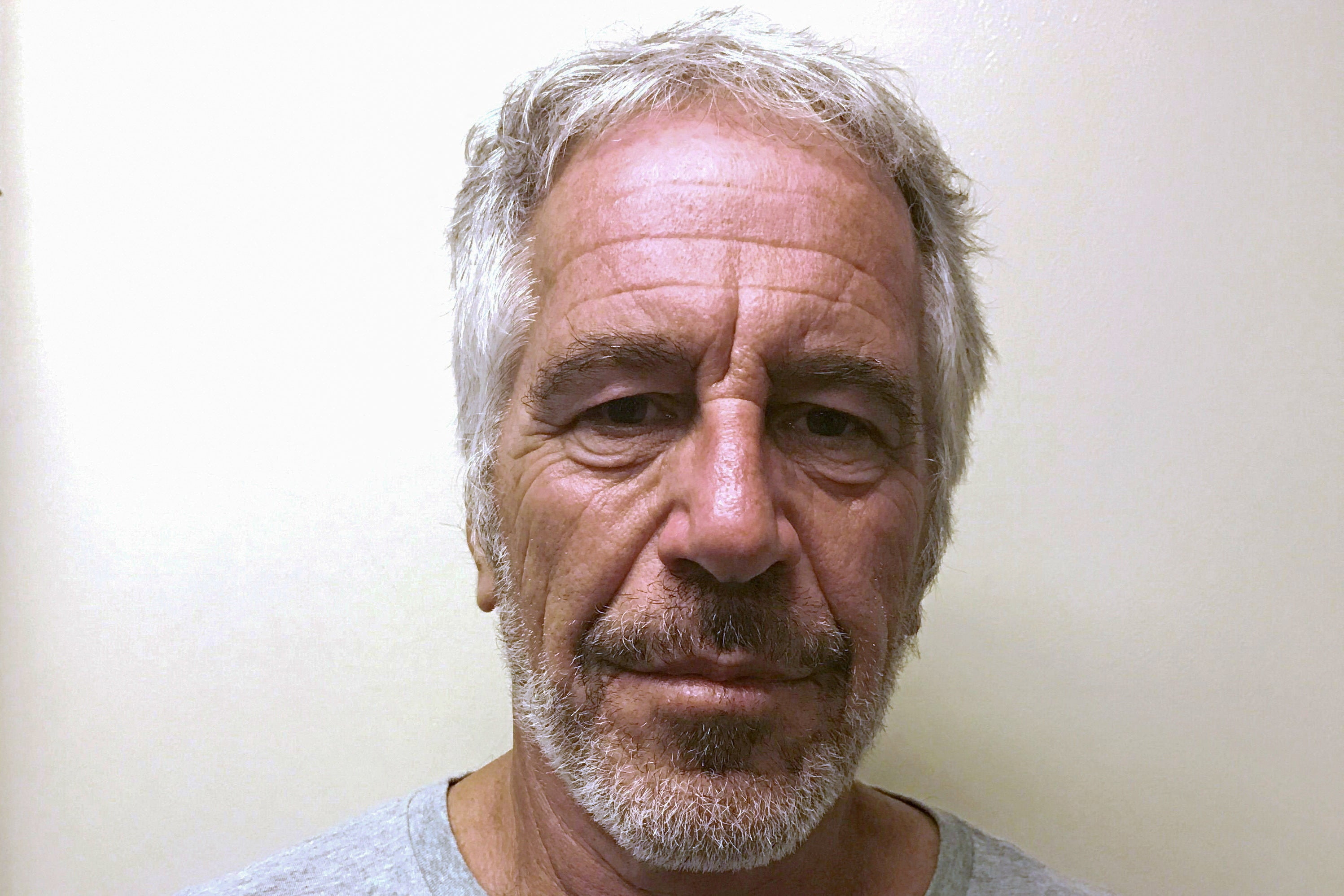

Jeffrey Epstein tried to purchase a luxurious palace days earlier than his arrest | EUROtoday

Charles Schwab wired about $27.7 million on behalf of Jeffrey Epstein to a realtor in Morocco because the disgraced financier tried to buy a palace within the 10 days earlier than his 2019 arrest, together with one switch from an account which lacked enough funds, information launched by the U.S. Department of Justice present.

Details of the transactions, reported by Reuters for the primary time, present how the U.S. brokerage dealt with funds for Epstein over the course of a number of months at a time when he was below intense public scrutiny after reviews within the Miami Herald in 2018.

Schwab flagged the funds in a suspicious exercise report (SAR) to the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) on July 13, seven days after Epstein’s arrest, the paperwork present.

An examination of greater than 100 paperwork exhibits Schwab opened three accounts for Epstein’s firms in April 2019, together with one for Southern Trust, a enterprise that was making an attempt to purchase the opulent Bin Ennakhil palace in Marrakesh, Morocco.

The Schwab company account listed Richard Kahn, Epstein’s accountant, as authorised particular person and Epstein as Southern Trust’s president and sole useful proprietor.

Between June 26 and July 9, 2019, Southern Trust instructed Schwab to wire about $12.7 million in euros for the acquisition however then reversed the order. Schwab then acquired one other wire request, which was signed by Epstein, and despatched $14.95 million to purchase the identical property, although there have been inadequate funds within the account pending the return of the unique cost.

Schwab declined to touch upon particulars of the accounts, saying federal regulation, privateness legal guidelines and its insurance policies and procedures require it to keep up confidentiality.

“An associate of Epstein opened accounts in April 2019. Shortly after, our Risk team began investigating the accounts and within 60 days of starting the review, we notified the client of our decision to close and terminate the relationship. We also referred the matter to federal law enforcement,” it mentioned in an emailed response to Reuters.

Schwab declined to offer particulars on precisely when its danger staff started investigating.

Under the U.S. Bank Secrecy Act, monetary corporations should file a suspicious exercise report no later than 30 days after the preliminary detection of information, along with submitting reviews of money transactions that exceed $10,000 every day to help in detecting and stopping cash laundering.

Per federal legislation, FinCEN can’t verify or deny the existence of an alleged suspicious exercise report, a FinCEN spokesperson instructed Reuters by e mail.

A lawyer for Kahn didn’t reply to Reuters‘ questions.

Marc Leon, the realtor in Marrakesh, instructed Reuters by e mail that Epstein first tried to purchase Bin Ennakhil in 2011 and negotiations on the phrases and worth continued through the years.

With gold-draped partitions, a hammam steam spa, 60 marble fountains and an out of doors pool and jacuzzi, Bin Ennakhil spreads throughout a complete plot of 4.6 hectares, a property itemizing included within the DOJ’s file cache mentioned. It boasts a number of gardens with tons of of olive bushes and greater than 2,000 palms, the itemizing mentioned, in an space larger than New York’s Washington Square Park or round six customary soccer pitches.

Leon additionally defended his function in facilitating Epstein’s bid for the property.

“Epstein had been convicted of sex crimes (in 2008) and had served his sentence. There was therefore nothing to prevent him from attempting to purchase property in Morocco. We had no way of knowing that he had continued his terrible crimes,” he mentioned.

Epstein died in jail in August 2019 whereas going through U.S. federal intercourse trafficking prices.

EPSTEIN INSTRUCTED FUNDS TO BE MOVED

Epstein turned to Schwab in 2019 as Deutsche Bank was winding down accounts held by the convicted intercourse offender, who had pleaded responsible in 2008 to soliciting prostitution from an underage woman and went to jail.

Schwab was amongst at the least seven monetary corporations subpoenaed by the U.S. Virgin Islands in 2020 requesting paperwork in relation to the co-executors of Epstein’s property. The subpoena didn’t title Schwab as a defendant and contained no accusations of wrongdoing in opposition to the brokerage.

Emails and wire switch requests contained within the DOJ paperwork, which is probably not complete, present that Epstein mentioned buying the posh property in Marrakesh together with his associates within the spring of 2019.

Southern Trust, the corporate owned by Epstein, agreed to purchase the property via Leon in March of that 12 months.

After contemplating numerous monetary preparations, the information present, Epstein instructed associates to maneuver funds to Leon.

Schwab then acquired an order from Southern Trust to wire 11.15 million euros, roughly equal to $12.7 million on the time, to Leon on June 26, 2019, Schwab mentioned within the SAR, which was seen by Reuters.

The SAR was contained within the batch the DOJ had launched publicly, however has since been withdrawn for causes Reuters couldn’t confirm. The DOJ declined to touch upon the file.

The funds have been despatched to a Julius Baer account in Switzerland held by Leon, who was primarily based in Marrakesh on the time, the SAR exhibits.

A file on the DOJ web site additionally exhibits the request.

The subsequent day, Schwab acquired a name from an individual whose id is redacted from the SAR requesting the termination of the switch. Asked why, they instructed Schwab that phrases on the real-estate deal had not been “agreeable”.

The particular person additionally mentioned one other cost could be made for a bigger sum to a special account, the SAR exhibits.

Schwab was profitable in reversing the order, which might be credited again on July 10, the SAR exhibits.

Two days earlier than Epstein’s arrest, in a July 4 wire switch request signed by Epstein and his co-signatory, Southern Trust instructed Schwab to ship Leon $14.95 million, the SAR exhibits.

Schwab mentioned the funds have been despatched to an account of Leon’s at Julius Baer, the SAR exhibits.

Yet Epstein’s Southern Trust account didn’t have enough funds as a result of Schwab had not but returned cash from the sooner switch, the SAR says.

While Schwab may have had an inexpensive expectation that the cost could be transferred again to Epstein’s account, the financial institution would have been uncovered to danger till the funds have been returned.

Reuters couldn’t set up when the $12.7 million finally landed again in Epstein’s account however the funds have been attributable to arrive on July 10, the SAR dated July 13 exhibits.

Asked by Reuters about its coverage at the moment for processing worldwide wire transfers when accounts had inadequate funds, Schwab declined to remark.

Reuters was not capable of set up whether or not Julius Baer accepted the transfers. A spokesperson for Julius Baer declined to remark.

Leon mentioned: “The anti-money laundering checks in force were carried out by the banking institutions involved in the future transaction, which ultimately never took place.”

It was not till July 9, three days after Epstein’s arrest, that Schwab cancelled the second switch on the request of a person performing on Epstein’s behalf whose title is redacted, the SAR exhibits.

An e mail included within the different DOJ paperwork exhibits Epstein’s accountant Kahn requested to cancel the switch on July 9.

Kahn has been ordered to testify earlier than Congress subsequent week to reply questions on whether or not he helped to facilitate Epstein’s crimes via his administration of the late intercourse offender’s monetary affairs, House Oversight Committee member Robert Garcia mentioned in a media assertion in January.

Reuters has no proof that Kahn is responsible of wrongdoing.

In a follow-up trade with Schwab after Epstein’s arrest, an unidentified Epstein affiliate requested if future transfers for Southern Trust’s account would nonetheless require two signatures as more cash could be despatched quickly, the SAR exhibits.

Epstein had been charged with intercourse trafficking of minors and remained in jail, the DOJ mentioned on July 8.

Schwab instructed FinCEN within the July 13 SAR it had “concerns with attempted wires for the purpose of real estate, in light of negative media surrounding Jeffrey Epstein” and worries about him being a potential flight danger forward of a bail listening to.

“This investigation is the result of an internal referral,” the doc exhibits Schwab saying.

While Epstein’s deal fell via, the palace of Bin Ennakhil – which implies “amidst the palms” – in Marrakesh is now not vacant.

“The property has since been sold to another buyer,” Leon instructed Reuters.

https://www.independent.co.uk/news/world/americas/us-politics/jeffrey-epstein-morocco-palace-marrakesh-wire-payments-transfers-b2924749.html