UK borrowing prices at highest for a yr after Budget | EUROtoday

Getty Images

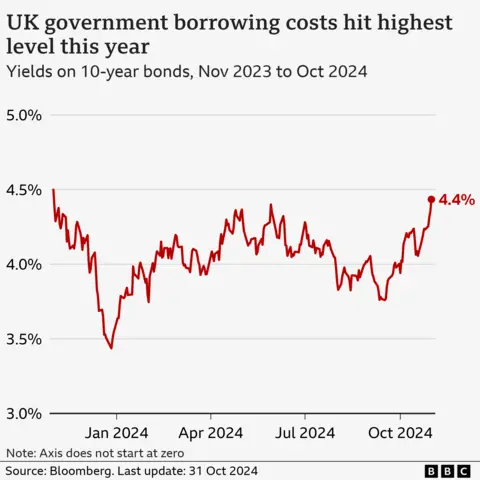

Getty ImagesThe price of UK authorities borrowing has risen to its highest stage for greater than a yr within the wake of Wednesday’s Budget.

The rate of interest – the so-called yield – the federal government has to pay lenders when it borrows cash from them over a 10-year interval, climbed above 4.5% on Thursday earlier than falling again.

Yields have been pushed increased after the chancellor introduced a pointy rise in authorities borrowing to finance spending tasks, sparking expectations that rates of interest will fall extra slowly.

This issues as a result of not solely does it imply the federal government should pay extra to borrow, however bond yields are additionally used as a information for setting the charges on on a regular basis loans and mortgages.

Downing Street has stated it doesn’t touch upon market actions however insisted “stability is at the heart” of the chancellor’s new fiscal guidelines.

The rise is partly a response to Chancellor Rachel Reeves’ resolution to considerably enhance borrowing, however the BBC’s economics editor Faisal Islam says thus far it’s a pure market adjustment reasonably than the panicked response which adopted Liz Truss’s mini-Budget two years in the past.

There has additionally been a wider rise in borrowing prices over the previous month, however that has been a world motion led by the US, he provides.

In the Budget, Reeves introduced almost £70bn of additional spending a yr, funded by tax will increase for enterprise and additional borrowing.

Analysts stated the upwards motion in bond yields was a sign that the markets weren’t completely satisfied concerning the enhance in authorities spending.

Kathleen Brooks, an analyst at buying and selling agency XTB, stated the motion indicated that the Budget “has not been well received” by markets.

“This is another sign that the chancellor overestimated the market’s desire to absorb more sovereign debt issuance from the UK,” she stated.

Susannah Streeter, head of cash and markets at Hargreaves Lansdown, stated expectations for rate of interest cuts had been scaled again, given forecasts that the Budget may push up inflation over the following two years.

“Financial markets are now not expecting rates to fall below 4% until 2026,” she stated.

“This has been reflected in the spike in UK gilt yields to some extent, but given that sterling has remained lower against the dollar, it also indicates that there is a growing nervousness about the way Labour is steering the economy.”

She stated bond yields have been set to remain “volatile” as establishments financing authorities borrowing “keep a more suspicious eye trained on what the swollen investment budget will be spent on”.

Prime Minister Sir Keir Starmer’s spokesperson stated the Budget was “first and foremost” about “restoring fiscal stability”.

“It is a matter of government policy not to comment on market fluctuations,” she stated.

However, she stated there have been no second ideas over the quantity the federal government was borrowing.

“We have seen response from our bodies such because the IMF welcoming this method.”

https://www.bbc.com/news/articles/cx2n0eeep90o