Mortgages charges are usually not rising but however Reeves has to behave | EUROtoday

Getty Images

Getty ImagesIt has not been week for Chancellor Rachel Reeves.

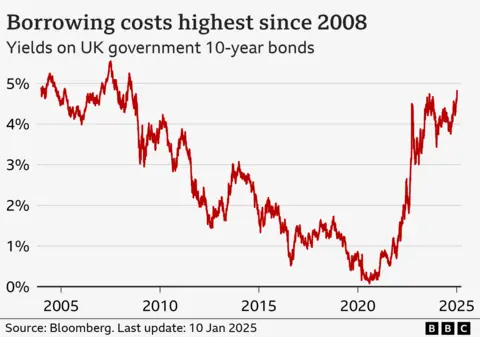

Government borrowing prices have hit their highest stage in 16 years and the pound has fallen to a 14-month low towards the greenback.

She has gone on a deliberate journey to China amid accusations from opposition events that she is leaving at a second of financial peril.

Bank of England governor Andrew Bailey is accompanying her on the journey. The 12-hour flight to Beijing might be the size of the assembly she may need needed to have with him.

So how severe are the latest actions on the markets and what may occur consequently?

Budget plans must be tweaked

While the markets stabilised from Thursday lunchtime, the transfer towards UK authorities debt is already sufficient to trigger an issue for the chancellor’s Budget maths.

Reeves has pledged to not borrow to fund day-to-day spending and to get debt falling as a share of nationwide revenue by the top of this parliament. The Treasury has stated these fiscal guidelines, set out within the Budget, are “non-negotiable”.

At instances over the previous week the markets have regarded fairly fragile for Britain, with each authorities borrowing prices going up and sterling falling again on the identical time. That is a key marker.

While it is true that the general course for the markets over the previous month has been set by an evaluation of the inflationary penalties of President-elect Trump’s commerce and financial insurance policies, the UK has been getting some particular consideration as well as.

It dangers being tarred with each the inflationary stickiness of the US, and the stagnant development of the eurozone – the worst of each worlds.

That stated, you will need to be exact concerning the extent of the issue. The further value of servicing the nationwide debt at these rates of interest can be a number of billion kilos a yr – i.e. materials sufficient to require some type of correction within the Budget maths, however doable, and the clear message this week is that “it will be done”.

No impression on mortgages thus far

The impression on budgetary maths is actual, however the wider impression that is perhaps anticipated – of upper borrowing prices for corporations and for households – has not but materialised.

The mortgage market has but to see a rise in charges for fixed-term mortgages, as occurred quickly within the panic after the 2022 mini-Budget. There is a curious calm.

One clarification lies in what isn’t taking place. This time final yr the key lenders vastly discounted mortgages in a battle for market share forward of the important thing moments for home shopping for. This has not occurred this yr, and should but have a consequence within the property market.

The Bank of England has indicated it would proceed with rate of interest cuts this yr. The markets suppose there could also be far fewer than beforehand anticipated, maybe just one, leaving base rates of interest at 4.5%.

Many economists say that is the improper name, and consider charges shall be minimize a number of instances. There’s various uncertainty right here, and the important thing Bank of England committee is cut up. The Bank’s phrases shall be very rigorously watched.

More positively for the financial system, regardless of lots of rhetoric from retailers, many have delivered robust outcomes and haven’t lowered their income expectations. Are shoppers a bit extra strong than had been assumed, and will this drive some development in 2025?

Growth technique wants a reboot

The drawback of servicing increased curiosity funds on the nationwide debt will increase the chance of the Treasury planning for an adjustment, primarily based on a squeeze on spending. A £10bn minimize will harm, however with a majority of 170 MPs within the House of Commons, and an ongoing spending evaluation already in prepare, it may be finished.

In these circumstances, with the credible risk of a world commerce warfare, for instance, it ought to be famous that Rachel Reeves’ new fiscal guidelines do have an escape hatch.

In the occasion of “an emergency of a significant negative economic shock to the economy” the chancellor might “temporarily suspend the fiscal mandate”.

While a world commerce warfare may qualify, it might be tough optics to droop a “non-negotiable” and “iron-clad” algorithm earlier than that they had actually bitten. The guidelines haven’t but formally handed into regulation but both, and stay a “draft” till the Commons votes to approve them.

It appears most unlikely that this route shall be taken until there’s a very clear financial shock within the coming weeks.

The larger level here’s what issues within the markets, which is whether or not the UK is pursuing a reputable set of insurance policies, a convincing total technique.

Labour’s deal with stability in any respect prices was comprehensible after the humiliation of Liz Truss’s mini-Budget. But “stability” isn’t a development technique.

Pursuing inexperienced development by borrowing for long-term capital funding is a possible technique, and it underpinned “Bidenomics” within the US. The incoming authorities embraced the rhetoric of US coverage below the outgoing president, with out the identical firepower. “Bidenomics without the money”, you would possibly say.

But now the brand new Trump administration is jettisoning this method, rightly or wrongly, and the markets are much less satisfied that such a technique pays for itself. It will value extra to fund such a technique, and require harsher trade-offs than anticipated.

Bidenomics with out each the cash and with out Biden is far too skinny. A extra detailed technique for sustained development is required, and briefly order.

https://www.bbc.com/news/articles/cx2pg75yn88o