What are PIP incapacity funds and why may they modify? | EUROtoday

Getty Images

Getty ImagesChanges to a key incapacity profit referred to as Personal Independence Payment (PIP) are being thought of by the federal government because it tries to chop welfare spending.

PIP is paid to individuals who have problem finishing on a regular basis duties or getting round on account of a long-term bodily or psychological well being situation.

Sir Keir Starmer is dealing with strain from some MPs and charities, who say weak individuals may lose out if the principles for qualifying are tightened or funds modified.

How a lot is a PIP price?

There are two components to PIP – a every day residing element and a mobility element. Claimants could also be eligible for one or each.

Daily residing covers areas resembling requiring assist with getting ready meals, washing, studying and managing your cash. The mobility component contains bodily transferring round or getting out of your property.

For every, there are two classes of fee – customary and, for these with better wants, enhanced.

For every day residing:

- The customary charge is £72.65 per week

- The enhanced charge is £108.55 per week

For mobility:

- The customary charge is £28.70 per week

- The enhanced charge is £75.75 per week

PIP is normally paid each 4 weeks and is tax-free.

It doesn’t change relying in your earnings and doesn’t depend as earnings affecting different advantages, or the profit cap. You can get PIP if you’re working.

The fee is made for a set time frame between one and 10 years, after which it’s reviewed. A reassessment may come earlier if your circumstances change.

How many individuals obtain PIP and who qualifies?

More than 3.6 million individuals presently declare PIP.

The funds are made in England, Wales and Northern Ireland. In Scotland, there’s a related however separate profit referred to as the Adult Disability Payment.

Claimants are assessed and scored for a way a lot assist is required for every of a sequence of every day residing and mobility duties, in a course of which has prompted appreciable debate and controversy.

A rating of between eight and 11 results in fee of the usual charge. The enhanced charge is paid to these with a rating of 12 and above.

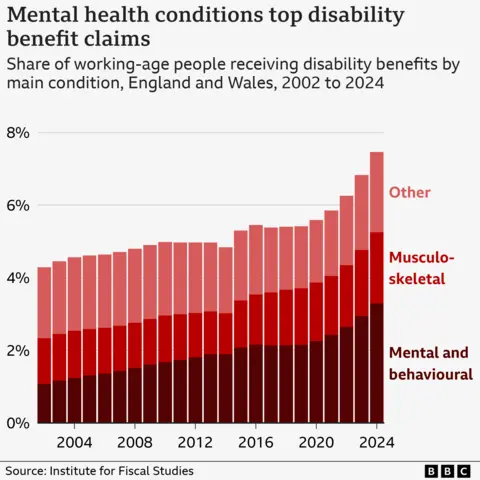

About 1.3m individuals now declare incapacity advantages primarily for psychological well being or behavioural situations resembling ADHD. That is 44% of all working age claimants, in line with the unbiased financial think-tank, the Institute for Fiscal Studies (IFS).

How may the principles be modified?

When PIP was launched in 2013, the goal was to save lots of £1.4bn a yr by lowering the variety of individuals eligible for funds.

However, preliminary financial savings had been modest and the variety of claimants has risen.

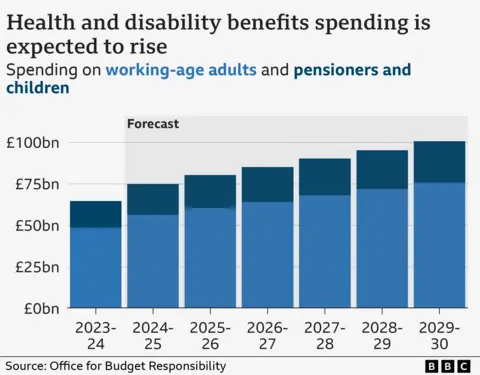

PIP is now the second-largest component of the working-age welfare invoice, with spending anticipated to nearly double to £34bn by 2029-30.

Overall, the federal government presently spends £65bn a yr on well being and disability-related advantages. This is projected to extend to £100bn by 2029.

As a end result, there’s a push by ministers to make adjustments and encourage individuals into work.

Initially, it was thought they won’t improve PIP funds consistent with inflation for a yr – however that concept is assumed to have been withdrawn after Labour MPs voiced opposition.

Another choice can be to tighten the factors, by altering the scoring system for many who qualify.

What about choices with different advantages?

Although a lot of the main focus is on PIP the federal government can also resolve to make adjustments to different advantages.

Universal Credit is the biggest working-age profit, paid to 7.5 million individuals who might, or might not, be in work.

More than three million recipients of Universal Credit haven’t any requirement to seek out work, a quantity that has risen sharply.

The authorities says that is unsustainable and that it desires to assist extra individuals into jobs.

https://www.bbc.com/news/articles/cj924xvzrr2o