The international economic system recalculates its route | Business | EUROtoday

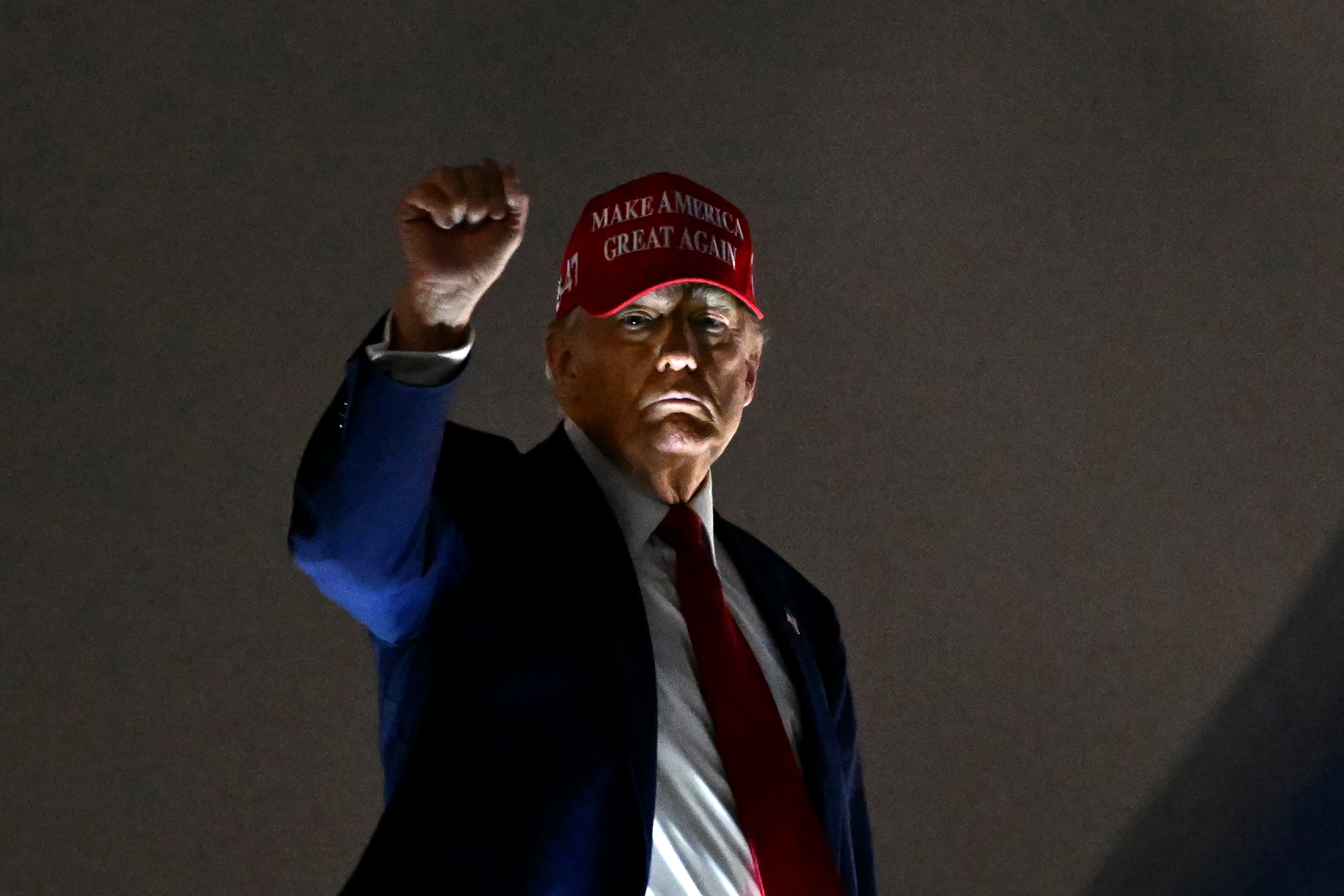

On March 31, simply two days earlier than the president of the United States, Donald Trump, revealed his tariff plan to cut back the cumbersome business deficit of the nation, the managing director of the International Monetary Fund (IMF), Kristalina Georgieva, assured that the establishment didn’t recognize “a dramatic impact” of the measures identified by Trump from her return to the White House and, in no case, in no case, in no case. “They were to cause a recession” within the brief time period. A couple of hours after Trump launched his tariff climb, the most important disaster in world commerce for the reason that nice despair, the establishment admitted the “significant risk for world perspectives at a time of little growth” of the rise in taxes and introduced that the IMF will evaluate its development its development forecasts on the assembly that the company celebrates on the finish of the month in Washington. Few anticipated the detonation of the business warfare from the primary world economic system to get thus far.

The tariff climb has unleashed a disaster within the luggage world wide that threatens to maneuver to the monetary sector, after a collapse of values thought-about refuge: the US debt and the greenback. Basically, the United States has utilized a minimal 10% tariff to nearly everybody, together with the international locations with which it has a business surplus, to which a badly known as reciprocal tariff is added, which is a impolite share of the business stability with that nation. The calculation of tax was so gross, and costly by way of credibility and rationality of the financial coverage of its administration, that on the identical day of its entry into power – final Wednesday – Trump needed to partially reverse and pause its utility for 90 days. This interval appears to open a extra practical negotiation margin, though the reality is that Trump wants tariff revenues to finance its fiance tax drop with out growing a deficit that exceeds 7% of GDP and a stage of public debt that’s round 124% of GDP.

What is maintained are 25% tariffs on metal and aluminum imports and 25% for autos and elements produced overseas, together with the specter of one other tax on medicines. Nor is there the minimal containment within the case of China, with whom the business warfare appears unleashed till its final penalties. The White House clarifies that China tariffs already whole 145%. Trump’s final govt order will increase Runes to Beijing from 84% to 125%, however to this we should add a 20% tax associated to fentanyl. Beijing has imposed a 125% tariff on US imports and export controls of a dozen US firms working in that nation. “The elephant in the room is that the trade between the US and China has basically disappeared. The relationship between the two powers is broken and will continue like this,” says Louis-Vincent Gave, CEO of Financial Consultant Gavekal Research.

An obsession of years

Despite Trump’s insistence, traders had underestimated the tariff threats of the Republican and his valuations didn’t mirror the true threat of the measures. Already in an interview with Larry King in 1987, Trump talked about how he was “tired of seeing other countries scaming the United States,” and in 1988, in David Letterman’s program, he mentioned particularly to the business stability: “If you look at what certain countries are doing to this country … that is, they have taken advantage of the country. I mean commercial deficits,” he mentioned.

It is obvious that it’s not a heat. “There is an ideology of long data and deeply rooted that supports these tariff World Cup, according to the measure used by Trump, ”says Libby Cantrill, director of public insurance policies at Pimco. “While the road can have turns and turns, fate seems clear: tariffs are here to stay,” Cantrill emphasizes in a notice.

The Trump administration evaluation ignores that the free circulation of products, which has resulted within the US business deficit, has been accompanied by a gap of world capital markets for the reason that Nineteen Eighties, which has allowed the US to learn from the financial savings of the remainder of the world. At the tip of 2024, the online worldwide funding place of the United States was 26.2 billion {dollars}, remembers Justin Muzinich, CEO of the fund supervisor that bears his title. This dynamic has supplied entry to low-cost financing, has promoted its management in world innovation, has maintained its navy superiority and has allowed it to determine world requirements and requirements. Today that place of privilege and area could also be in danger.

Conventional financial principle argues that if a rustic imposes tariffs its foreign money is strengthened to compensate for the impression of taxes. In this case, nevertheless, the greenback has depreciated remarkably in comparison with the primary currencies and weak spot is maintained as the times go by. “That the dollar falls in a global movement of risk aversion is unusual. That fixed income and variable income collapses at the same time is even more rare. It is a combination that usually occurs more in a crisis of emerging markets than in the developed ones,” says Gave.

The threat of an incipient monetary disaster has shot, within the phrases of the Nobel Prize in Economics Paul Krugman. If the greenback and the American bonds lose engaging for traders, the fiscal scenario of the primary world economic system is difficult and far from the large quantity of debt – private and non-private – that this 2025 should be refinant, particularly within the second half of the 12 months. Only within the case of the Federal Government the refinancing quantities to seven billion {dollars}. The escalation of the efficiency of the American bonds within the final week, which got here to the touch 5% within the title to 30 years, has been the trump of Trump’s break in his tariff warfare, within the opinion of the primary specialists. It was exactly the bond market that took the Prime Minister of the United Kingdom, Liz Truss in 2022, with whom some analysts have in contrast nowadays the determine of the New Yorker. “With all honesty, the situation is not only chaotic, it is crazy,” says Macro’s international chief in Ing Carsten Brzeski in a primary evaluation.

If they lastly apply in all its depth, the measures accredited by the Trump administration characterize a rise within the efficient common tariff price of the US of two.5% to 24% and even above, its highest stage in a century. Since US imports reached 3.3 billion {dollars} in 2024, that’s equal to about 715,000 million {dollars}, based on UBS calculations, earnings for the federal authorities, which is able to principally pay US shoppers and firms, regardless of how a lot Trump’s advisors insist on saying the alternative. The majority of predictive fashions don’t ponder a commerce warfare of the caliber of the trump and are restricted to an accounting train of the impression of the tariff enhance on the demand of households and firms, in addition to its impact on the funding within the US derived from the drop in luggage, the place 58% of Americans have their financial savings. Other analysts increase cargo for properties as much as $ 3,800 a 12 months.

At the second that state of affairs is in pause for as much as three months, however the injury to the economic system doesn’t. Governments, worldwide organizations and evaluation homes are reassessing how all this may have an effect on the views of the US and the remainder of the worldwide economic system. Someone who has very taken the heart beat to the US economic system because the president of JP Morgan, the most important financial institution within the nation, Jamie Dimon, believes that the US is directed with excessive likelihood to a recession. Even if the worst omen don’t materialize, the views level in the very best case to a stagnation of development with inflation (stagflation, within the jargon of economists), which might considerably complicate the selections of the Federal Reserve. The collapse in worldwide oil costs – which is round $ 62 within the case of the Brent barrel – is suitable with a recessive state of affairs.

Autoinfling injury

It is tough to think about a self -inflicted injury state of affairs just like the one which has unleashed the United States. The 2025 forecasts have been marked by uncertainty, derived exactly from the tariff and financial insurance policies of the brand new administration, however the worst omen centered on the European economic system. Now that state of affairs has rotated. Not as a result of the business warfare between the 2 best world powers is not going to have an effect on the economic system of the twenty -seven, which is able to achieve this, however as a result of the settlement reached in Germany between conservatives and social democrats has allowed the Bundestag to approve a mass bundle of fiscal stimulus, which revokes the constitutional restrict to the general public debt and provides the inexperienced gentle to the emission of debt of as much as a billion {dollars} to put money into protection, infrastructure and infrastructure surroundings. A real revolution for all of Europe, which has been constrained by the German Adjustment Fiscal Policy for years.

Face winds from the United States, and earlier than the German fiscal bundle had been recognized, had already taken the European Central Bank (ECB) to evaluate their projections for the European economic system to 0.9% for the entire of the 12 months, a two tenth minimize with respect to the December forecasts. The power of the euro will enable to compensate a part of the impression of the brand new tariff coverage on inflation and the ECB can proceed with the kind gross sales. But the hawks present their reluctance. The governor of the Dutch Central Bank, Klaas Knot, has come to affirm that the mixture of a provide shock derived from the rise in tariff The value of cash at your assembly subsequent Thursday, April 17, to 2.25%.

Nor will China be proof against the business warfare, regardless of how a lot it has financial and financial instruments to stimulate its economic system. Goldman Sachs is assured that China’s actual GDP will develop 4% in 2025 and three.5% in 2026, half a degree beneath its earlier forecasts. The American financial institution highlights that between 10 and 20 million Chinese staff may very well be uncovered to exports for the US, which generates issues about stress within the labor market, a supply of rigidity for the Government of Xi Jinping.

The director of the World Trade Organization (WTO), Ngozi Okonjo-Iweala, has warned that confrontation between China and the United States “entails broader implications that could seriously damage global economic perspectives.” For instance, as some analysts concern, China will search for different markets to have the ability to promote their merchandise now that the US market closes, which may injury native producers and switch deflationist pressures about their economies. However, the best hazard in his opinion is the risk derived from a potential fragmentation of world commerce “along geopolitical lines”, that’s, a division of the worldwide economic system into at the least two blocks. The consequence may very well be a protracted -term discount of the world actual GDP of virtually 7%, helps the WTO. The business warfare might have given the lace, who is aware of if definitive, to globalization.

https://elpais.com/economia/negocios/2025-04-14/la-economia-global-recalcula-su-ruta.html