What the Budget means for you and your cash | EUROtoday

Kevin PeacheyCost of residing correspondent

Getty Images

Getty ImagesChancellor Rachel Reeves is saying her Budget, however particulars had been revealed early by the official forecaster.

It is full of insurance policies that can instantly have an effect on you and your funds.

Here are the important thing measures and the way they may have an effect on you and your cash.

You might pay extra tax

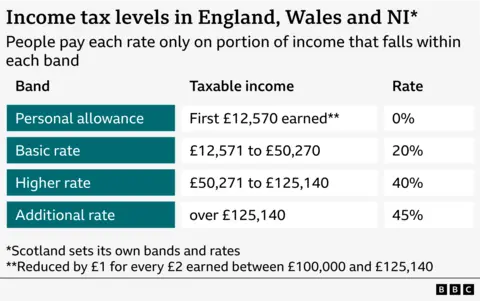

The quantity of earnings at which you pay totally different charges of earnings tax will nonetheless not be elevated in keeping with rising costs.

Instead the bands – often known as tax thresholds – will keep frozen till 2031. That is three years longer than beforehand deliberate.

This means any type of pay rise may drag you into a better tax bracket, or see a larger proportion of your earnings taxed than would in any other case be anticipated.

Scotland has its personal earnings tax charges.

You might not earn sufficient to pay earnings tax, so VAT, paid when shopping for items and providers, might hit you tougher and that is been left unchanged.

Driving an electrical automotive can be dearer

Electric automobile and hybrid automotive drivers can be taxed for utilizing the street from 2028.

EV drivers can be charged per mile, on high of different street taxes, in new street pricing.

Calculating the variety of miles that drivers cowl is troublesome.

But gas obligation will proceed to be frozen.

You will get an increase in case you’re on low pay

The chancellor confirmed will increase in April for these on minimal wages.

It means:

- Eligible staff aged 21 and over on the National Living Wage will obtain £12.71 an hour, up from £12.21

- If you might be aged 18, 19 or 20, the National Minimum Wage improve to £10.85 an hour, up from £10

- For these aged 16 or 17, the minimal wage will rise to £8 an hour, up from £7.55

The separate apprentice charge which applies to eligible folks below 19 – or these over 19 within the first 12 months of an apprenticeship – may also improve to £8 an hour, from £7.55.

If your house is value £2m you’ll pay extra tax

Anyone who lives in a house valued at £2m or extra in England will face a council tax surcharge from April 2028.

There can be 4 value bands with the surcharge rising from £2,500 for a property valued within the £2m to £2.5m band, to £7,500 for a property valued within the highest band of £5m or extra

While often known as a mansion tax, it could additionally seize houses in costly areas, and can be levied on about 100,000 properties, primarily in London and south east England.

The transfer would require the valuation of houses within the high council tax bands – F, G and H – for the primary time since 1991.

You can verify your council tax band right here in case you are in England and Wales, Scotland, and Northern Ireland.

Travelling by practice in England will not price you extra

Regulated rail fares in England can be frozen till March 2027 – the primary time they’ve been left unchanged for 30 years.

These fares embody season tickets masking most commuter routes, some off-peak return tickets on long-distance journeys and versatile tickets for journey in and round main cities.

Getty Images

Getty ImagesThe freeze solely pertains to journey in England, and likewise solely applies to providers run by England-based practice working firms.

Train operators are free to set costs for unregulated fares.

The bus fare cap of £3 for a single journey, masking most bus journeys in England, is already in place till March 2027.

If you’ve three youngsters you could get extra money

At current, mother and father can solely declare common credit score or tax credit for his or her first two youngsters.

The chancellor says this two-child cap can be scrapped in April subsequent 12 months.

A restrict on what it can save you right into a pension via wage sacrifice

A 3rd of personal sector staff and a tenth of public sector staff use a wage sacrifice scheme for his or her pension financial savings.

These staff hand over a portion of their wage in return for his or her employer paying the equal quantity into their pension. The profit to each worker and worker is that they make financial savings in nationwide insurance coverage.

A £2,000-a-year cap on the quantity that may be put into pensions via this wage sacrifice association can be in place from April 2029.

Employees would nonetheless get earnings tax aid on their pension contributions, however some argue the transfer will scale back pension saving incentives.

Most advantages and the state pension will rise

Some advantagestogether with all the principle incapacity advantages, akin to private independence fee, attendance allowance and incapacity residing allowance, in addition to carer’s allowance will rise by 3.8% in April, in keeping with rising costs.

There can be a string of modifications to common credit score in April, following bulletins made earlier by the federal government.

The state pension in April will rise by 4.8% in keeping with common wages, which suggests:

- the brand new flat-rate state pension – for individuals who reached state pension age after April 2016 – will improve to £241.30 every week, or £12,547.60 a 12 months, an increase of £574.60

- the outdated fundamental state pension – for individuals who reached state pension age earlier than April 2016 – will go as much as £184.90 every week, or £9,614.80 a 12 months, an increase of £439.40

In common, you want 35 years of qualifying contributions to get a full state pension.

This brings the state pension nearer to being topic to earnings tax – a supply of some debate. It may also reignite discussions over the “fairness” of the so-called triple lock.

More on the milkshake tax, prescription costs and Motability

A spread of different measures within the Budget had already develop into clear or been introduced in current days. They included:

- The UK tax on fizzy drinks can be prolonged to milk-based merchandise in 2028, taking in pre-packaged milkshakes and coffees which can be excessive in sugar. This might push up costs, or result in ingredient modifications

- The price of a single NHS prescription in England can be frozen at £9.90 for the second 12 months in a row in April

- Disabled individuals who have a automotive via the Motability scheme will now not be allowed “premium” autos akin to BMWs, Mercedes, Audi, Alfa Romeo and Lexus

- England’s mayors could possibly be given the powers to cost a levy on in a single day staysgenerally known as a ‘vacationer tax’. Mayors would determine the extent of the cost, and tips on how to spend the cash of their areas, below the plans which can be consulted upon

https://www.bbc.com/news/articles/c5y2g2qn0eyo?at_medium=RSS&at_campaign=rss