How the chancellor simply took a bit out of your future pay | EUROtoday

Lucy HookerBusiness reporter

Getty Images/ljubaphoto

Getty Images/ljubaphotoThere was no rise within the fee of earnings tax. Still, the Budget is more likely to push up your tax invoice earlier than the top of this parliament.

That’s as a result of the chancellor has opted to freeze tax thresholds – the purpose at which you begin to pay tax, and the purpose the place you tip into paying the next fee of tax – for an additional three years.

This is usually dubbed a stealth tax as a result of, in contrast to elevating the headline charges, it isn’t apparent in your payslip.

It will hit you hardest in case your earnings is near one of many tax thresholds as a result of extra of what you earn will probably be dragged over the road, making it topic to the next fee of tax.

About 1,000,000 individuals who presently do not earn sufficient to pay earnings tax will probably be drawn into paying it.

That will embody individuals residing on the state pension, which is presently just below £12,000 a yr however is ready to rise. An element-time minimal wage earner, working simply 18 hours every week may also pay earnings tax, in line with the assume tank, the Institute for Fiscal Studies (IFS)

People in Scotland may also see their tax free allowance frozen, though different tax bands there fluctuate.

People may also pay extra in National Insurance Contributions (Nics) as the edge for beginning to pay that is additionally being frozen.

How does it work?

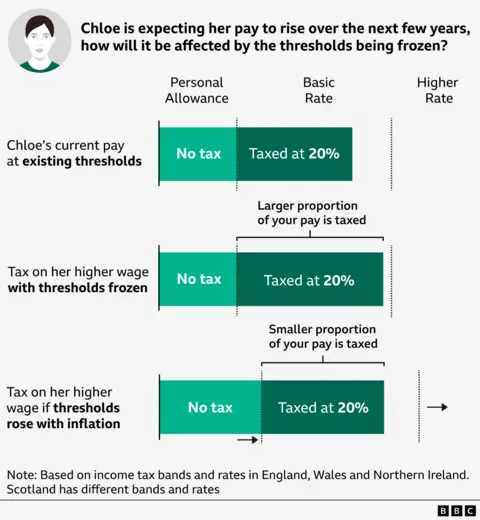

Wages normally go up year-on-year to cowl the rising value of residing. Normally tax thresholds would even be lifted according to rising costs.

However, because of the thresholds being frozen, as your pay rises, an even bigger proportion of it would find yourself above the edge and so being taxed.

For instance, if you happen to work full-time and are paid the minimal wage, you’ll pay £137 per yr extra in tax by 2030, than if these thresholds moved larger after 2028.

Will I pay the upper fee?

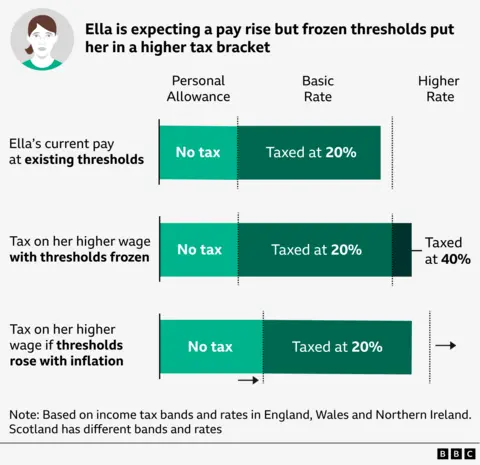

As incomes rise, frozen thresholds additionally imply increasingly individuals will probably be dragged into the upper, 40% tax bracket.

For instance, if you happen to presently earn £49,000 and your pay rises with inflation, by 2031 you might be incomes £54,000 which means a few of your earnings will probably be taxed on the larger fee for earnings over £50,271.

More than one in 4 staff will probably be larger fee tax payers by 2031, in line with the IFS.

The identical precept applies to the extra 45% fee, that’s charged on an individual’s earnings over £125,140.

Will thresholds ever return up?

Tax payers are already paying tons of of kilos greater than they’d have been if thresholds had been allowed to rise with costs since 2021, once they had been frozen by the earlier authorities.

Inflation has been excessive lately, making the impression of frozen thresholds larger.

By 2030 over 5 million extra individuals are anticipated to have been introduced into the taxpaying web by the coverage.

In complete the coverage may have raised £56bn by 2031, £12bn from the three yr extension simply introduced. That’s cash that helps pay for the NHS, faculties and assist for the sick, disabled and the aged.

As issues presently stand, thresholds are anticipated to start out rising once more in 2031.

However, there isn’t a elementary precept at stake, no measurement that’s the “right” measurement for the tax free private allowance. Before the monetary disaster the private allowance earlier than you begin paying tax was round £5,000, a lot smaller than immediately, even permitting for inflation, and it was allowed to develop till the pandemic hit.

https://www.bbc.com/news/articles/clydn7r5pn1o?at_medium=RSS&at_campaign=rss