Nine methods the Budget may have an effect on you for those who’re underneath 25 | EUROtoday

Archie MitchellBusiness reporter

Getty Images

Getty ImagesThe chancellor has introduced her Budget which features a freeze to revenue taxthresholds, an increase in minimal wages and a so-called milkshake tax.

Here are 9 methods Chancellor Rachel Reeves’ Budget may have an effect on you if you’re 25 or underneath.

Minimum wage employees will profit

Minimum wages will go up from April with 18 to 20-year-olds getting the largest pay rise.

Their hourly price will go up by 85p to £10.85, whereas under-18s and apprentices will see a 45p uplift to £8 an hour. Over-21s will get an increase of 50p per hour to £12.71.

Reeves stated 2.7 million individuals will profit from these will increase.

More broadly, the federal government is attempting to carry minimal wages for 18 to 20-year-olds consistent with employees aged 21 and over.

But companies have warned that the will increase may push up costs and result in a freeze on hiring.

Think tank the Resolution Foundation stated the “unnecessarily big” rise for under-21s particularly may make it tougher for 18 to 20-year-olds to search out work.

Student mortgage reimbursement thresholds frozen

The chancellor has frozen the brink at which scholar loans should be paid again from 2027-28.

The threshold is presently £28,470 for these with loans taken out from September 2012 onwards in England or Wales.

This means every year, employees incomes above that quantity can be dragged into making bigger repayments on their scholar loans than they might have if thresholds rose consistent with inflation.

Student mortgage repayments sometimes quantity to 9% of their incomes over a given threshold every month.

Reeves additionally unveiled a brand new worldwide scholar levy, which can see universities charged £925 per abroad scholar per 12 months from August 2028, with an exemption for 220 college students per 12 months.

The revenue raised by the levy can be used to fund upkeep grants for deprived college students finding out so-called precedence programs equivalent to college levels and technical {qualifications}.

Private renters anticipated to be hit

The chancellor made an attraction to renters in her Budget speech, saying it’s unfair that revenue from work is taxed greater than revenue made by landlords.

Reeves set out plans to lift the tax price on revenue from properties by 2%.

But the adjustments risked contributing to “a steady long-term rise in rents”, the official forecaster the Office for Budget Responsibility (OBR) warned.

This is as a result of landlords could depart the personal rental market, limiting provide and pushing up costs for renters, it stated.

Young individuals can be helped into work

The chancellor put aside £1.5bn over the subsequent 5 years to assist 16 to 24-year-olds into work or coaching.

Reeves stated £820m will go in the direction of her assure to supply paid work placements to younger individuals who have been out of labor, training or coaching for 18 months.

It is a part of a drive by the federal government to scale back the variety of individuals out of labor, with those that refuse to take up the supply dealing with the specter of being stripped of their advantages.

An additional £725m will go in the direction of making the coaching of under-25 apprentices free for small and medium sized corporations.

Getty Images

Getty ImagesSome on-line buying to get costlier

The chancellor’s resolution to scrap a tax loophole on small parcels may see some on-line buying get costlier from 2029.

The “de minimis” loophole permits abroad retailers to ship items to the UK value as much as £135 with out incurring customs responsibility.

British retailers have been extremely essential of the loophole, arguing it undercuts excessive road corporations, and wished the change to be launched sooner.

It means manufacturers that profit from this loophole, like Shein and Temu, are prone to up their costs when it’s closed.

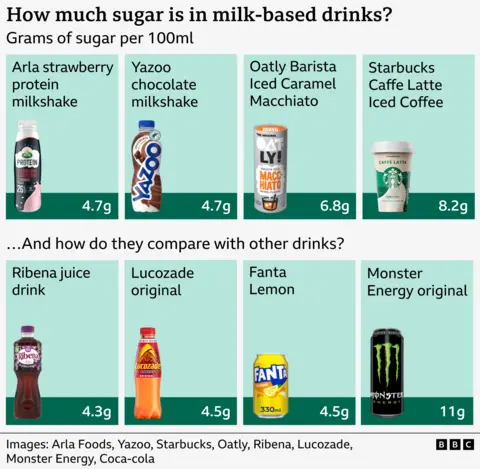

Iced lattes and fizzy drinks to fall underneath sugar tax

If you seize a pre-made latte together with your lunch or a protein shake on the best way again from the health club you may be hit by the so-called milkshake tax.

Pre-packaged milkshakes and coffees with excessive sugar content material will face an additional tax from 2028.

The threshold at which the sugar levy applies can be 4.5g of sugar per 100ml, down from 5g.

The change, a part of a bid to deal with childhood weight problems, may imply an additional tax on widespread merchandise like Yazoo, Muller’s Frijj and Starbucks Caffe Latte in addition to drinks branded “high protein” like Ufit and Shaken Udder.

First-time consumers to be helped with financial savings

Reeves promised a “new, simpler” method to assist first-time consumers onto the property ladder.

There can be a session in early 2026 on what could possibly be a alternative for the Lifetime Isa (Lisa).

Anyone underneath 40 can open a Lisa to both assist save in the direction of retirement or purchase a primary house. Savers can put in as much as £4,000 a 12 months and the federal government will prime it up by 25%.

Frequent complaints in regards to the Lisa embrace that savers face a penalty for withdrawing cash early, that means they might lose 6.25% of their very own financial savings.

Critics have additionally referred to as for the £450,000 threshold for properties eligible to be bought utilizing a Lisa to be elevated, having been unchanged since 2017.

The session may additionally see the retirement facet of Lisas eliminated in favour of focusing solely on first-time consumers.

Rail fares in England frozen

If you utilize trains or buses to get about then the excellent news is fares will not be going up for now.

For the primary time in three a long time, the chancellor introduced that regulated rail fares in England can be frozen till March 2027.

Typically the fares, which embrace season tickets for many commuter routes, are uprated consistent with inflation plus 1%. The most up-to-date improve, in March 2025, was 4.6%.

The bus fare cap of £3 for a single journey, overlaying most bus journeys in England, is already in place till March 2027.

https://www.bbc.com/news/articles/cn4dxmg7jyjo?at_medium=RSS&at_campaign=rss