The proportion of first-time patrons in England and Northern Ireland who might want to pay stamp responsibility will double from April, in response to evaluation by a property web site.

Currently, 21 per cent of first-time patrons pay the tax, however Zoopla estimates this can surge to 42 per cent after the upcoming adjustments. Existing owners aren’t immune both, with the proportion answerable for stamp responsibility predicted to leap from 49 per cent to a staggering 83 per cent.

These shifts are pushed by reductions in stamp responsibility reductions.

The “nil rate” band, the edge under which no stamp responsibility is paid, will shrink from £425,000 to £300,000 for first-time patrons.

Other homebuyers will see a fair steeper drop, from £250,000 to only £125,000. These adjustments imply a considerably bigger portion of patrons will discover themselves paying stamp responsibility, including to the price of shifting residence.

Overall Zoopla estimates that the stamp responsibility adjustments may add an additional £1.1 billion yearly within the tax to authorities coffers.

The web site’s evaluation was primarily based on purchaser inquiries to property brokers and property costs and excludes the impression of these shopping for extra houses.

Richard Donnell, govt director at Zoopla mentioned: “Stamp duty has become a big source of tax revenue, approaching £10 billion a year for the Government. The reduction in tax reliefs from April will see more home buyers paying stamp duty.”

He added: “It’s positive that most first-time buyers will still pay no stamp duty from April, but these changes hit those buying over £300,000 in southern England the most, where buying costs are already high. This will reduce buying power and market activity at a local level.

“Stamp duty is a big tax on home movers in southern England, where affordability problems are already a major challenge. The case for reforming stamp duty remains, but the question is where to replace the multi-billion in annual tax revenues.”

Simon Gerrard, chair of Martyn Gerrard property brokers, mentioned: “These upcoming stamp duty changes will disproportionately affect first-time buyers in London, where housing is much more expensive, with 97 per cent of sales set to pay stamp duty from April.

“In other areas, the impacts will be less pronounced. On the ground, we saw a big uptick in interest from first-time buyers in the last few months as they sought to get ahead of the changes, which will add thousands to the cost of buying a home.

“Some of the negative impacts may be offset by the Bank of England lowering interest rates, which will make mortgages more affordable, but it could also see house prices increase even further.

“The route onto the property ladder still contains so many barriers and the upcoming stamp duty threshold reductions will only aggravate an already dire situation.”

He prompt that current stamp responsibility reduction needs to be saved in place for first-time patrons, “or better still abolish it for first-time buyers”.

According to figures from Rightmove, the typical asking value for a house has elevated by 22 per cent since November 2017, when the £300,000 first-time purchaser reduction threshold was launched. The typical price ticket has elevated from £302,630 in November 2017 to £367,994.

Rightmove mentioned there are 28 per cent extra first-time patrons in London presently going by way of the gross sales completion course of than right now final 12 months.

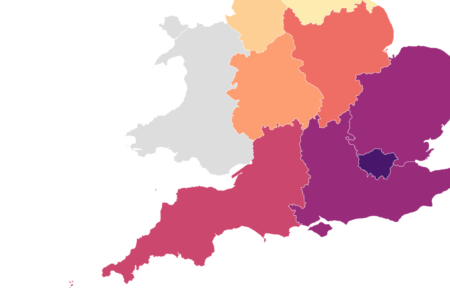

Here are the chances of transactions the place current owners shopping for a property as their fundamental residence are liable to pay stamp responsibility now, adopted by the estimates from April, in response to Zoopla:

- North East, 7 per cent, 40 per cent

- Yorkshire and the Humber, 8 per cent, 56 per cent

- Northern Ireland, 10 per cent, 59 per cent

- North West, 16 per cent, 83 per cent

- West Midlands, 20 per cent, 61 per cent

- East Midlands, 29 per cent, 84 per cent

- South West, 49 per cent, 90 per cent

- Eastern England, 73 per cent, 95 per cent

- South East, 75 per cent, 95 per cent

- London, 89 per cent, 97 per cent

And listed here are the chances of first-time purchaser transactions that are liable to pay stamp responsibility now, adopted by the estimates from April, in response to Zoopla:

- North East, 0.4 per cent, 2 per cent

- Yorkshire and the Humber, 1 per cent, 3 per cent

- Northern Ireland, 1 per cent, 5 per cent

- North West, 1 per cent, 5 per cent

- West Midlands, 1 per cent, 7 per cent

- East Midlands, 1 per cent, 9 per cent

- South West, 3 per cent, 20 per cent

- Eastern England, 16 per cent, 50 per cent

- South East, 17 per cent, 51 per cent

- London, 49 per cent, 79 per cent

https://www.independent.co.uk/news/uk/home-news/map-uk-stamp-duty-areas-b2700300.html