Business reporter

We have all heard of carmaker Ford, however what about its one-time rivals Abbot-Detroit, Acme, Adams and Aerocar?

No? Well that’s hardly stunning as a result of in contrast to Ford all of them went bust very early on. And they’re simply a few of the failed automotive firms beginning with the letter “A”.

We solely bear in mind the winners who went on to dominate the world’s motor trade, and the present high-tech sector is way the identical.

An awesome many buyers backed the unsuitable horseless carriages round a century in the past and misplaced their cash. Only just a few picked Ford or Chrysler, which is sort of precisely what is occurring now, solely to the tech sector.

Tech shares have been massively risky over the previous yr, as has been broadly reported, with share worth graphs usually wanting like rollercoaster rides, even earlier than President Trump’s tariffs have brought about wider shares falls.

A precept motive for this tech sector volatility, in keeping with Elroy Dimson, professor of finance on the University of Cambridge, is that just like the as soon as nascent automotive trade we do not know which tech companies will win in the long term.

“If you go back to the beginning of the last century there were an awful lot of motor companies, and it was clear that automobiles were going to make a huge difference,” says Prof Dimson. “But almost every company went bankrupt, you didn’t know which company you should be buying.”

Then, after all, not all high-tech companies are creating wealth. The measure of the return on an funding in shares makes use of two components, the expansion in income or dividends, and the expansion within the worth of the shares.

Boring firms would possibly pay dependable dividends and see their shares regularly improve in worth. But many high-tech firms should not paying out a lot if something in dividends. Instead, they’re investing in future progress, and so their share costs fluctuate primarily based on hopes of future income.

As Susannah Streeter, head of cash and markets at UK monetary companies agency Hargreaves Lansdown, places it: “Tech shares are more volatile, they have high valuations and their price-earnings ratios are very high, and growth stocks are more sensitive to interest rate movements.”

But additionally, buyers in such shares are, as Ms Streeter places it, playing on “not jam today but jam tomorrow”. They are all attempting to select the subsequent future huge winner, not the one paying out income now, however the one that can ultimately pay big dividends someday sooner or later.

So, any information and even suggestion that future progress isn’t going to be nearly as good as beforehand anticipated means share values can collapse.

On the opposite hand, any excellent news boosts share costs even when present income, and even losses, do not change in any respect, as buyers pile into what they suppose is the longer term winner. The shares are extra risky as a result of they aren’t underwritten by present income or dividends.

That means as Prof Dimson places it, “that small changes in growth expectation can lead to large changes in share value”, which might impact numerous firms on the identical time.

“You have companies that are reasonably similar, so when growth rates change it is effecting quite a few companies in a similar way,” he says.

“This is not different from the dotcom boom at the beginning of the 2000s. There were companies with huge growth prospects. And when the growth prospects disappeared, these were the companies that disappeared.”

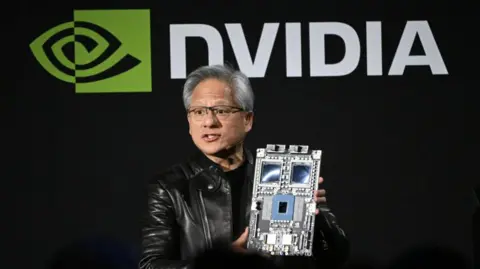

Also, even right now there should not that many actually giant high-tech firms. In America they’re colloquially referred to as the “magnificent seven” – Nvidia, a chipmaker, Alphabet, which owns Google, Amazon, Apple, Microsoft, Meta, the guardian of Facebook, and Tesla.

So, it doesn’t take a lot to spook the market, particularly since a number of of those companies are actually fairly younger, and are dominant in sectors the place earlier leaders have crashed and burned. Anyone bear in mind Ericsson, Boo or Compaq?

Technology, in contrast to say metal manufacturing or meals manufacturing, is altering at a really fast charge, and there may be clearly the prospect {that a} new high-tech firm will come alongside and destroy the enterprise mannequin of its most established rivals.

There is solely no assure that right now’s “magnificent seven” will stay magnificent and even keep as the identical seven companies.

Take Tesla for instance, its gross sales have lately fallen in response to 2 widely-reported components. Firstly, some potential prospects are against Tesla proprietor Elon Musk’s involvement in President Trump’s authorities. And secondly, Chinese electrical automotive companies equivalent to BYD are more and more sturdy opponents.

Meanwhile, Nvidia noticed its share worth drop sharply at the beginning of this yr following the discharge of Chinese synthetic intelligence chatbot DeepSeek. This app was reportedly created at a fraction of the price of its rivals.

The prompt reputation of DeepSeek has raised questions on the way forward for America’s AI dominance and the size of investments US companies are planning. This considerations Nvidia as a result of it’s on the forefront of constructing microchips for AI processing.

AI is now the most important tech recreation on the town, and plainly completely everyone seems to be claiming that AI is remodeling their trade, their merchandise and their income. They cannot all be proper.

Or as Prof Dimon places it: “At least in 1910 you knew what automobiles did, but today with AI companies you have to rely on the wisdom of the crowd, and for AI companies that isn’t good enough.”

And not all AI companies can win, provides Robert Whaley, professor of finance at Vanderbilt University in Tennessee. “AI is certainly contributing to tech volatility. The race is on.”

That signifies that AI shares are delicate to predictions. And any signal {that a} explicit agency is lagging within the AI race might imply that numerous buyers, most of whom do not perceive the topic, abandon it for an additional that appears to be additional forward.

Then there are buyers who seemingly do not appear to care which firms’ shares they purchase, as long as they’re within the “booming” high-tech sector, as they’re speculating and spreading their dangers.

In brief, share costs should not at all times a rational measure of a agency’s worth, particularly within the high-tech sector, and even of its prospects. Instead, they will signify the optimism of buyers. And optimism doesn’t at all times final.

It is commonly short-lived, passing, and faddish. And generally optimism comes head to head with actuality or simply plain fades away. It is, in brief, risky.

https://www.bbc.com/news/articles/cy83djkz2n1o