On April 2, 2025, will probably be recorded in American financial historical past because the day Donald Trump guess every little thing on his most radical protectionist imaginative and prescient. It was foresee that the president baptized because the “day of liberation” triggered a waterfall of market reactions that he has as soon as once more had, though to a lesser extent, on May 21.

We should do not forget that Trump’s tariff technique exceeded all forecasts. Imposing terribly excessive tariffs on key economies comparable to China, Vietnam and the European Union, the President applied probably the most aggressive industrial coverage in additional than a century. This tariff offensive had a drastically higher attain than anybody applied throughout their first mandate, affecting an enormous quantity of imported items, valued in billion {dollars}.

It is no surprise that US markets would react laborious in early April. The S&P 500 suffered a substantial fall, whereas worldwide reprisals intensified. China responded with forcefulness, making use of huge tariffs on American merchandise, and the European Union introduced its personal countermeasures. The volatility present that unleashed – with steep inventory market falls and a rising uncertainty – started to recollect extra typical dynamics of much less consolidated markets, of markets from rising nations.

The chapter level arrived on April 9, when European markets collapsed alarmingly. The stress was so intense that Trump, in an unprecedented maneuver, introduced a ninety -day break in most tariffs via its social reality platform. The market response was instant: Dow Jones skilled a spectacular rebound in a single day. They weren’t the markets reacting to a profitable coverage. It was merely partially returning to the start line; to the one who had by no means needed to go away.

However, on May 21 the ghost of volatility returned with a fall in Nasdaq of just about 2% in simply two hours, a depreciation with respect to the euro of 0.5% and a rise within the profitability of the generalized American public debt. While Congress superior within the dialogue of the tax cuts proposed by Trump – mission so as to add billions to the already cumbersome nationwide debt together with his “One Big Beautiful Bill Act” – The bond markets reacted with skepticism. The American treasure noticed how the yields of their lengthy -term bonds amounted to ranges not seen in years, properly above the meager kinds of the pandemic period.

Investors despatched an unequivocal sign: the mix of a commerce warfare and tax cuts with out financing threaten the nation’s fiscal sustainability. Thus, in lower than a month and a half, the United States, the biggest economic system on the planet, has exhibited in a number of days signs of vulnerability – prisoners on its forex, markets in free fall and a price of indebtedness triggered – that often affiliate with growing economies coping with disaster of belief, to not nations with the standing of ‘protected refuge’.

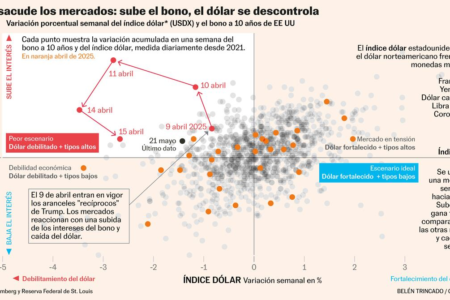

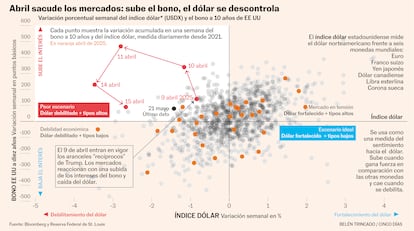

And it’s that these episodes, even removed from these skilled by much less advanced economies and with even weaker establishments, are often related to capital flight. In a globalized economic system, the rise in doubts concerning the fiscal and financial sustainability of a rustic implies that lively gross sales of that nation and revenues derived from such gross sales are often modified to different currencies, to be able to diversify dangers or return investments. In belongings comparable to shares, this suggests the autumn of inventory market indices. For debt, it reduces the worth of this, which raises its profitability. And for the forex, what’s noticed is a depreciation. It might be verified within the chart that’s accompanied that mixtures of will increase within the profitability of debt with depreciation of the trade charge has spent a number of days within the current historical past of the greenback, however not within the depth that has been noticed in probably the most agitated days of the second Trump administration.

The systemic results of this injured self -inflicted are additionally evident and alarming. The GDP had already registered a contraction within the first quarter. Pre -recessive possibilities within the United States for the next twelve months, and it’s estimated that tariff lengthy -term American.

Paradoxically, whereas Trump promised that tariffs would generate enormous annual earnings for state coffers, volatility unleashed by their insurance policies eroded billions in market worth. By the top of April, their approval charges in Economic Management had collapsed to historic minimums.

This dangerous cocktail of financial insurance policies, which pushed a sophisticated economic system in the direction of typical instability patterns of rising markets, has an in depth precedent. Just a number of years in the past, the then British Prime Minister, Liz Truss, triggered a monetary storm with an identical program of mass cuts with out credible financing, ignoring the warnings of impartial organizations.

The markets reacted rapidly, and likewise within the route they often do when it’s an rising economic system: the sterling pound sank to historic minimums, the price of the sovereign debt shot and the financial institution of England needed to intervene emergency to keep away from a higher collapse within the pension funds. Even the International Monetary Fund launched an unusually direct criticism of these measures, underlining the dangers to stability. Truss herself noticed her mandate collapsed in a matter of weeks, a uncooked demonstration of how fiscal belief, as soon as misplaced, can have fulminant political penalties and the way even probably the most developed economies should not proof against one of these disaster when politics deviates from prudence.

The lesson, subsequently, is devastating and sadly repeated: fiscal irresponsibility has penalties. Trump found that even the “safer debt in the world” can lose their luster when markets understand an uncontrolled authorities, resulting in the economic system to unstable land that believed reserved for different latitudes. His experiment reveals that, within the twenty first century, combining excessive protectionism with an uncontrolled fiscal enlargement isn’t a recipe for greatness, however for monetary chaos.

https://cincodias.elpais.com/economia/2025-05-26/del-dia-de-la-liberacion-a-la-desconfianza-fiscal-la-de-gradacion-de-la-economia-estadounidense.html