The International Monetary Fund (IMF) dedicates a considerably cryptic phrase in its annual report on Spain to the BBVA OPA on Sabadell Bank. The company helps the situations or commitments that the National Commission of Markets and Competition (CNMC) has licensed the operation, however does so with a conditional with which it doesn’t find yourself. It additionally claims to judge its potential damaging impression on monetary stability, however the European Central Bank (ECB), answerable for that evaluation, has seen the operation.

It isn’t frequent that an IMF report on a rustic refers to non-public entities and ongoing operations, not even briefly. In an encounter with the nation on the general public’s publication, the IMF Mission Chief for Spain, Romain Duval, emphasizes that the approval of the fusion have to be stranded completely to those two standards: the impact on competence and monetary stability.

“The possible negative repercussions of the merger between BBVA and Sabadell must be carefully evaluated in competence and financial stability; competition concerns could be mitigated through the corrective measures of behavioral and structural nature proposed by the competence authority,” is the textual phrase of the report devoted to the operation.

The European Central Bank (ECB), in command of the Bank of Spain to look at the consequences on solvency, expressed its non -opposition to the operation in September final 12 months.

On the opposite hand, after an extended investigation, the National Commission of Markets and Competition (CNMC) licensed with commitments to take management of Banco Sabadell by the BBVA by the OPA. The CNMC concluded that the commitments offered by the BBVA are “adequate, sufficient and provided” to resolve the issues that this focus supposes for competitors within the affected markets.

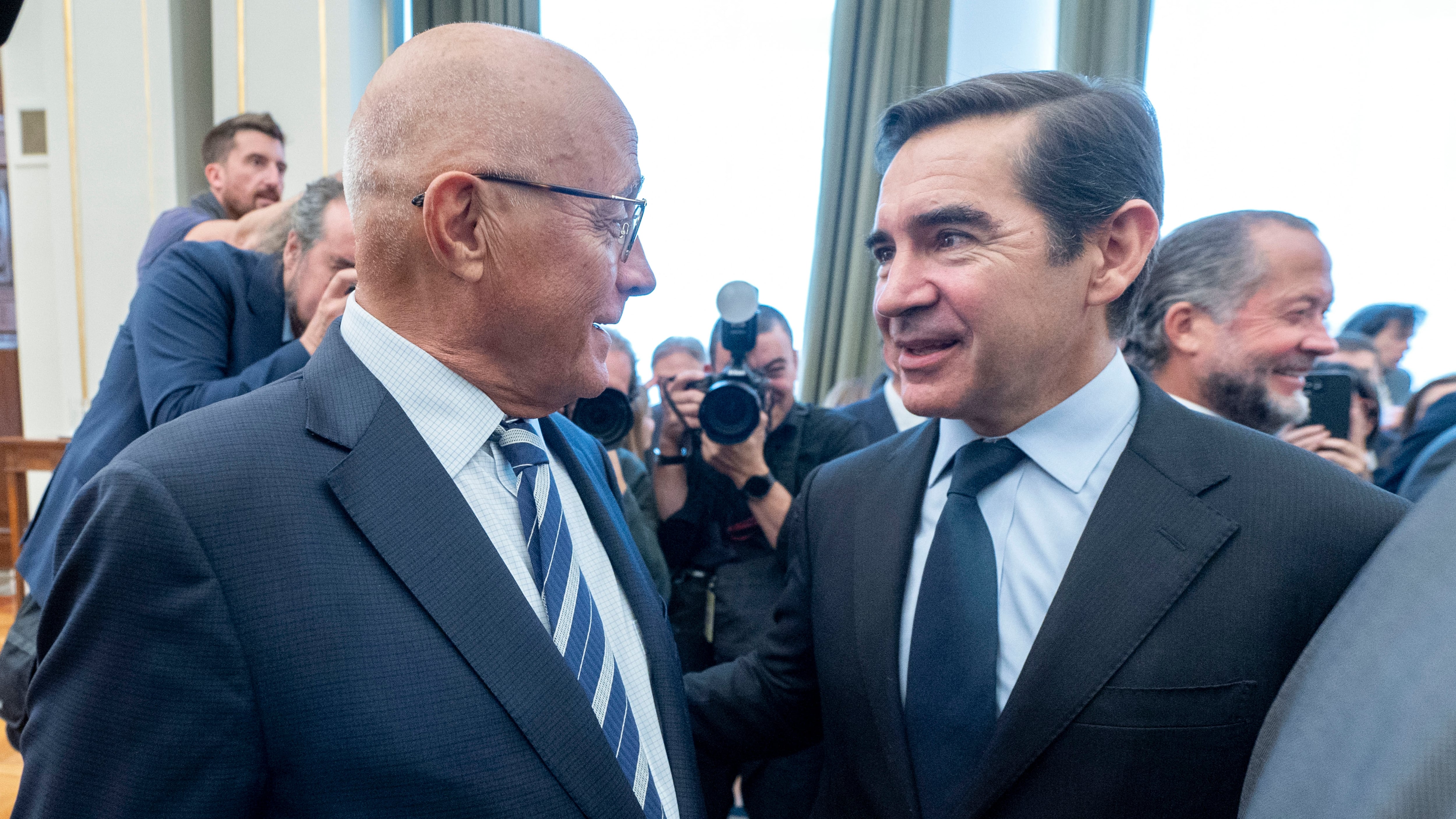

The Minister of Economy, Carlos Body, determined to lift the operation to the Council of Ministers. The Government, in response to the regulation, might assess it in response to standards of common curiosity aside from the protection of the competitors and after that it might affirm the decision of the CNMC or impose situations that aren’t associated to causes of competence.

The IMF declines to touch upon the method of the operation, however its standards, just like that of the European Commission, is that they’re solely the explanations for competence and monetary stability, already established by the corresponding authorities, which should information the choice.

“There is a procedural aspect on which we do not have an opinion, what should be the process. On what we have an opinion, it is about what the approach to decide if the merger must be carried out,” Duval factors out to El País. “The foremost standards relying on which one should determine whether or not a fusion have to be carried out or not that of competitors. A fusion might be an effectivity acquire and that could be a level in favor that ought to result in settle for it, nevertheless it entails a lack of competitors, and that could be a level in opposition to for the buyer in that sense. And each have to be valued and make the fitting resolution. That is the facet of the competitors. Now, within the financial institution there’s a further issue monetary.

Although Duval doesn’t say it expressly, that criterion would go in opposition to the setting of extra necessities by the Council of Ministers, for the reason that regulation expressly signifies that the situations imposed have to be as a consequence of standards aside from the competence (and, for discounted, it doesn’t correspond to investigate the monetary stability).

Bank tax

In its report on Spain, the IMF additionally develops criticism of the financial institution tax that had anticipated in April within the declaration of its technical workers on the finish of the mission. The fund considers that the reform addresses a number of the deficiencies of the earlier tax by eliminating the minimal enterprise quantity threshold and together with deductions for low profitability entities. “However, its general economic justification remains clear and its design remains excessively complex and confuses the size of the banks with excess profitability. Therefore, it should continue to be a temporary measure and be suppressed at the end of its validity of three years,” he recommends.

The analysis of the monetary sector signifies that it enjoys good well being, with banks which have snug capital and liquidity mattresses, even if the principle capital ratios are barely under these of their eurozone counterparts. The background helps proceed with the second stage of the gradual introduction of the constructive anti -cyclical mattress till reaching 1% and advises banks to take care of appropriate volunteer mattresses by a prudent dividend distribution.

The IMF additionally insists on its earlier advice to grant autonomy to the CNMV in its contracting processes and likewise requests to strengthen the decision competences of the Banking Orderly Restructuring Fund (FROB).

https://elpais.com/economia/2025-06-06/el-fmi-avala-las-condiciones-de-cnmc-para-la-opa-del-bbva-sobre-el-sabadell.html