the federal government desires to proceed monitoring social networks | EUROtoday

Bercy will be capable to proceed to seek out fraudsters on on-line gross sales platforms and solid its internet on social networks. The finance invoice for 2024, definitively adopted Thursday, December 21, extends for 2 years and expands an experiment which, since 2021, has allowed the Ministry of the Economy to mass retrieve on-line knowledge to detect a number of types of fraud.

The world obtained the “final assessment” experimentation, which supplies new particulars on a tool which sparked controversy when it was adopted. This report reveals the primary outcomes – timid however judged “encouraging” by the administration –, its value and the precise methodology used. He additionally explains to the legislator the necessity, in line with Bercy, for its enlargement.

The regulation adopted on the finish of 2019, regardless of the numerous reservations of the National Commission for Information Technology and Liberties (CNIL), entrusted this mission to the General Directorate of Public Finances (DGFiP) and customs. The tax authorities have gone in search of hidden actions, for instance an organization speculated to be closed which continues its exercise behind the backs of the administration or an expert who has not registered his firm with the tax authorities. Customs had been within the illicit sale of tobacco and firearms.

Even if the regulation was to permit the administration to get well knowledge from every kind of on-line platforms, it didn’t danger utilizing social networks, similar to Facebook, on account of limits set by the CNIL and the Council constitutional. The tax authorities and customs subsequently centered on commercials posted on on-line gross sales websites, similar to Leboncoin or vacationer rental platforms.

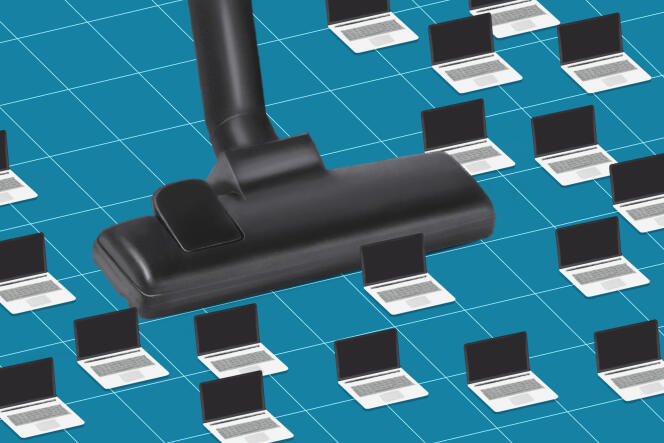

Aspiration of adverts on on-line gross sales websites

Bercy started its knowledge aspiration salvos in 2021. During the primary, carried out by the tax authorities in July that yr, 13,227 commercials had been recovered (for hairdressing, transferring, plumber companies, and so forth.). During subsequent waves, the tax administration turned keen on automotive gross sales, which signify a a lot better monetary stake, in addition to in furnished leases. In complete, as of June 2023, seventeen collections had been organized by the DGFiP and customs.

Once the commercials have been vacuumed, they’re categorised and cleaned to extract the related data, vital specifically for the identification of the skilled: person title, phone particulars or Siren quantity, the corporate identifier. As the venture progresses, State companies enrich this data by requesting further data from Internet entry suppliers, and even instantly from the platforms.

You have 65% of this text left to learn. The relaxation is reserved for subscribers.

https://www.lemonde.fr/pixels/article/2023/12/21/loi-de-finances-2024-le-gouvernement-veut-continuer-a-surveiller-les-reseaux-sociaux-pour-lutter-contre-la-fraude_6207143_4408996.html