Rachel Reeves heads to China amid stress over borrowing prices | EUROtoday

PA Media

PA MediaChancellor Rachel Reeves is travelling to China in a bid to spice up commerce and financial ties, as she faces rising stress after authorities borrowing prices hit their highest stage in years.

The three day-visit has been criticised by some Conservatives, who say she ought to have cancelled the journey to prioritise financial points at residence.

Higher authorities borrowing prices means spending extra tax income, leaving much less cash to spend on different issues.

Economists have warned this might imply spending cuts, affecting public companies, or tax rises that might hit folks’s pay or companies’ capability to develop.

Travelling to China with the chancellor are senior monetary figures, together with the governor of the Bank of England and the chair of HSBC.

There she’s going to meet China’s Vice Premier He Lifeng in Beijing earlier than flying to Shanghai for dialogue with UK companies working in China.

The authorities is seeking to revive an annual financial dialogue with China that has not been held because the pandemic.

Ties have been strained in recent times by rising considerations in regards to the actions of China’s Communist leaders, allegations of Chinese hacking and spying and its jailing of pro-democracy figures in Hong Kong.

The Conservatives have criticised the chancellor for continuing with the deliberate journey reasonably than staying within the UK to deal with the price of authorities borrowing and slide within the worth of the pound.

Shadow chancellor Mel Stride accused Reeves of being “missing in action” and mentioned she ought to have stayed within the UK.

But Chief Secretary to the Treasury Darren Jones, standing in for Reeves within the Commons on Thursday, mentioned the journey was “important” for UK commerce and there was “no need for an emergency intervention”.

Former chancellor Philip Hammond additionally instructed the World at One programme on Thursday that he “wouldn’t personally recommend the chancellor cancels her trip to China. This can wait until she gets back next week”.

Governments usually spend greater than they increase in tax so that they borrow cash to fill the hole, often by promoting bonds to traders.

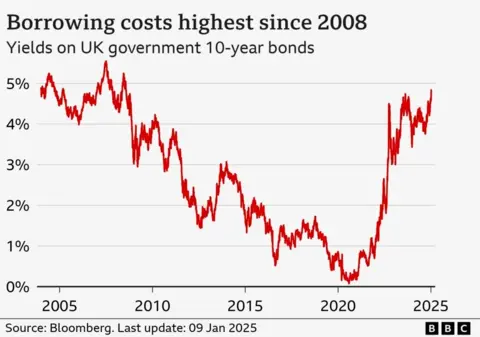

Interest charges – generally known as the yield – on authorities bonds have been going up since round August, an increase that has additionally affected authorities bonds within the US and different international locations.

The yield on a 10-year bond has surged to its highest stage since 2008, whereas the yield on a 30-year bond is at its highest since 1998, which means it prices the federal government extra to borrow over the long run.

Reeves has beforehand dedicated solely to make vital tax and spend bulletins yearly on the autumn Budget.

But if larger borrowing prices persist, there may be the potential of cuts to spending earlier than that or not less than decrease spending will increase than would in any other case occur.

Any additional spending cuts might be introduced within the chancellor’s deliberate fiscal assertion on 26 March , forward of a spending evaluate that has already requested authorities departments to search out effectivity financial savings value 5% of their budgets.

https://www.bbc.com/news/articles/c5y7kr5p4lko