The homebuyers who misplaced hundreds when their off-plan dream turned bitter | EUROtoday

BBC Yorkshire and Lincolnshire Investigations

BBC

BBCWith panoramic views of Leeds, fashionable decor and an on-site fitness center, new dad and mom Enrico and Luciana Marini have been dreaming of their future life of their metropolis centre flat.

But after six years of saving, the first-time patrons misplaced their £21,000 deposit after the new-build residences have been devalued by mortgage lenders they approached.

The BBC has spoken to a number of potential homeowners who got the identical “earth-shaking” information, shattering their funds and plans.

Unable to realize a mortgage and locked right into a contract, the developer was legally entitled to maintain their deposit – regardless of the pair having to drag out of the sale.

Mrs Marini says: “They get your money and say, ‘don’t worry about the mortgage until three years from now.'”

The couple say they felt “pressured” by North Property Group property brokers to proceed with the acquisition in 2021, with a non-refundable £5,000 reservation payment locking in a restricted time 10% low cost.

Both the agent and a lawyer beneficial by the agency instructed them they didn’t want a mortgage provide till the £230,000 flat was close to completion, the couple say.

“All the money that we were going to invest on our family, things you want for your children, is just lost,” Mrs Marini provides.

“It’s just devastating.”

North Property Group “categorically deny the allegations of high-pressure sales tactics”, a spokesperson says.

“All buyers have the right to conduct independent due diligence before committing to a purchase.

“Buyers have been knowledgeable of the accessible items and had the chance to safe them – nobody is ever compelled to commit instantly.”

“We have been first-time patrons and comparatively new to the UK, so we weren’t actually conscious of the way it labored,” says Mr Marini, originally from Brazil.

“It was earth-shaking after we came upon we must always have gotten a mortgage provide then.”

After more than a year of building delays, the couple approached lenders and were shocked to find mortgage applications refused.

Surveyors cited a range of reasons for devaluing the property, including the location and too many buy-to-let investments.

Torsion Group, the developer, says it can’t comment on the independently owned agent, but it “expects them to function on the highest skilled requirements”.

“The property was constructed to the end specified and all of the anticipated structural, security and high quality requirements have been delivered inside the contractual interval,” a spokesperson says.

“We had actually good credit score scores, we had sufficient revenue to cowl the funds, so it was very stunning to us when the mortgage was denied,” Mr Marini says.

“I can not specific how unhappy, irritating, demeaning even, it feels,” says Mrs Marini, originally from Italy.

When “off-plan” properties are sold it is “widespread observe to attend till nearer the completion date earlier than making a mortgage software”, says Mundy’s Specialist Property Lawyers, one of the agent’s recommended solicitors.

“The motive is that any mortgage provide issued previous to trade of contracts would inevitably expire earlier than the completion date and must be renewed.”

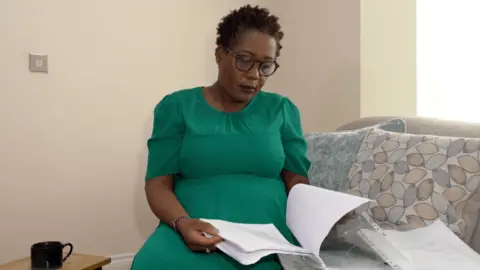

Patience Chinogureyi paid £51,000 in fees, deposits and furniture packs on two Phoenix flats as buy-to-let investments.

When exchanging contracts, she says she was told a mortgage offer was not needed at that stage, as long as she could finance the properties.

Lenders later refused her applications, citing the same property valuation issues.

“I’ve not been capable of sleep as a result of it is all I ever take into consideration,” she says.

“I do not know the place to start out as a result of I’ve misplaced that cash – I do not understand how lengthy it’s going to take me to work and get it again.”

North Property Group says buyers are “free to decide on their very own authorized representatives”, with a total of 29 independent legal firms advising clients on Phoenix contracts.

Carolyn Barraclough successfully bought one of the flats, near the A61, for her son using money from an inheritance, but he never moved in due to building delays.

“The agent mentioned she would maintain the property for me for an hour, so I acquired a taxi right down to the workplace,” she recalls.

“I used to be instructed I would wish to put a reservation payment instantly as a result of any person else had already been on the telephone – if I left the constructing it was going to go to them and it was the final one.”

Ms Barraclough says she was never advised to have the flat valued and is worried she might not be able to sell.

“It was apparent that I used to be new to this sort of factor, I’ve by no means bought a property earlier than for an funding aside from the home I reside in,” she says.

“I did not know any of the pitfalls.”

Offering advice on best practice, Sarah Cookson, director of Switalskis solicitors, says buyers should always gain a mortgage offer before exchanging contracts and paying a deposit – even when buying off-plan.

“It may be very uncommon to not advise a consumer to do that,” she says.

“A mortgage provide and valuation is crucial – a surveyor would nonetheless be capable to worth what will be constructed.

“They would look at the documents and say whether or not it is a good buy.”

She provides: “You wouldn’t buy a car that hasn’t got an MOT certificate, why would you buy a house without having it valued?”

All patrons spoken to by BBC News say they’d have obtained mortgage presents earlier than exchanging contracts if that they had been suggested to take action.

North Property Group says: “Buyers were informed that mortgage offers are typically valid for six months, which is standard for off-plan purchases.

“Lenders appoint surveyors independently to evaluate property values, and market situations have shifted considerably lately, affecting mortgage approvals.”

It provides: “Since 2017, North Property Group has efficiently brokered 1,007 gross sales.

“Of those transactions, 857 were off-plan purchases.”

A spokesperson for Mundy’s Specialist Property Lawyers says: “We are aware that some buyers have unfortunately been unable to complete their purchase of apartments within The Phoenix.

“We in fact have each sympathy with these patrons and are extraordinarily sorry for the difficulties they’ve confronted.

“Nevertheless, it has to be said that we have acted for many clients who have completed their apartment purchase without any particular issues.”

They add: “We do not accept the suggestion that we failed to give proper legal advice to any buyer on this development or that we failed to explain the risks so far as they relate to property acquisition.”

https://www.bbc.com/news/articles/c0kgr0y6e10o