Who owns Thames Water and why is it in a lot hassle? | EUROtoday

Getty Images

Getty ImagesThames Water has been fined a document £122.7m and been informed it has “let down its customers and failed to protect the environment” by the water regulator Ofwat.

The firm has big money owed and is struggling to repair leaks, cease sewage spills, and modernise outdated infrastructure.

It serves a few quarter of the UK’s inhabitants, largely throughout London and elements of southern England, and employs 8,000 folks.

Why was Thames Water fined a lot?

Ofwat ordered Thames Water to pay a tremendous following two investigations into its operations.

The firm has been hit with a £104.5m penalty for breaches of guidelines related to its sewage operations.

After heavy rainfall, water operators can launch untreated waste into rivers and seas to forestall properties flooding.

But regulator Ofwat mentioned its findings instructed three quarters of Thames Water’s storm overflows have been spilling “routinely and not in exceptional circumstances”.

Additionally, Thames was fined £18.2m due to multi-million-pound funds to its shareholders in 2023 and 2024. Ofwat known as these “undeserved” given the corporate’s efficiency.

The cash from Ofwat’s fines will in the end go to the Treasury, however no agency choice has been made about what it will likely be used for.

Thames has estimated it may very well be fined as much as £900m over the following 5 years for leaks and sewage spills which might hinder efforts to draw new funding.

What did the regulator say about Thames Water’s dividends?

The Ofwat tremendous marks the primary time a water firm has confronted a penalty due to its funds to shareholders, that are known as dividends.

The regulator highlighted Thames Water’s fee of £37.5m made in October 2023 and £131.3m in March 2024, which it mentioned “broke the rules”.

The regulator mentioned the shareholder payouts did “not properly reflect the company’s delivery performance”.

Thames Water mentioned the dividends “were declared following a consideration of the company’s legal and regulatory obligations.”

How did Thames find yourself with a lot debt?

Many UK water firms have giant money owed, however Thames Water’s issues are the worst.

When Thames was privatised in 1989, it had no debt. But through the years it borrowed closely and its complete debt – which incorporates all of its borrowings and liabilities – now stands at £22.8bn, based on newest monetary outcomes.

Its debt pile elevated sharply when Macquarie, an Australian infrastructure financial institution, owned Thames Water, with money owed reaching greater than £10bn by the point the corporate was offered in 2017.

Macquarie mentioned it invested billions of kilos in upgrading Thames’s water and sewage infrastructure whereas it owned the corporate, however critics argue that it took billions of kilos out of the corporate in loans and dividends.

What does all this imply for patrons?

No matter who finally owns or runs Thames Water, prospects will see no affect on their providers. Taps will nonetheless run and bogs will nonetheless flush.

However, Thames has mentioned it wants to extend its payments to repair issues, with the common annual invoice rising by virtually a 3rd to £639 in April.

Consumer teams argue folks should not should pay extra as a result of the corporate has been badly run.

But Sir Adrian Montague, Thames Water’s chairman, warned that with out larger value rises, the corporate can not assure protected and resilient water provides that may address local weather change and inhabitants development.

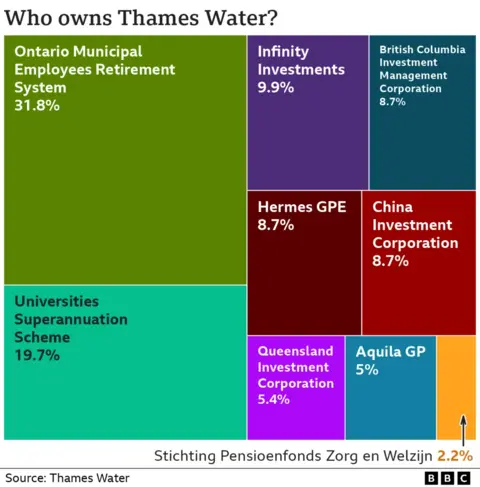

Who owns Thames Water now?

Thames Water is privately owned by a bunch of pension funds and funding corporations. The greatest shareholders embrace:

- Ontario Municipal Employees Retirement System (Canada) – 32%

- Universities Superannuation Scheme (UK) – 20%

- Abu Dhabi Investment Authority – 10%

- China Investment Corporation – 9%

Other buyers embrace funds from Canada, Australia, and the Netherlands.

Could Thames have fallen beneath authorities management?

Earlier this 12 months, Thames secured £3bn in emergency funding, which it mentioned would give it the area wanted to finish a restructuring of its money owed and entice a money injection from potential new buyers.

The proposals needed to be accepted by the High Court after a bunch of collectors opposed it, arguing the 9.75% rate of interest on the mortgage was too pricey.

The group then appealed in opposition to the High Court’s choice, however this was dismissed.

If the funding deal had not been accepted, Thames confronted the potential of a brief nationalisation, beneath a measure often called a Special Administration Regime.

Will Thames now be purchased by a US firm?

Thames Water is in discussions with US funding group KKR a few money injection of as much as £5bn.

KKR is among the world’s largest personal fairness corporations with $160bn of investments globally. The agency is already a shareholder in one other UK water supplier, Northumbrian Water.

That deal being accomplished can also be depending on lenders to the corporate accepting a reduction on the billions they’re owed. Some junior lenders may see their complete mortgage being written off.

Thames mentioned in March there was no certainty {that a} binding proposal would emerge, and any deal would should be accepted by regulators.

Why was Thames Water privatised?

The complete water and waste sector was privatised beneath Margaret Thatcher’s Conservative authorities. At the time, Thatcher wrote off the trade’s £5bn debt, leaving firms with a clear slate, and gave them £1.5bn in public cash.

At the time, the UK was beneath strain to fulfill European water high quality commonplace requirements. Thatcher wished the billions of kilos of funding want to do that to return from the personal sector and, by extension, firms’ prospects.

“If we want environmental improvement, it will cost money,” mentioned Mrs Thatcher in 1988. “It will be the people who want those improvements in water who will have to pay.”

However, critics say that privatisation has not labored as water corporations have taken on an excessive amount of debt whereas failing to spend money on infrastructure.

https://www.bbc.com/news/articles/cgleg70r7rno